General Motors and energy drink maker Celsius Holdings lead this weekend's list of five stocks — none AI-related for a change — near buy points. Homebuilder Lennar, oil field equipment play Weatherford International and Shockwave Medical, whose products are focused on treating cardiovascular disease, round out the list.

Celsius and Shockwave stock are both part of the IBD 50 list of leading growth stocks. Weatherford was Friday's IBD Stock Of The Day.

As the AI-led stock rally faces a key test with Nvidia's Q4 earnings report late Wednesday, these five stocks may not be in the limelight in the coming week if AI stocks go crazy again. But they won't be in the line of fire either, in the event of a sell-on-the-news reaction.

Be sure to read IBD's The Big Picture column after each trading day to get the latest on the prevailing stock market trend and what it means for your trading decisions.

GM Stock

Almost everything seemed to go wrong for General Motors last fall, from the UAW strike, to a Cruise robotaxi running over a pedestrian, to a battery module snafu that kept its EV ramp in first gear.

Yet now, as a turnaround play, GM's outlook has largely been de-risked, but it's still throwing off plenty of cash from its gas-powered SUV and pickup truck franchises. Following the strike resolution, despite a $9.3 billion hit to GM's bottom line over five years, the company said it would buy back $10 billion in stock and boost its dividend by 33%. That confidence boost helped lift GM stock off three-year lows.

Still, GM's guidance of 2024 EPS of $8.50 to $9.50 means the stock is selling for less than 5 times forward earnings, offering the potential for upside if the company can execute on scaled-back near-term goals. GM has said it expects to sell 250,000 EVs this year. Reports have indicated that Cruise robotaxis should be back on the road in Q4, though it could happen earlier with a safety driver aboard.

Another plus is that traditional automakers appear to be in favor again, with Toyota and Stellantis at record highs

GM stock is etching out a tight handle on the end of a double-bottom base formation. GM stock edged up 0.4% to 38.70 last week, leaving it in range of a 39.75 handle buy point.

Celsius Stock

Celsius Holdings' sugar-free, caffeinated energy drinks have been shown to increase the amount of calories burned while exercising. Celsius has been gaining shelf space and market share, while expanding internationally.

That combination should drive 99% year-over-year sales growth in Q4, Stifel said on Friday. That compares to a FactSet consensus for 85% growth. Stifel, which said its own estimate could prove conservative because it assumes no meaningful contribution from international growth, raised its price target for CELH stock to 67 from 64, keeping a buy rating.

Celsius earnings are due in early March.

On Friday, Celsius stock rose 1.6% to 64.41. Wednesday's 4.5% rise to 62.56 flashed an early entry opportunity (or two). On the same day, CELH cleared a down-sloping trendline from its September peak near 60 and broke above resistance near 62.

The relative strength line is well off all-time levels, but has hit a three-month best. The RS line, the blue line in the charts provided, reflects a stock's performance vs. the S&P 500.

One issue: Celsius is now 17.4% above its 50-day moving average. A handle, or some sort of pause, could be constructive.

For now, CELH has an official buy point of 68.95 from a five-month consolidation.

Zoom, Zoom: Look Who's Helping Drive Shares Of Celsius Higher

Lennar Stock

Lennar, the second largest homebuilder, announced on Jan. 9 that it was hiking its annual dividend to $2 from $1.50 a share. It also authorized an extra $5 billion stock buyback. On the same day, Arugus analyst Chris Graja hiked his LEN price target to 175 from 140.

Graja cited Lennar's edge in producing affordable homes over many rivals, a function of its scale and holdings of land and options to build on others' property. He also estimated a shortage of 2 million to 4 million affordable units.

The average 30-year fixed mortgage rate has jumped 50 basis points over the past two weeks as the Fed has reeled in market expectations for rate cuts and January inflation data came in hot. Still, Lennar showed in its fiscal Q4 through November that it can navigate a high-rate environment, on the chance it persists. EPS rose 3% in Q4 as sales grew 8%.

"Higher interest rates tested homebuyer sentiment, although purchasers remained responsive to incentives that enabled affordability," co-CEO Stuart Miller said in the Dec. 14 earnings statement.

LEN stock slipped 2.6% to 150.22 on Friday in a test of its 50-day and 10-week moving averages after the producer price index showed a spurt in health care prices and portfolio management costs in January.

Lennar has formed a flat base since it spiked in mid-December, as dovish Fed rate guidance and tame inflation data sent mortgage rates tumbling. LEN stock perked above a 156.01 buy point on Monday, before the next day's CPI reading sent Treasury yields higher.

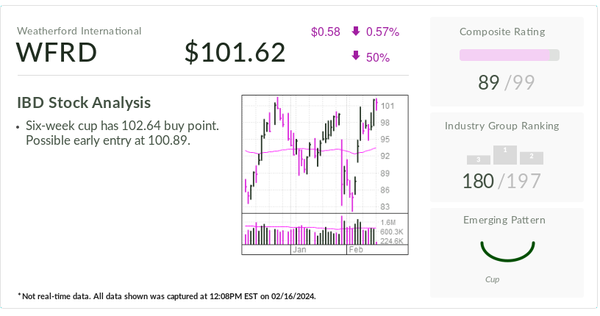

Weatherford Stock

On Feb. 6, Weatherford posted fourth-quarter EPS of $1.90, up 70% from a year ago and 54 cents ahead of estimates. Revenue grew 13% to $1.362 billion.

The company also announced some acquisitions, an important part of its strategy, adding to technology that differentiates its capabilities from rivals. The latest acquisitions include a leader in well-decommissioning technology and two recognized brands in the wireline or cabling technology category.

Weatherford said it expects full-year revenue growth of 10% to "low teens" in 2024, led by growth in the Middle East. It also expects adjusted EBITDA margins to move closer to its 25% goal. Weatherford reported an adjusted EBITDA margin of 23.6% for Q4 and 23.1% for the full year, up from 18.9% in 2022.

On Monday, BofA raised its price target for WFRD to 123 from 120, calling buy-rated Weatherford its top oilfield services mid-cap pick.

Rebounding crude oil prices, which hit a three-month high last week, also is helping.

WFRD stock rose 5.1% to 101.61 last week. Weatherford has a 102.64 buy point from a six-week consolidation, according to MarketSmith. But it's really been consolidating since mid-September, with a couple of short-lived breakout attempts along the way.

Weatherford stock plunged on Jan. 30, along with many drilling, services and machinery plays, on reports that Saudi Aramco was halting expansion plans. But shares soon found support at the 200-day line and rebounded with earnings.

The RS line, while bouncing back in February, has lagged since early November. But WFRD stock has outperformed most of its energy peers.

Shockwave Medical

Shockwave Medical was among the best performers in Friday stock market action, surging 11.15% to 262.66 after a big earnings beat.

On Thursday afternoon, Shockwave reported Q4 EPS of $1.16, up 3% from a year ago but trouncing estimates by 27 cents. Revenue grew 41% to $203 million, and Shockwave's outlook calls for 25% to 27% growth in 2024.

Shockwave pioneered intravascular lithotripsy, or IVL, which treats people who have problematic calcium buildups in their arteries. "We have a couple of meaningful reimbursement tailwinds that will support continued adoption," CEO Doug Godshall said on the earnings call.

SWAV stock blew past an aggressive entry of 239, mostly above the 200-day line. A handle or tight action here could create a new entry point above Friday's high of 270.87. SWAV remains 17% below its 52-week high in June as it builds the right side of a base that's more than 50% deep.