Whales with a lot of money to spend have taken a noticeably bullish stance on GE Aero.

Looking at options history for GE Aero (NYSE:GE) we detected 27 trades.

If we consider the specifics of each trade, it is accurate to state that 44% of the investors opened trades with bullish expectations and 25% with bearish.

From the overall spotted trades, 18 are puts, for a total amount of $1,174,902 and 9, calls, for a total amount of $272,060.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $170.0 to $190.0 for GE Aero over the last 3 months.

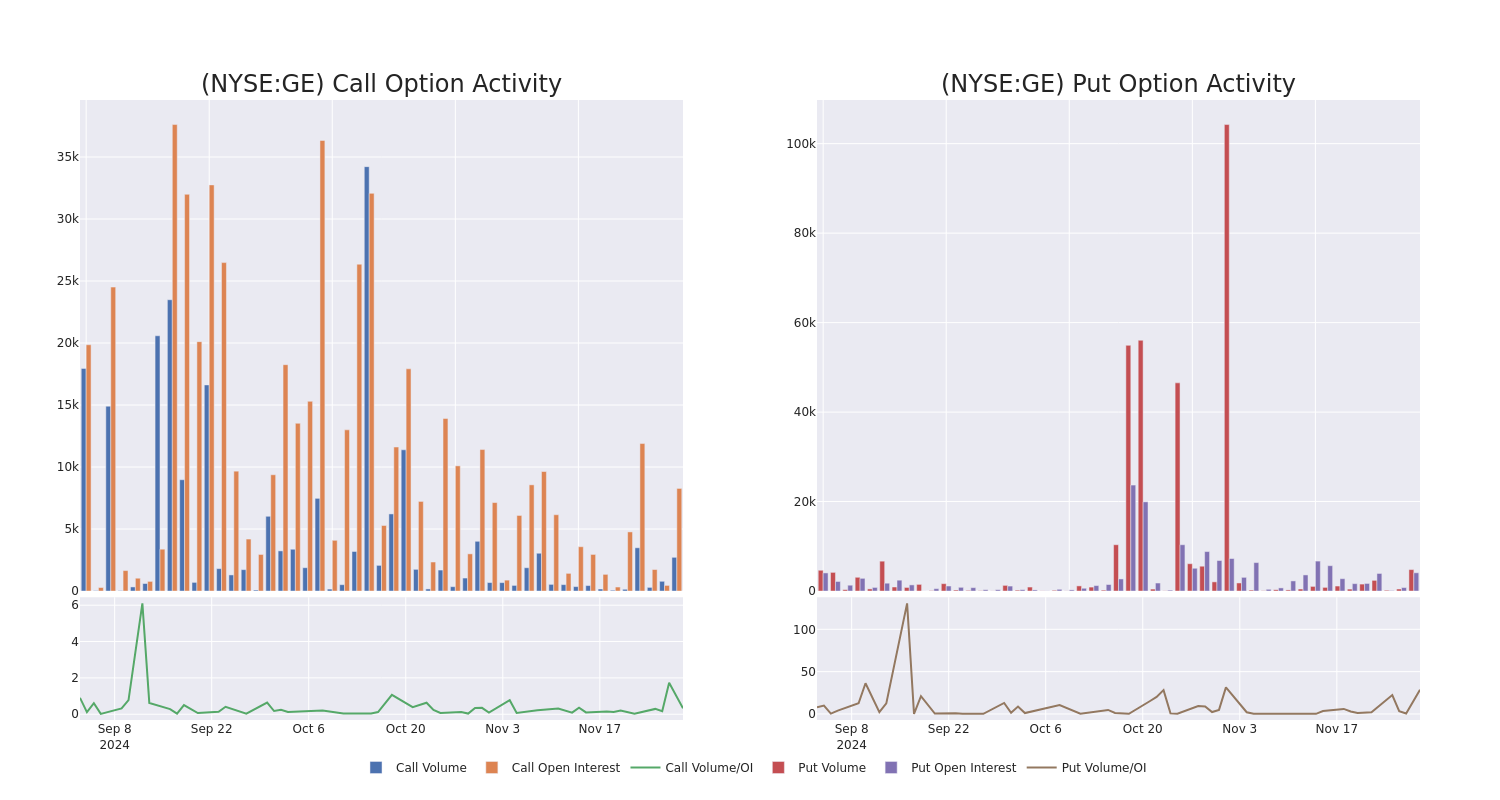

Volume & Open Interest Development

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for GE Aero's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of GE Aero's whale trades within a strike price range from $170.0 to $190.0 in the last 30 days.

GE Aero Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GE | PUT | TRADE | NEUTRAL | 01/17/25 | $3.75 | $3.6 | $3.68 | $175.00 | $170.0K | 2.0K | 554 |

| GE | PUT | TRADE | BULLISH | 02/21/25 | $13.9 | $13.7 | $13.78 | $190.00 | $75.7K | 137 | 620 |

| GE | PUT | SWEEP | BULLISH | 02/21/25 | $13.9 | $13.7 | $13.79 | $190.00 | $75.5K | 137 | 565 |

| GE | PUT | SWEEP | NEUTRAL | 02/21/25 | $13.75 | $13.7 | $13.75 | $190.00 | $75.3K | 137 | 675 |

| GE | PUT | SWEEP | NEUTRAL | 02/21/25 | $14.2 | $13.9 | $14.05 | $190.00 | $69.6K | 137 | 280 |

About GE Aero

GE Aerospace is the global leader in designing, manufacturing, and servicing large aircraft engines, along with partner Safran in their CFM joint venture. With its massive global installed base of nearly 70,000 commercial and military engines, GE Aerospace earns most of its profits on recurring service revenue of that equipment, which operates for decades. GE Aerospace is the remaining core business of the company formed in 1892 with historical ties to American inventor Thomas Edison; that company became a storied conglomerate with peak revenue of $130 billion in 2000. GE spun off its appliance, finance, healthcare, and wind and power businesses between 2016 and 2024.

After a thorough review of the options trading surrounding GE Aero, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

GE Aero's Current Market Status

- With a trading volume of 2,051,996, the price of GE is up by 0.86%, reaching $182.16.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 53 days from now.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for GE Aero, Benzinga Pro gives you real-time options trades alerts.