Home Depot (HD) shares are holding up on Tuesday after the DIY retailer reported earnings before the open.

The sentiment, however, is not great.

While the company beat earnings expectations with a 6.6% decline, revenue of $37.26 billion missed analysts’ expectations by just over $1 billion. Further, sales fell 4.2% year over year.

Worse, management lowered its earnings outlook. HD now expects earnings to fall between 7% and 13% from 2022 vs. a prior outlook of a mid-single-digit-percent decline.

Don't Miss: Can Broadcom Stock Catch Up to Chip Favorites Nvidia and AMD?

Tuesday’s decline -- the stock was off 1.4% at last check -- was enough to send it to its lowest level since late October.

Rival Lowe’s (LOW), which reports next week, is down a similar amount on the day. But it’s held up much better so far this year, down just 1.6% in 2023 vs. an 11% decline for Home Depot.

Investors want to know if this Home Depot move is a dip to buy or to avoid. Let’s look at the chart.

Trading Home Depot Stock on Earnings

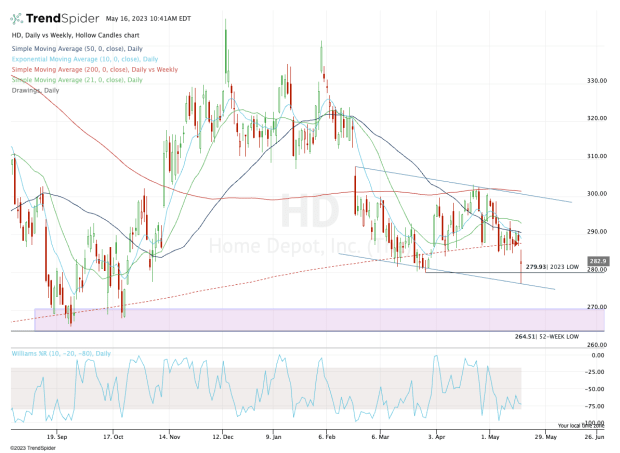

Chart courtesy of TrendSpider.com

Home Depot stock gapped down this morning, opening below the May low and the 200-week moving average.

The early selling sent the shares below the prior 2023 low near $280, and the stock tagged channel support (blue lines).

With the bounce off the lows, one has to wonder how much selling power the bears have, given that the company’s quarter was a disappointment and its guidance for the year was lowered.

In other words, is the bad news already priced in?

Keep in mind: Home Depot shares are still down nearly a third (32.5%) from the high and have lagged the indexes all year long.

Don't Miss: Do Tax Credits Make First Solar Stock a Buy? Here's What the Chart Says.

From here, watch today’s low near $277. A break below this mark could open the door back down to the annual lows and a major support area in the $265 to $270 zone.

For the bulls, holding this level and the $280 level are key. So far, Home Depot stock has reclaimed $280 (which is roughly the prior 2023 low). If it can stay above that figure, then the shares could continue to work their way higher.

Regaining $290 should be a top priority in that scenario. That would put the shares back above the 200-week, 10-day and 50-day moving averages. In that scenario, it could put $300-plus back in play.

But for that to happen, the bulls will likely need strong earnings reports from other retailers this week.

Action Alerts PLUS offers expert portfolio guidance to help you make informed investing decisions. Sign up now.