In the latest quarter, 7 analysts provided ratings for Dentsply Sirona (NASDAQ:XRAY), showcasing a mix of bullish and bearish perspectives.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 3 | 2 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 1 | 1 | 1 | 0 | 0 |

| 2M Ago | 1 | 1 | 0 | 0 | 0 |

| 3M Ago | 0 | 1 | 0 | 0 | 0 |

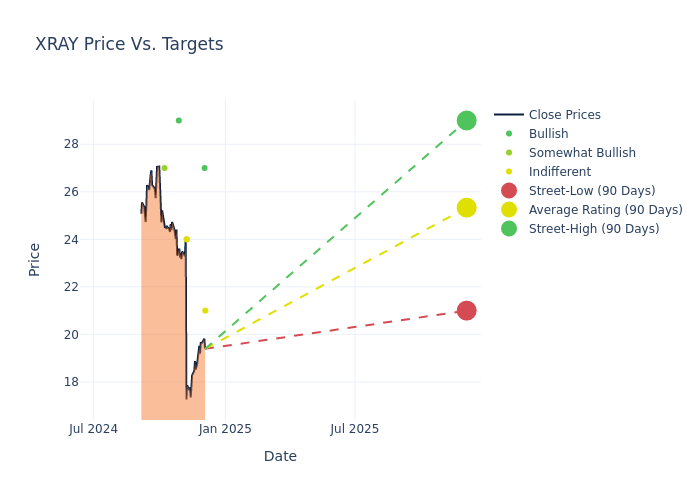

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $26.86, a high estimate of $36.00, and a low estimate of $21.00. A decline of 19.82% from the prior average price target is evident in the current average.

Interpreting Analyst Ratings: A Closer Look

The standing of Dentsply Sirona among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Steven Valiquette | Mizuho | Announces | Neutral | $21.00 | - |

| Kevin Caliendo | UBS | Lowers | Buy | $27.00 | $35.00 |

| Michael Petusky | Barrington Research | Lowers | Outperform | $24.00 | $36.00 |

| Jeffrey Johnson | Baird | Lowers | Neutral | $24.00 | $31.00 |

| David Saxon | Needham | Lowers | Buy | $29.00 | $34.00 |

| Elizabeth Anderson | Evercore ISI Group | Lowers | Outperform | $27.00 | $29.00 |

| Michael Petusky | Barrington Research | Maintains | Outperform | $36.00 | $36.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Dentsply Sirona. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Dentsply Sirona compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of Dentsply Sirona's stock. This examination reveals shifts in analysts' expectations over time.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Dentsply Sirona's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Dentsply Sirona analyst ratings.

Delving into Dentsply Sirona's Background

Dentsply Sirona is one of the world's largest manufacturers of dental equipment and supplies. It is a result of a merger of equals in 2016 between Dentsply International (manufactured dental consumables and lab products) and Sirona Dental Systems (manufactured technologically-advanced dental equipment). The firm's wide portfolio consists of dental consumables, lab products, CAD/CAM and imaging technology, medical devices, and specialty products in orthodontics, endodontics, and implantation. It distributes two-thirds of its dental consumables, technology and equipment through third-party distributors and the remaining portfolio is either sold to labs and offices through the firm's salesforce or directly to consumers (such as Byte clear aligner).

Understanding the Numbers: Dentsply Sirona's Finances

Market Capitalization: Positioned above industry average, the company's market capitalization underscores its superiority in size, indicative of a strong market presence.

Positive Revenue Trend: Examining Dentsply Sirona's financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 0.42% as of 30 September, 2024, showcasing a substantial increase in top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Health Care sector.

Net Margin: Dentsply Sirona's net margin is below industry averages, indicating potential challenges in maintaining strong profitability. With a net margin of -51.95%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Dentsply Sirona's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of -17.79%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): Dentsply Sirona's ROA is below industry averages, indicating potential challenges in efficiently utilizing assets. With an ROA of -7.31%, the company may face hurdles in achieving optimal financial returns.

Debt Management: Dentsply Sirona's debt-to-equity ratio is notably higher than the industry average. With a ratio of 0.93, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

Analyst Ratings: What Are They?

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.