Providing a diverse range of perspectives from bullish to bearish, 6 analysts have published ratings on Martin Marietta Materials (NYSE:MLM) in the last three months.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 2 | 1 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 2 | 1 | 0 | 0 | 0 |

| 2M Ago | 1 | 0 | 1 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

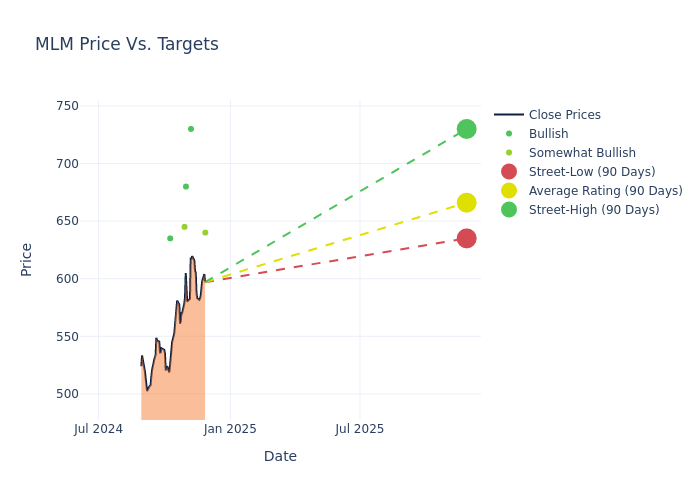

Insights from analysts' 12-month price targets are revealed, presenting an average target of $640.83, a high estimate of $730.00, and a low estimate of $515.00. Observing a 9.73% increase, the current average has risen from the previous average price target of $584.00.

Deciphering Analyst Ratings: An In-Depth Analysis

The perception of Martin Marietta Materials by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Adrian Heurta | JP Morgan | Raises | Overweight | $640.00 | $515.00 |

| Steven Fisher | UBS | Announces | Buy | $730.00 | - |

| Garik Shmois | Loop Capital | Raises | Buy | $680.00 | $600.00 |

| Adam Seiden | Barclays | Raises | Overweight | $645.00 | $595.00 |

| Philip Ng | Jefferies | Lowers | Buy | $635.00 | $650.00 |

| Adrian Heurta | JP Morgan | Lowers | Neutral | $515.00 | $560.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Martin Marietta Materials. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Martin Marietta Materials compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for Martin Marietta Materials's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of Martin Marietta Materials's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on Martin Marietta Materials analyst ratings.

Get to Know Martin Marietta Materials Better

Martin Marietta Materials is one of the United States' largest producer of construction aggregates (crushed stone, sand, and gravel). In 2023, Martin Marietta sold 199 million tons of aggregates. Martin Marietta's most important markets include Texas, Colorado, North Carolina, Georgia, and Florida, accounting for most of its sales. The company also produces cement in Texas and uses its aggregates in its asphalt and ready-mixed concrete businesses. Martin's magnesia specialties business produces magnesia-based chemical products and dolomitic lime.

Martin Marietta Materials's Financial Performance

Market Capitalization Analysis: With an elevated market capitalization, the company stands out above industry averages, showcasing substantial size and market acknowledgment.

Revenue Growth: Martin Marietta Materials's revenue growth over a period of 3 months has faced challenges. As of 30 September, 2024, the company experienced a revenue decline of approximately -5.27%. This indicates a decrease in the company's top-line earnings. When compared to others in the Materials sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Martin Marietta Materials's net margin is impressive, surpassing industry averages. With a net margin of 19.22%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Martin Marietta Materials's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of 4.03%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): Martin Marietta Materials's ROA lags behind industry averages, suggesting challenges in maximizing returns from its assets. With an ROA of 2.21%, the company may face hurdles in achieving optimal financial performance.

Debt Management: Martin Marietta Materials's debt-to-equity ratio is below the industry average at 0.48, reflecting a lower dependency on debt financing and a more conservative financial approach.

Understanding the Relevance of Analyst Ratings

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.