Foot Locker (FL) stock is getting hammered on Friday, down 27% at last glance. The slump comes after the athletic-apparel chain reported its first-quarter results.

The company missed analysts’ expectations and cut its full-year outlook. That’s a double-whammy and helps explain today’s extreme weakness.

Specifically, the earnings fell more than 50% year over year to 70 cents a share in the most recent quarter. That missed consensus estimates, as did revenue, which fell 11.4% year over year.

Management axed its full-year outlook, from a prior range of $3.35 to $3.68 a share down to a range of $2 to $2.25 a share.

Don't Miss: Can AI Power Nvidia Stock to All-Time Highs?

No matter how you slice it, this was not a good quarter, particularly as investors were getting bullish on CEO Mary Dillon’s efforts.

Nike (NKE) shares are down about 3.7% on the day in sympathy to the price action in Foot Locker.

The action in Foot Locker is particularly painful given the disappointing fundamental backdrop. On Holding (ONON) is another footwear stock that has struggled this week on earnings, although it’s approaching key support and had a very strong quarter.

For Foot Locker, the shares are approaching a key support zone, too.

Trading Foot Locker Stock

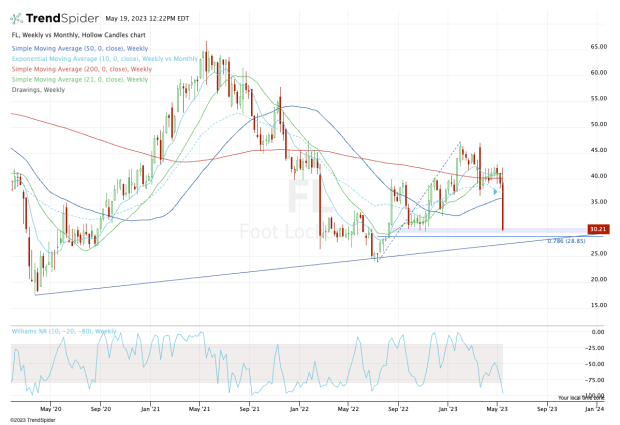

Chart courtesy of TrendSpider.com

There are two key observations in the $28 to $30 area.

First, $30 was significant support in the fourth quarter, which led to a rally of more than 50%. Second, the 78.6% retracement comes into play just below $29.

Between these two measures, the bulls may expect some sort of technical support. A slight overshot could put uptrend support in play (blue line).

Don't Miss: Walmart Beat on Earnings; Now, It Needs a Breakout

Holding support is the first and only real situation that bulls should be concerned with right now. If they want to focus on the upside, then $36 could be in the cards, but it will take a powerful bounce to get there.

If it does, that’s where traders will find the 50-week moving average and the 50% retracement. Given the earnings report t,hough, that may be a tough ask at this point.

Get investment guidance from trusted portfolio managers without the management fees. Sign up for Action Alerts PLUS now.