Contract chipmaker GlobalFoundries is riding high amid heightened demand for semiconductor products during the global chip shortage. GFS stock entered a buy zone on Friday.

On the stock market today, GFS stock jumped 6.8% to close at 76.78. In intraday trading, it notched a record high of 77.

On Thursday, GFS stock broke out of a 15-week consolidation period at a buy point of 73.35, according to IBD MarketSmith charts. However, GFS stock pulled back and ended the regular session up 2.4% to 71.91. The 5% buy zone extends to 77.02, based on IBD trading guidelines.

GlobalFoundries went public in October with its IPO priced at $47 a share. GFS stock climbed as high as 73.25 in November before retreating and forming a consolidation pattern.

On Feb. 8, the Malta, N.Y.-based company delivered a beat-and-raise report for the fourth quarter. In the December quarter, GlobalFoundries earnings rose 117% year over year on an absolute value basis while sales increased 74%.

GFS Stock Ranks First In Group

GlobalFoundries is sold out for 2022 and 2023 and plans to bring more capacity online to meet demand. It has 30 long-term agreements with fabless semiconductor firms.

"We view GFS as the leading trailing-node, analog/mixed-signal foundry benefiting from IoT (Internet of Things) demand drivers that will translate to unit demand 10 times the size of cellphones," Jefferies analyst Mark Lipacis said in a recent note to clients. He rates GFS stock as buy with a price target of 90.

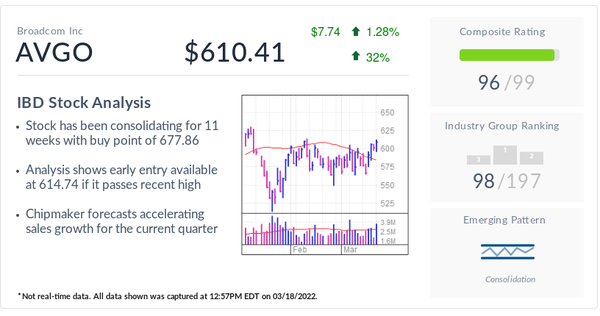

GlobalFoundries stock ranks first out of 44 stocks in IBD's semiconductor manufacturers industry group, according to IBD Stock Checkup. It has an IBD Composite Rating of 97 out of 99.

Elsewhere among semiconductor stocks, Rambus added 5.4% to 31.23 on Friday. On Thursday, Rambus stock broke out of a cup-with-handle base at a buy point of 29.11, based on a weekly MarketSmith chart. Rambus stock ended regular trading Thursday up 2.1% to 29.63.

Follow Patrick Seitz on Twitter at @IBD_PSeitz for more stories on consumer technology, software and semiconductor stocks.