Maintaining a stable and secure income is an essential financial priority for retirees. Risks such as inflation, stock market fluctuations and unexpected expenses can pose threats to retirement security and cause sleepless nights. Fortunately, retirees and people approaching retirement can take steps to help ensure their retirement income remains secure.

One essential component of retirement security: strategic consideration of investments.

While investing is a complex topic and can be intimidating, there are steps just about everybody can take to manage their investments. Once the following steps are taken, making asset allocation decisions for how you divide your money between stocks, bonds and/or cash in a way that balances returns and safety according to your comfort and needs becomes easier. Asset allocation is one of the most important investment decisions.

Step #1: Determine the character of your income.

You should take into account income from both your employment and other sources. And “character” refers to how steady and secure your income may be. Income that is uncertain or volatile might call for a lower-risk investment portfolio, and a more secure, steady income might be able to withstand a riskier portfolio that offers higher potential returns.

Step #2: Assess your risk tolerance.

Once you’ve figured out your income’s character, you should take stock of how tolerant you are of the potential ups and downs of investment returns. For instance, oftentimes, portfolios with a greater chance of high returns in the long run experience more ups and downs from year to year, and higher returns are not guaranteed.

You should be honest with yourself about your tolerance for potential volatility and the accompanying risk.

Step #3: Consider your risk capacity and your risk tolerance together.

Risk capacity refers to how well your finances can bear risk. If you have a high tolerance for risk, but your income and other financial resources wouldn’t be able to recover adequately if the market takes a downturn, you’ll need to carefully balance your need to stay financially secure and your preference for risk-taking.

Step #4: Decide how to allocate your funds.

Allocation of funds means figuring out where to put them, usually in stocks, bonds and/or cash. For example, if you want to potentially earn more, and both you and your funds can withstand greater risk, you might choose to have more stocks than bonds in your portfolio.

On the other hand, if you want to avoid as much risk as possible and are willing to earn less on your investments, make sure your portfolio has more bonds. Savvy investors make allocation decisions before thinking about specific investments.

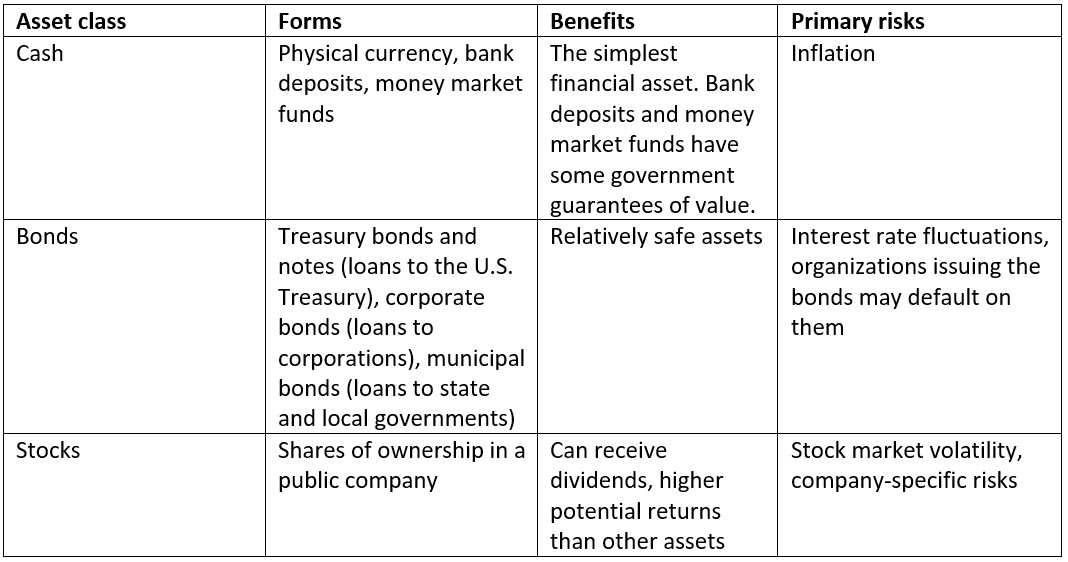

Asset classes are the building blocks of asset allocation. There are three basic classes: stocks, bonds and cash. Below is a summary of the asset classes:

As listed in the table above, each asset class poses its own risk. Investment risks tend to fit into these categories:

- Inflation. This refers to a decline in a currency’s purchasing power.

- Interest rate fluctuations. Interest rates change in response to economic conditions, and these affect bond prices. For instance, generally, when interest rates rise, bond prices fall.

- Stock market volatility. If investors expect a good economy in the near future, the stock market tends to rise. On the other hand, if investors feel wary or negative about the economy’s prospects, the stock market tends to fall.

- Individual companies’ stocks. Good news about a company can make its stock price go up faster than the rest of the stock market, while bad news can do the opposite.

- Currency risks. Currencies from different countries and regions fluctuate in relation to one another and can impact the U.S. dollar’s purchasing power.

Diversification — dividing investment funds between a variety of stocks and/or bonds — is a good strategy to reduce risk. Diversification won’t eliminate risks, however. If the stock market drops, a diversified portfolio will likely drop, too.

Step #5: Choose how to implement your asset allocation decisions.

You can choose to make your investment decisions a reality by using a pre-packaged method, a customized solution or a combination of these approaches.

Mutual funds and exchange-traded funds (ETFs) pool investors’ money in stocks, bonds and other assets. Both are pre-packaged solutions and managed by professional fund managers.

A customized or self-directed approach enables you to design your own asset allocation strategy, choosing among several mutual funds, ETFs, bonds, government Treasury bonds and notes, real estate or individual securities, to create a portfolio aligned with your preferences.

A financial plan provides a good framework to help you choose your asset allocation target by quantifying a spending plan and setting savings and investment return targets. It can also help you see the potential impact of investment risks, expenses and tax implications.

When taking the self-directed approach, you’ll need to choose specific investments once you’ve decided on an asset allocation target. Below are a few things to consider:

- Active vs passive mutual funds. Active mutual funds are actively managed by a portfolio manager, usually to achieve returns higher than the market average (though this isn’t guaranteed). These funds tend to have higher costs due to the activities performed by the fund manager. Passive mutual funds (such as indexed mutual funds and ETFs) typically mirror the structure and performance of a specific market index, such as Standard & Poor’s 500 index. These funds tend to have lower costs.

- The impact of investment costs on potential returns and tax implications.

You don’t have to be completely on your own if you decide on the customized or self-directed approach to asset allocation. A financial adviser can help you design and implement your investment mix.

Find out more about asset allocation and learn practical considerations and advice on related topics from retirement professionals in the Society Of Actuaries Research Institute’s Asset Allocation: A Roadmap to Investing and other briefs located at Managing Retirement Decisions.