Ford Motor (F) -) shares moved lower in early Wednesday trading after the carmaker said it has made a new "comprehensive" counter-offer on pay and benefits to the United Autoworkers' Union and published weaker-than-expected sales figures for its signature electric truck.

Ford, which has singled-out by UAW president Shawn Fain as having made early progress in talks to break the union's unprecedented strike action, said its new proposals would establish the basis for a 'master labor agreement' that would last until the spring of 2028.

The carmaker said it would increase pension contributions, lift wages for temporary workers and reduce the amount of time that new hires would need to work before reaching higher pay tiers.

The UAW, which opened new point-by-point negotiations with General Motors (GM) -) and Jeep-owner Stellantis (STLA) -) Tuesday, has yet to respond to Ford's new offer.

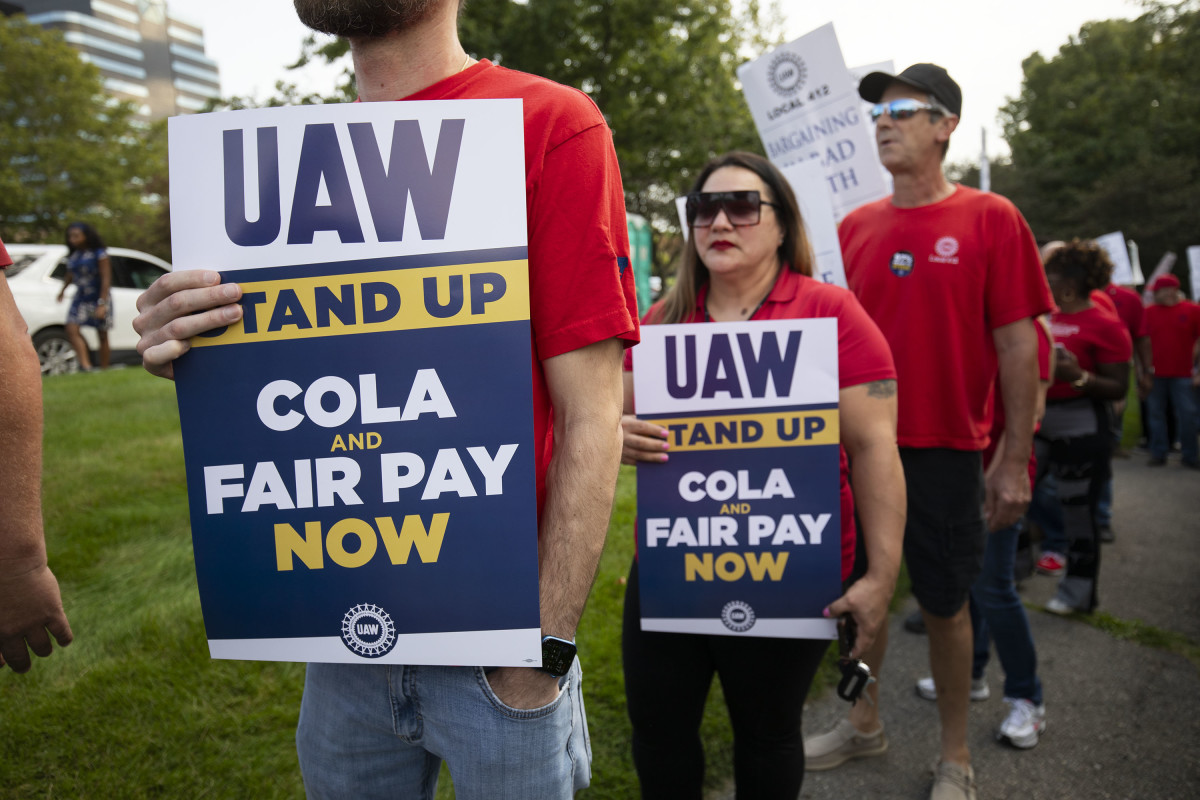

Fain authorized pickets and stoppages at plants in Lansing, Michigan and Chicago, Illinois late last week, taking the number of striking workers to around 25,000, following claims that talks with Ford and GM had failed to progress over the prior seven-day period.

The union is seeking a 40% pay increase, spread over 4 and a half years, as well as the re-introduction of cost-of-living adjustments, defined benefits pensions and the end to pay tiering for newly-hired workers.

GM CEO Mary Bara said that calling for more strikes "just for the headlines, not real progress" and said that "It’s clear that there is no real intent to get to an agreement". Ford CEO Jim Farley said the union was attempting to hold automakers "hostage" adding that strikes would have a "devastating" impact on its business.

Thus far, the 22-day strike has had a limited impact on production and sales for the so-called Big 3 automakers, with GM posting a 21% rise in U.S. sales over the third quarter, adding that it has around 443,000 vehicles in inventory heading into the final months of the year.

Ford published its own third quarter numbers prior to the opening bell, with overall sales up 7.7% to just over 500,000 unit, including a 14.8% surge in overall EV deliveries.

Sales of its flagship F-150 Lightning truck, however, were down 45.8% over the quarter adding early pressure to the company's stock price.

Ford shares were marked 0.12% lower in mid-day Wednesday trading to change hands at $12.06 each while GM slipped 0.16% to $31.32 each. Stellantis was down 0.75% in late trading in Milan.

Anderson Economic Group, a Lansing, Mich., consultancy, published a report last weekend suggesting that even a 10-day strike could cost the U.S. economy around $5.6 billion and tip the economy of the state of Michigan itself into recession.

“If we were to have a long strike in 2023, the state of Michigan and parts of the Midwest would go into a recession,” said CEO Patrick Anderson. “When GM workers went on strike in 2019, you saw gross state product drop in Michigan in the fourth quarter, while in the rest of the country it was largely unaffected."

"That won’t be the case this time if the UAW goes through on its threat to strike all three companies.” he added.

- Get exclusive access to portfolio managers and their proven investing strategies with Real Money Pro. Get started now.