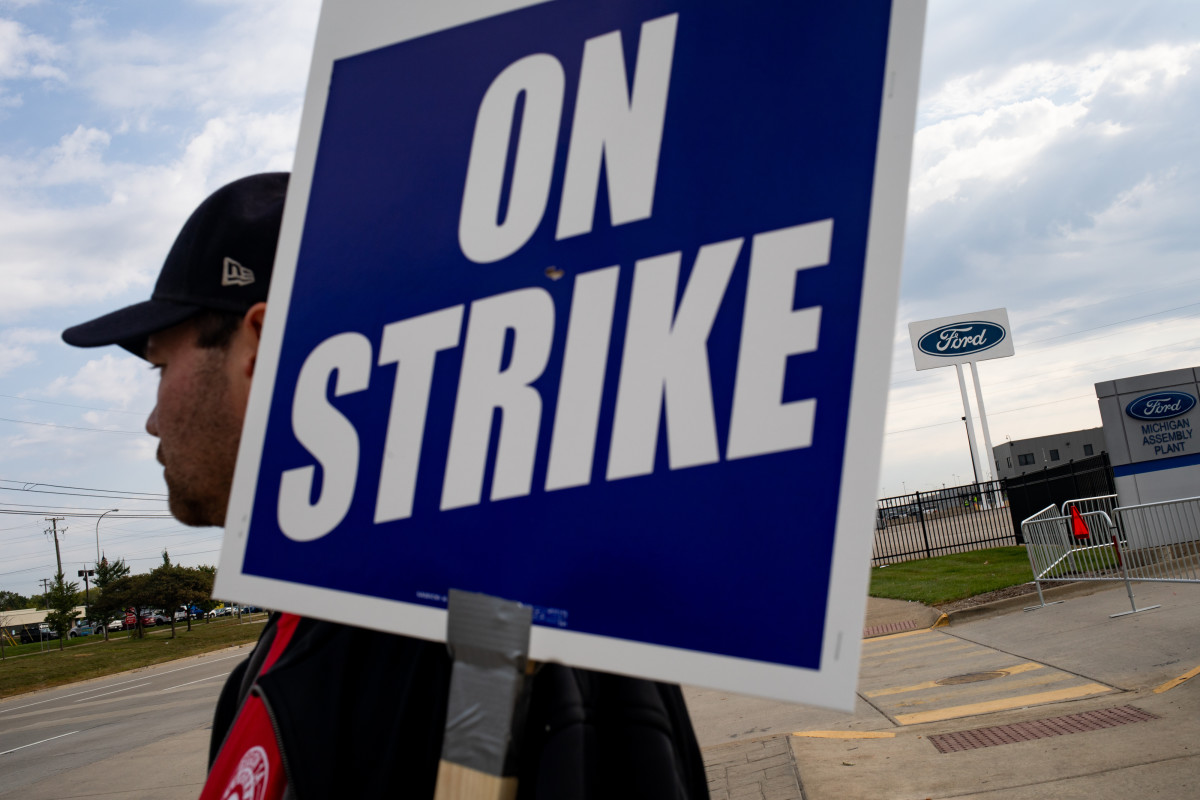

General Motors (GM) -) shares edged cautiously higher in pre-market trading as workers at its three facilities in Canada, under the Unifor union banner, are set to strike after failing to reach a labor agreement by last night's deadline.

Unfior said its 4,300 members who work for General Motors will strike at three plants in the province of Ontario Tuesday, including its main assembly facility in Oshawa after talks over pay and pensions broke down late Monday.

Last month, Unifor agreed to terms on a three-year deal with GM rival Ford Motor F just hours before planned strike action in assembly and engine plants in three different cities in Canada's largest province. It then extended deadlines for talks with both GM and Stellantis (STLA) -).

"The company (GM) continues to fall short on our pension demands, income supports for retired workers, and meaningful steps to transition temporary workers into permanent, full-time jobs," said Unifor National President Lana Payne.

The breakdown suggests the ongoing strikes in the U.S, lead by the United Autoworkers Union and its president, Shawn Fain, could last several more weeks as management and labor remain far apart on key issues such as over wages, pay tiers for new hires and the return of cost-of-living adjustments for the UAW's 150,000 members employed by the Big 3.

UAW members also voted Sunday to reject a proposed labor agreement with Volvo-owed Mack Trucks, which included a 19% pay increase and a $3,500 dollar ratification bonus, in a move that will lead to expanded strike action by the 4,000 union members working for the company in Maryland, Pennsylvania and Florida

Thus far, the near month-long strike has had limited impact on production and sales for the Big 3, with GM posting a 21% rise in U.S. sales over the third quarter, adding that it has around 443,000 vehicles in inventory heading into the final months of the year.

Ford published its own third quarter numbers prior to the opening bell, with overall sales up 7.7% to just over 500,000 unit, including a 14.8% surge in overall EV deliveries.

General Motors shares were marked 0.29% higher in pre-market trading to indicate an opening bell price of $31.05 each while Ford rose 0.25% to $12.10 each. Stellantis was up 2.65% in Milan.

Anderson Economic Group, a Lansing, Mich., consultancy, published a report last weekend suggesting that even a 10-day strike could cost the U.S. economy around $5.6 billion and tip the economy of the state of Michigan itself into recession.

“If we were to have a long strike in 2023, the state of Michigan and parts of the Midwest would go into a recession,” said CEO Patrick Anderson. “When GM workers went on strike in 2019, you saw gross state product drop in Michigan in the fourth quarter, while in the rest of the country it was largely unaffected."

"That won’t be the case this time if the UAW goes through on its threat to strike all three companies.” he added.

- Get exclusive access to portfolio managers and their proven investing strategies with Real Money Pro. Get started now.