/Fifth%20Third%20Bancorp%20ban%20location%20by-Joe%20Hendrickson%20via%20iStock.jpg)

Cincinnati, Ohio-based Fifth Third Bancorp (FITB) operates as the bank holding company for Fifth Third Bank, National Association, which offers a wide range of financial products and services. Valued at $30 billion by market cap, the company’s principal businesses include retail banking, commercial banking, investment advisory, and data processing.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and FITB perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the banks - regional industry.

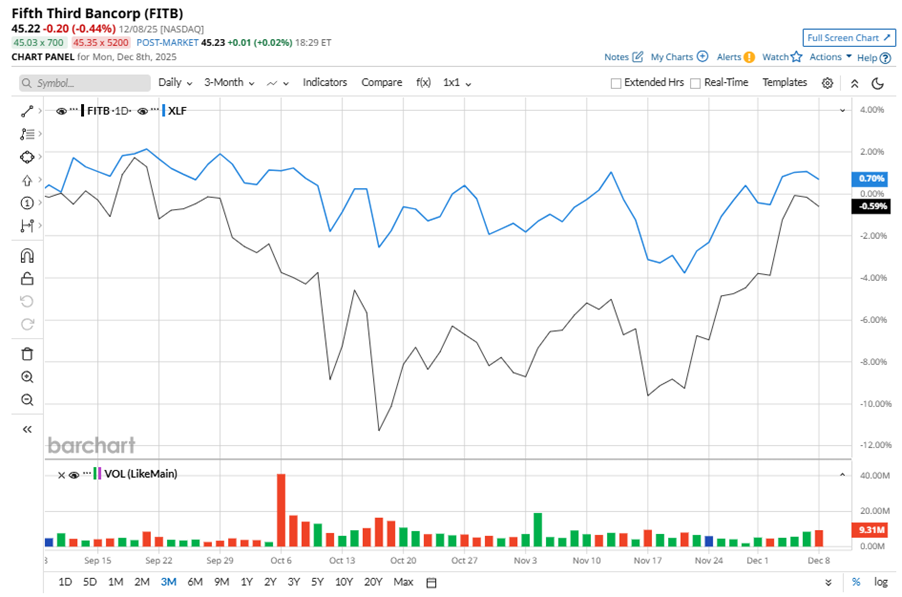

Despite its notable strength, FITB slipped 7.8% from its 52-week high of $49.07, achieved on Nov. 25, 2024. Over the past three months, FITB stock declined marginally, underperforming the Financial Select Sector SPDR Fund’s (XLF) marginal gains during the same time frame.

In the longer term, shares of FITB rose 14.7% on a six-month basis, outperforming XLF’s six-month gains of 4.3%. However, the stock dipped 4.2% over the past 52 weeks, underperforming XLF’s 6.1% returns over the last year.

To confirm the bullish trend, FITB has been trading above its 50-day moving average since late November. The stock has been trading above its 200-day moving average since early July, with slight fluctuations.

On Oct. 17, FITB shares closed up more than 1% after reporting its Q3 results. Its revenue was $2.31 billion, surpassing analyst estimates of $2.29 billion. The company’s EPS of $0.91 beat analyst estimates by 5.9%.

In the competitive arena of banks - regional, Truist Financial Corporation (TFC) has lagged behind FITB, showing resilience with a 17.3% uptick on a six-month basis and marginal returns over the past 52 weeks.

Wall Street analysts are reasonably bullish on FITB’s prospects. The stock has a consensus “Moderate Buy” rating from the 23 analysts covering it, and the mean price target of $50.86 suggests a potential upside of 12.5% from current price levels.