/General%20Dynamics%20Corp_%20sign%20in%20San%20Jose%2C%20Ca-by%20Michael%20Vi%20via%20Shutterstock.jpg)

General Dynamics Corporation (GD) is a major U.S. global aerospace and defense company headquartered in Reston, Virginia. Valued at $95.6 billion by market cap, it operates through four principal business segments, Aerospace, Marine Systems, Combat Systems, and Technologies, offering a diversified portfolio of products and services that includes business jets, nuclear-powered submarines and other naval vessels, armored combat vehicles and weapons systems, and secure communications, command-and-control, and IT solutions for military and government customers worldwide.

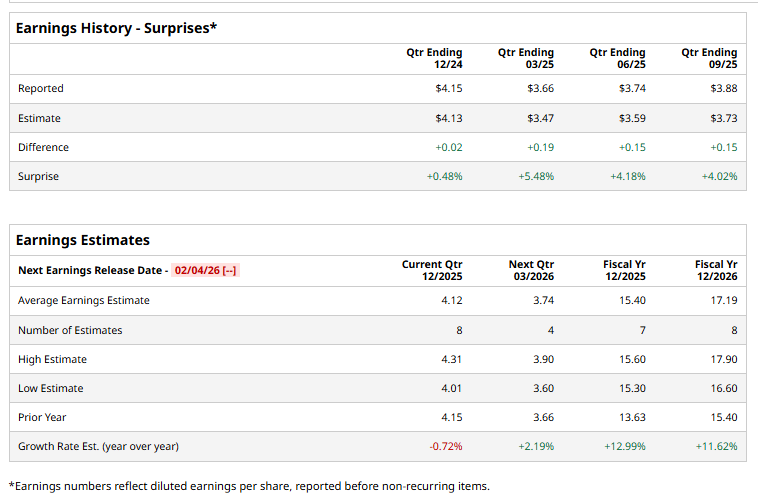

The defense giant is expected to announce its fiscal fourth-quarter earnings for 2025 soon. Ahead of the event, analysts expect GD to report a profit of $4.12 per share on a diluted basis, down marginally from $4.15 per share in the year-ago quarter. The company beat the consensus estimates in each of the last four quarters.

For FY2025, analysts expect GD to report EPS of $15.40, up 13% from $13.63 in fiscal 2024. Its EPS is expected to rise 11.6% year-over-year to $17.19 in fiscal 2026.

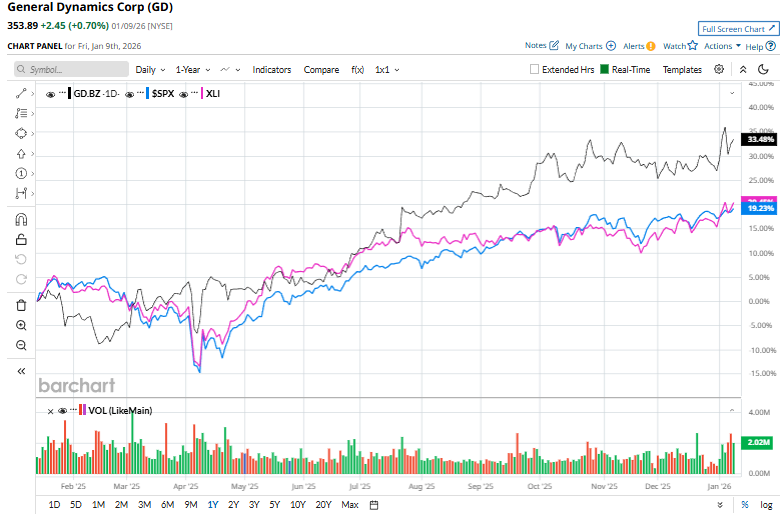

GD shares have surged 35.4% over the past year, surpassing the S&P 500 Index’s ($SPX) 17.7% gains and the Industrial Select Sector SPDR Fund’s (XLI) 21.9% gains over the same time frame.

On Jan. 8, shares of General Dynamics rose 3.1% after President Donald Trump called for a sharp increase in the U.S. military budget for 2027, proposing $1.5 trillion versus $901 billion approved for the prior year. The announcement sparked a broad rally across the defense sector on expectations of higher government spending and contract awards.

Analysts’ consensus opinion on GD stock is reasonably bullish, with a “Moderate Buy” rating overall. Out of 23 analysts covering the stock, 12 advise a “Strong Buy” rating, 10 give a “Hold,” and one recommends a “Strong Sell.” Its mean price target of $379.80 implies an upswing potential of 7.3% from the current market prices.