Transcript:

CONWAY GITTENS: I’m Conway Gittens reporting from the New York Stock Exchange. Here’s what we’re watching on TheStreet today.

Investors have turned cautious as lending rates remain elevated and Wall Street moves into the thick of earnings season. Verizon slightly missed earnings forecasts. The company cited a 10 percent drop in upgrades during the third quarter. Higher interest rates may have scared consumers away from buying a new, more-expensive phone.

Related: AI's surge is sparking demand for an unexpected GE Vernova product

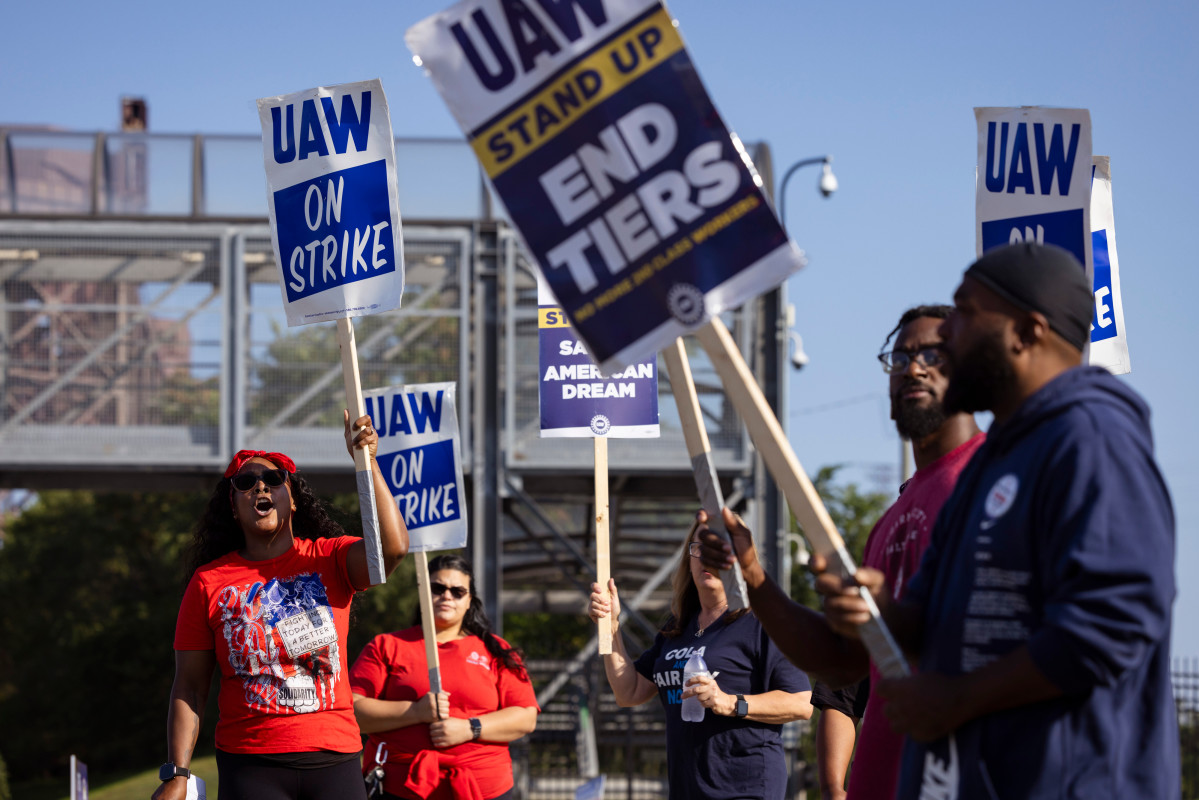

Turning to other business developments….Labor negotiations are under the microscope after several higher profile strikes including dockworkers, Boeing machinists, Hollywood actors, and Detroit auto workers. Pay is usually at the center of the dispute - - workers want more, the company wants less. Quarterly numbers out of General Motors are adding some color to the discussion. Just one year after a costly walkout, General Motors is on the road to posting record profits.

The company’s adjusted earnings for the third quarter jumped to $3.4 billion from $3.2 billion. And for the first nine months of the year combined, GM pocketed just under $10 billion. Things are going so well GM raised its profit outlook for the year - for the third time. It now expects a measure of profitability to come in between $14 to $15 billion for 2024 - putting it on track to eclipse the record profit it saw in 2022.

Watch ICYMI This Week:

- Top economist reveals solution to the home affordability crisis

- Stellantis continues cost-cutting measures

- Here are the commodities you should be investing in right now

- Expert retirement tips for recent college graduates

And these higher profits are thanks to higher sales. Revenues rose in the third quarter, hitting $48.8 billion. The average North American selling price per vehicle is running ahead of last year. That sales rate is enabling GM to cover the additional labor costs it agreed to after workers went on strike in 2023. It agreed to pay an 11 percent raise and boost pay by another 14 percent spread over 4 years.

A year after the strike, and with sales in the tens of billions, GM’s CFO said there’s “no regrets over the UAW contract.”

That’ll do it for your Daily Briefing. From the New York Stock Exchange, I’m Conway Gittens with TheStreet.

Don’t miss the move: SIGN UP for TheStreet’s FREE Daily newsletter