The stock market has been trading pretty well lately and defense stocks have joined the party.

Lockheed Martin (LMT) and Raytheon (RTX) on Monday had moved up 2.9% and 2.7% respectively. While the gains were far from robust, it vaulted the prominent defense contractors to multiweek highs.

Don't Miss: What the Technicals Say for the S&P 500, Nasdaq in the Second Quarter

After temporarily pushing higher on Tuesday, both names have reversed to the downside. Notably, both had taken out last month’s high with this week’s gain. Both are now back below the March high.

But with defense stocks waking up and playing offense this week, the bulls want to know whether more upside could be in the cards.

These two stocks showed a lot of potential with the early action this week, but they need to show further upside proof before investors become more confident.

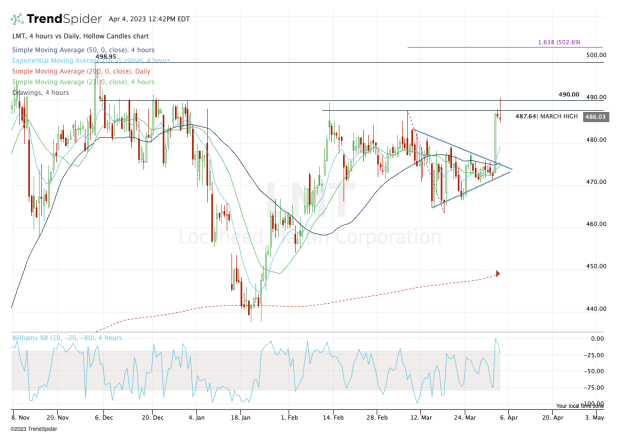

Trading Lockheed Martin Stock

Chart courtesy of TrendSpider.com

While Monday’s spike sent the shares notably higher, the March high and $490 level rejected Lockheed’s rally.

From here, the bulls need to wait either for confirmation over the $490 area or for a pullback into support.

If it’s a pullback, look for support around the $480 level and the 10-period exponential moving average on the four-hour chart (which is pictured above). These measures should act as support if the bulls are in control.

Don't Miss: Meta Was the Best-Performing FAANG Stock of Q1. Can It Continue?

If the shares instead push up through the $487.50 to $490 range, that opens the door to the $500 area. The stock’s 52-week high is at $498.95, while the 161.8% extension of the recent range is near $502.50.

So in the short-term, $500 is a reasonable upside target if Lockheed Martin clears current resistance.

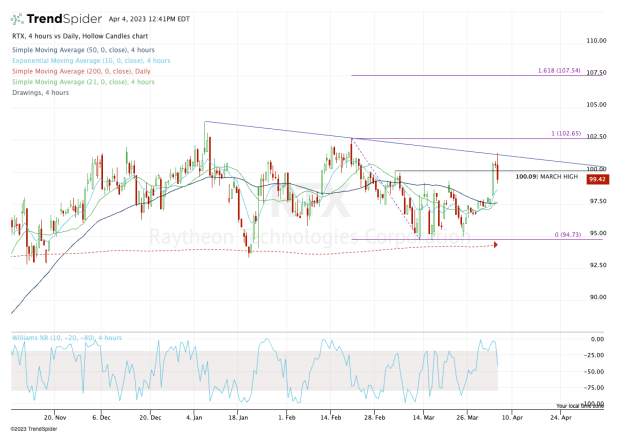

Trading Raytheon Stock

Chart courtesy of TrendSpider.com

As for Raytheon, the charts aren’t quite as clear.

Again, look at the four-hour chart, and notice how the shares traded above the March high and ran right into downtrend resistance (blue line). This measure continues to hold firm as resistance.

Now the shares are pulling back, and the bulls would love to see support around $99 hold, along with the 10-ema. The 50-day and 10-day moving averages are around $98, so this $98 to $99 zone is critical.

Don't Miss: Buy Johnson & Johnson Stock and Its 3% Dividend Yield?

On the upside, the bulls want to see a move up through $100, then up through this week’s high near $101.50.

If the shares break out, the bulls could make a case for Raytheon stock to climb up toward $107.50.