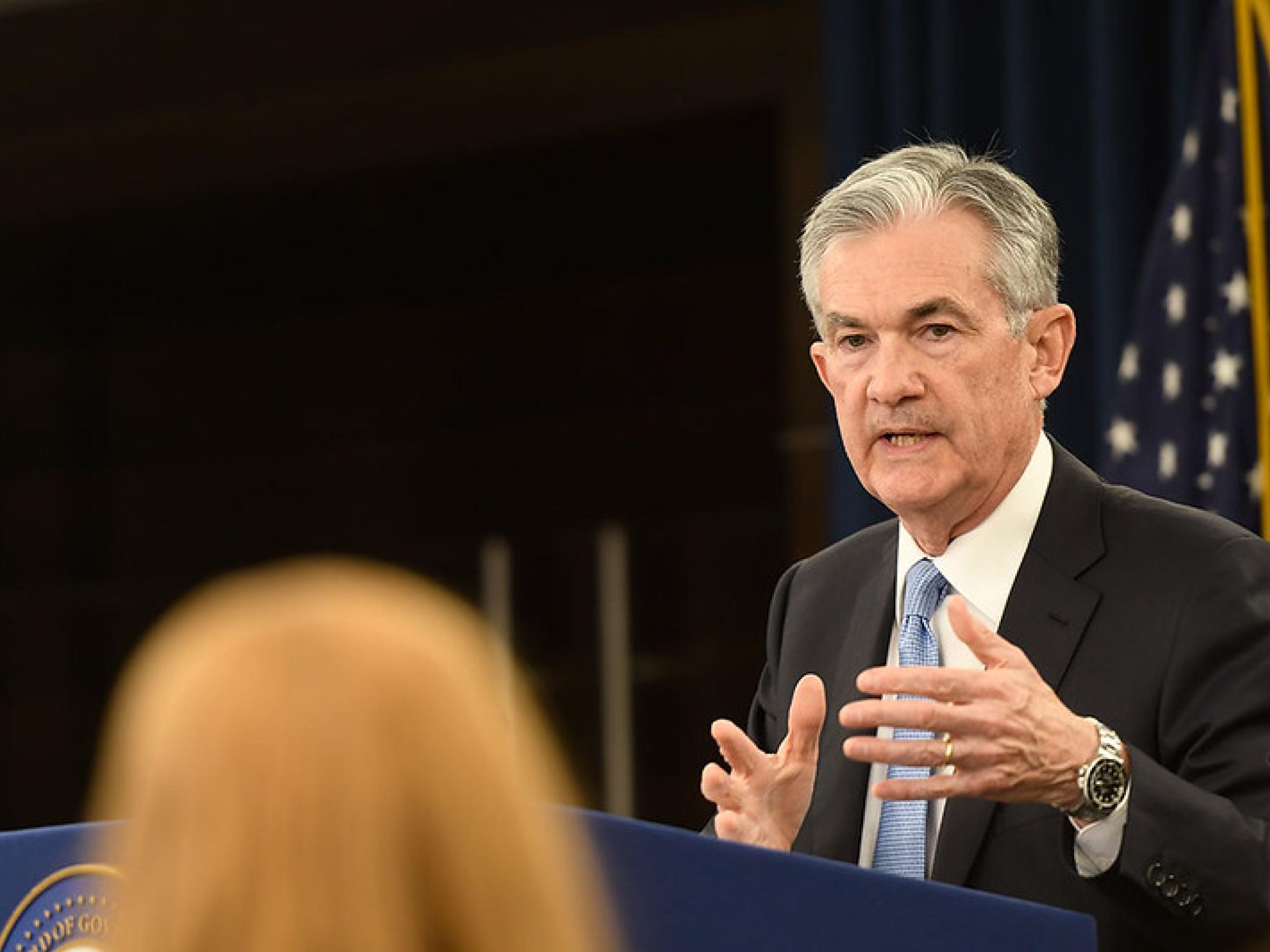

- Reuters revisits March 15, 2020, when the U.S. Federal Reserve, in the words of its boss Jerome Powell, "crossed a lot of red lines that had not been crossed before."

- Powell cut interest rates to zero, announced huge asset purchases to deflect bond market stress, and opened dollar supply lines for other central banks, fearing a pandemic that threatened recession on a scale not seen since the 1930s.

- Fed is expected to throw its pandemic emergency measures into reverse, as on Tuesday it starts a two-day meeting that should deliver a 25 basis-point rate rise and could signal how far and fast policy tightening might go, reported Reuters.

- The challenges remain more daunting than those faced in 2020, with a war raging, food and fuel prices soaring expected to exacerbate inflation already more than three times the Fed's target; a double-digit factory inflation print is expected on Tuesday.

- Photo by Fed via Flickr