Four in 10 people in the UK said they were struggling to pay their energy bills in March, even before the latest price cap hike, new data shows.

A survey by the Office for National Statistics (ONS) found that 43% of those who pay energy bills said it was “very or somewhat difficult” to afford them last month.

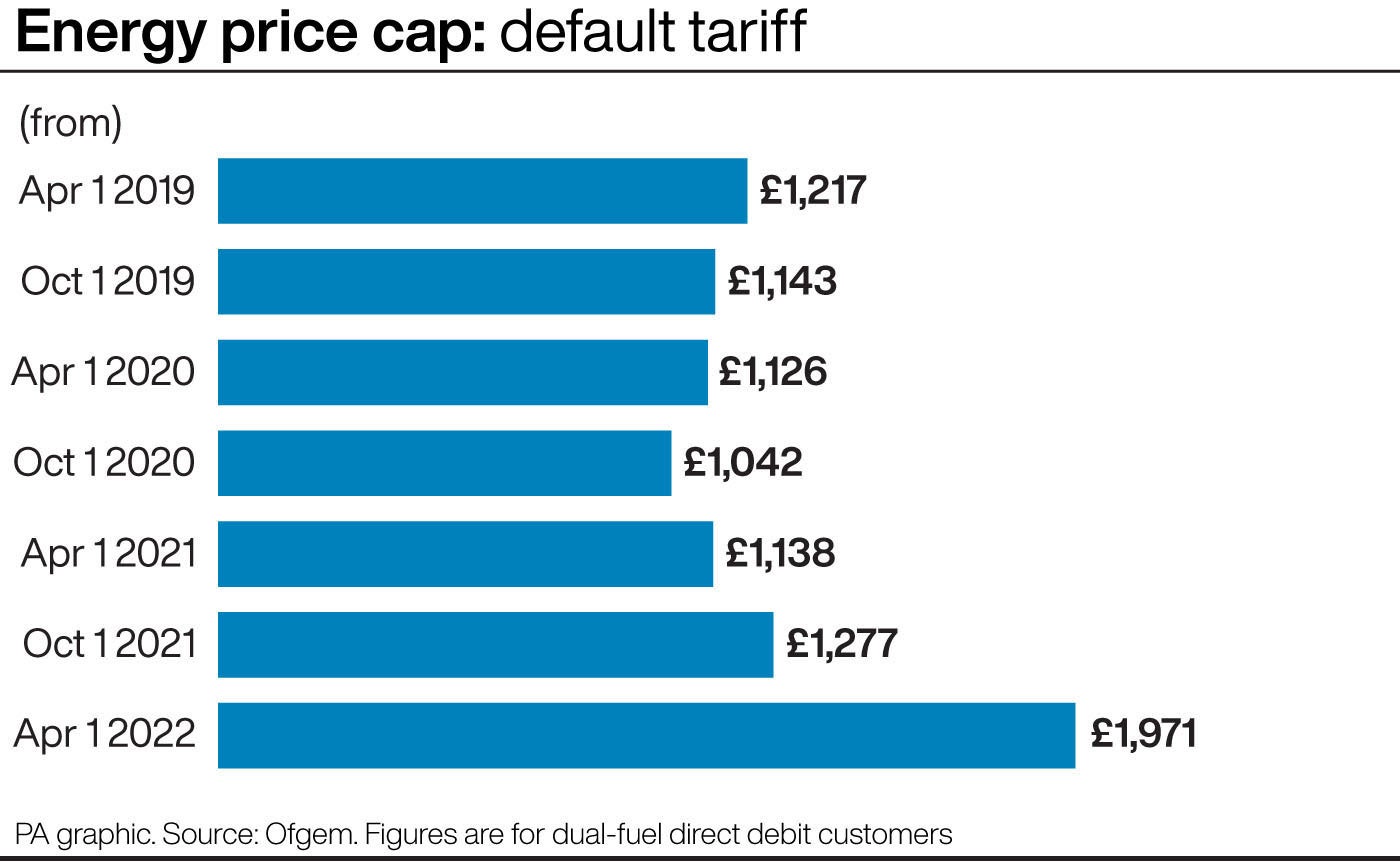

This was while 22 million households in Britain still had their energy bills capped at £1,277 per year for the average household. The cap rose to £1,971 on April 1 and has been applied to most default tariffs.

In the most deprived parts of England 57% of people reported difficulty in paying energy bills, but even in the least deprived areas of the country, 35% struggled.

Meanwhile, nearly a quarter (23%) of adults across the country reported it was very difficult or difficult to pay their usual household bills last month compared to a year ago. In November the same figure was 17%.

Bills are rising alongside everyday costs for nearly everyone in the UK, as well as in many other countries.

Inflation rose by 7% in the 12 months to March, according to the latest Consumer Prices Index data from the ONS.

Nearly all the people surveyed by the ONS in March (87%) reported that their cost of living had risen compared to just a month before.

In November only 62% of people reported the same.

The survey found that 17% are borrowing more money or using more credit than a year ago while 43% reported they will not be able to save money over the next 12 months.

Jack Leslie, senior economist at the Resolution Foundation, said: “The combination of shrinking pay packets and rising costs means that the pressure on households is building, with lower-income families set to feel the squeeze the most, and over a third of the most deprived fifth of households in England already saying it has been difficult or very difficult to pay their usual bills.

“This is set to get worse, with the estimated number of households experiencing fuel stress hitting five million this month.

“Going forwards, the Government must do all it can to protect those who will be hardest hit – with support for low-income households a priority.”

Separate research from MetLife, an insurance company, found that one in six people have cut back costs and 57% say they expect to do so soon.

People were most likely to consider giving up everyday perks such as eating lunch out (40%), luxury items (37%), holidays and day trips (34%), socialising (32%) and entertainment subscriptions (28%).