General Electric (GE) shares have been trading quite well, giving investors a surprising start to 2023.

The industrial stalwart's shares are up more than 40% this year and have climbed 27% in the past year. Both measures trounce the S&P 500 and Nasdaq over those time frames.

Interestingly, a few weeks ago GE shares underwent a massive breakout at the same time the U.S. stock market entered a wave of volatility.

The breakout occurred ahead of the company's annual meeting after management gave an update on the business.

Despite the recent bank-related volatility, GE shares have held up well and are still trading above the $90 breakout level.

That’s key action for the bulls, so let’s take another look at one of the healthier setups currently in play.

Trading GE Stock

Chart courtesy of TrendSpider.com

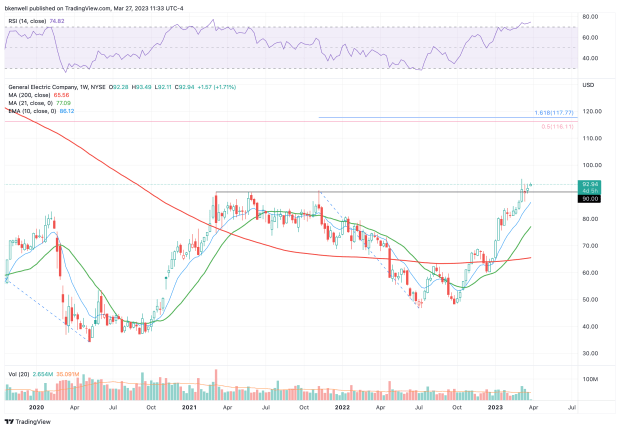

When we look at the weekly chart of GE stock, it’s clear that the stock is still trading in the bulls' favor.

If we zoom in on the daily chart, traders notice that it continues to hold its short-term moving averages as support — another bullish observation.

But it's when we stick with the weekly chart -- call it the bigger picture -- that the bulls can get a sense of just how well this stock has been trading.

If GE stock were to pull back to the 10-week moving average, it would give dip-buyers an opportunity to go long. That’s particularly true if this measure were to line up with the $90 breakout level.

On the upside, a move over the 2023 high at $94.94 — and particularly on a close above this mark — would open the door to the key $100 mark.

Above $100 and investors could start talking about the possibility of the shares rallying to the $115 area, which is a key Fibonacci level.

The bottom line here is simple: Regardless of what traders thought about GE stock before this year, the name has been a relative-strength leader in 2023.

It’s one to stick with on the long side, and it’s one to buy on the dips until the trend breaks.

As long as GE stock is above $90, it looks healthy.

Get investment guidance from trusted portfolio managers without the management fees. Sign up for Action Alerts PLUS now.