In our last four posts, we have described how our Federal Criminal Justice Clinic's Freedom Denied report reveals a culture of detention, with federal judges routinely violating the Bail Reform Act that they are tasked with upholding.

This post addresses the last of our four findings and recommendations: "Judges must stop unlawfully jailing people for poverty through excessive financial conditions."

The Bail Reform Act unequivocally prohibits judges from jailing people who are too poor to pay for their release: "The judicial officer may not impose a financial condition that results in the pretrial detention of the person." 18 U.S.C. § 3142(c)(2).

Despite the Act's prohibition,

[o]ur courtwatching study shows that federal judges consistently impose financial conditions of release that result in pretrial detention. This practice violates the explicit statutory language of the Bail Reform Act, perpetuates a system where wealth buys release and people are jailed for poverty, and has a disproportionate racial impact. These detentions, which violate the law, contribute to rising detention rates as well as racial and socioeconomic disparities in the federal system.

Given the Act's clarity on this issue, we were shocked to see judges imposing unmeetable financial conditions, ultimately resulting in pretrial jailing:

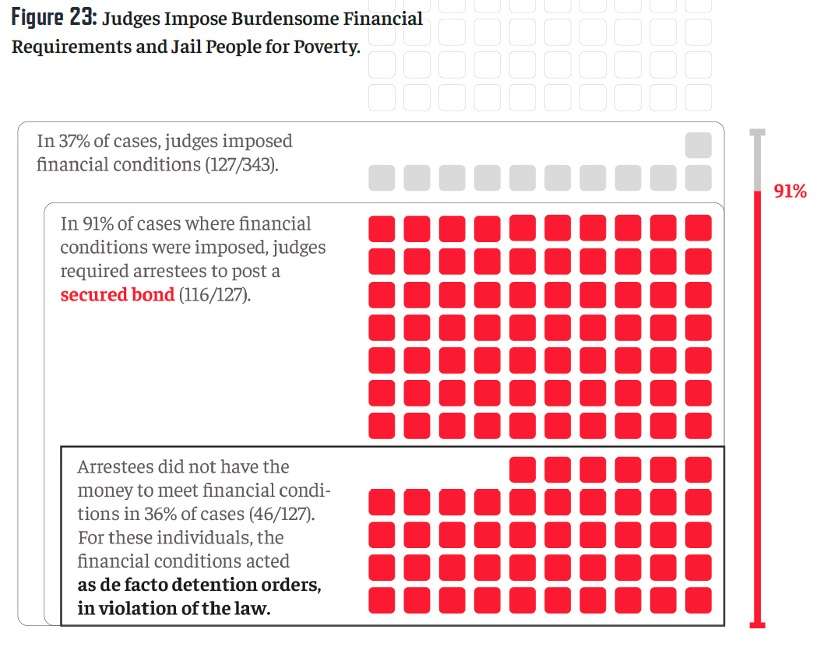

Across all 4 districts, arrestees did not have the money to meet financial conditions in 36% of cases where such conditions were imposed. See Figure 23. In fact, 21% of all arrestees detained at the Initial Appearance remained in jail after the Detention Hearing because they could not meet financial conditions of release. For these individuals, the financial conditions acted as de facto detention orders, in violation of the law.

Even more strikingly, we found judges jailing people on unmeetable bail bonds:

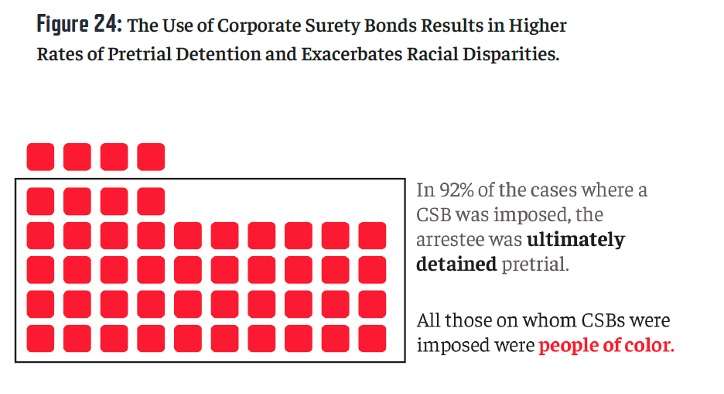

In one district where we courtwatched, arrestees were detained in 40% of cases involving financial conditions solely because they did not have the money to pay for their release…. Judges in that district regularly imposed federal bail bonds known as corporate surety bonds (CSBs). In 92% of cases where a CSB was imposed, the accused was locked in jail because they were unable to obtain a bail bond. Every single individual subjected to a CSB was a person of color….

