/GE%20Aerospace%20turbine%20engine-by%20hapabapa%20via%20iStock.jpg)

Evendale, Ohio-based GE Aerospace (GE) designs and produces commercial and defense aircraft engines, integrated engine components, electric power, and mechanical aircraft systems. With a market cap of $310.2 billion, GE Aerospace operates through Commercial Engines and Services and Defense and Propulsion Technologies segments.

Companies worth $200 billion or more are generally described as "mega-cap stocks." GE Aerospace fits right into that category, with its market cap exceeding this threshold, reflecting its substantial size and influence in the aerospace and defense industry. GE Aerospace employs nearly 52,000 people and has an installed base of more than 44,000 commercial and over 26,000 military aircraft engines.

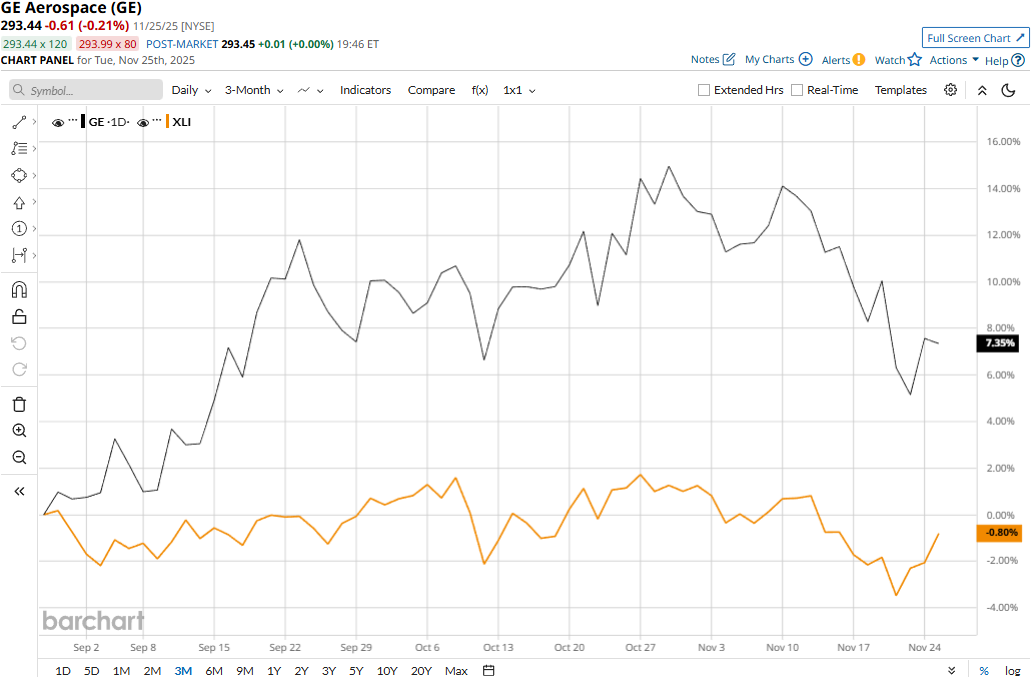

GE stock touched its all-time high of $316.67 on Oct. 28 and is currently trading 7.3% below that peak. Meanwhile, GE stock has gained 10.1% over the past three months, outpacing the Industrial Select Sector SPDR Fund’s (XLI) marginal 20 bps uptick during the same time frame.

GE’s performance has remained robust over the longer term as well. GE stock prices have soared 75.9% on a YTD basis and 62.8% over the past year, compared to XLI’s 15.3% gains in 2025 and 5.8% uptick over the past 52 weeks.

GE stock has traded mostly above its 50-day and 200-day moving averages since late April, with some fluctuations recently, underscoring its bullish trend.

GE Aerospace’s stock prices gained 1.3% in the trading session following the release of its exceptional Q3 results on Oct. 21. Driven by increased material input from priority suppliers, the company’s commercial engines & services revenues grew 28%, while deliveries rose 33%. Overall, the company’s non-GAAP topline came in at $11.3 billion, up 26.4% year-over-year and 9.4% ahead of the Street’s expectations. Further, its adjusted EPS soared 44% year-over-year to $1.66, surpassing the consensus estimates by 13.7%.

Observing the solid year-to-date performance and order book, GE raised its full-year revenue and earnings guidance, boosting investor confidence.

Meanwhile, GE Aerospace has also outperformed its peer RTX Corporation’s (RTX) 48.8% surge in 2025 and 45.1% gains over the past year.

Among the 20 analysts covering the GE stock, the consensus rating is a “Moderate Buy.” Its mean price target of $337.11 represents a 14.9% premium to current price levels.