The use of CSBs results in higher rates of pretrial detention because indigent people are unable to obtain such bonds. In our study, CSBs were used in 14% of all cases (and only in one district, the Southern District of Florida (Miami)). In 92% of the cases where a CSB was imposed, the arrestee was ultimately detained pretrial (after both the Initial Appearance and the Detention Hearing). See Figure 24. At the Initial Appearance, 100% of cases involving a CSB ultimately resulted in pretrial detention; at the Detention Hearing, 70% of cases involving a CSB resulted in the detention of the arrestee. In contrast, when an unsecured bond was imposed, only 10% of people were detained at the Initial Appearance, and no one was detained at the Detention Hearing.

We were also surprised to find judges requiring people to post secured bonds in one-third of cases:

In 34% of all cases and 91% of cases where financial conditions were imposed, judges required arrestees to post a secured bond, reintroducing the evils of cash bail systems that the BRA sought to avoid.

The excessive use of financial conditions of release fell hardest upon people of color:

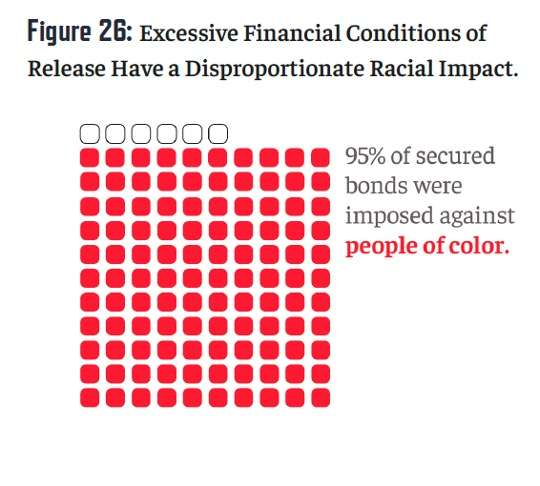

People of color are less likely to meet financial requirements, as institutionalized racism in the form of housing, tax, financial, and education policies has resulted in highly uneven distributions of wealth and property ownership. Black Americans own just one-tenth of the wealth of white Americans, and this wealth gap "persists regardless of households' education, marital status, age, or income." Although the average Black American household owes one-third of the debt owed by the average white American household, the interest rates for Black borrowers are noticeably higher. Research conducted in the Second Circuit, for example, found that 33% of white arrestees in that federal court were homeowners, compared to just 7% of Black arrestees and 9% of Latino arrestees.

Against this backdrop, it is striking that in 95% of cases in our study where a secured bond was imposed, the arrestee was a person of color. See Figure 26. Moreover, in every single case in our study where a CSB was imposed, the arrestee was a person of color. See Figure 24.

"The Solution: At Both Pretrial Hearings, Judges Must Stop Imposing Financial Conditions that Result in Detention and Tailor Release Conditions to Each Arrestee's Individual Economic Circumstances."

As a practical matter, judges should pay close attention to each arrestee's personal financial circumstances and fashion individualized conditions of release that are reasonable for that specific person. Before imposing a financial condition, a judge should carefully examine whether the particular arrestee before them has the means and the wherewithal to meet that condition. The judge should also evaluate whether a financial condition might impermissibly result in the arrestee's detention. In making these individualized determinations, judges must be mindful of how financial conditions compound existing racial and socioeconomic disparities.

As the Bail Reform Act makes clear, there are many alternatives to imposing financial conditions of release, and those alternatives are often more effective at ensuring the individual's appearance in court and disincentivizing reoffending while on release.

All block-quoted material comes from the Clinic's Report: Alison Siegler, Freedom Denied: How the Culture of Detention Created a Federal Jailing Crisis (2022).

The post Freedom Denied Part 5: Judges Must Stop Unlawfully Jailing People for Poverty Through Excessive Financial Conditions appeared first on Reason.com.