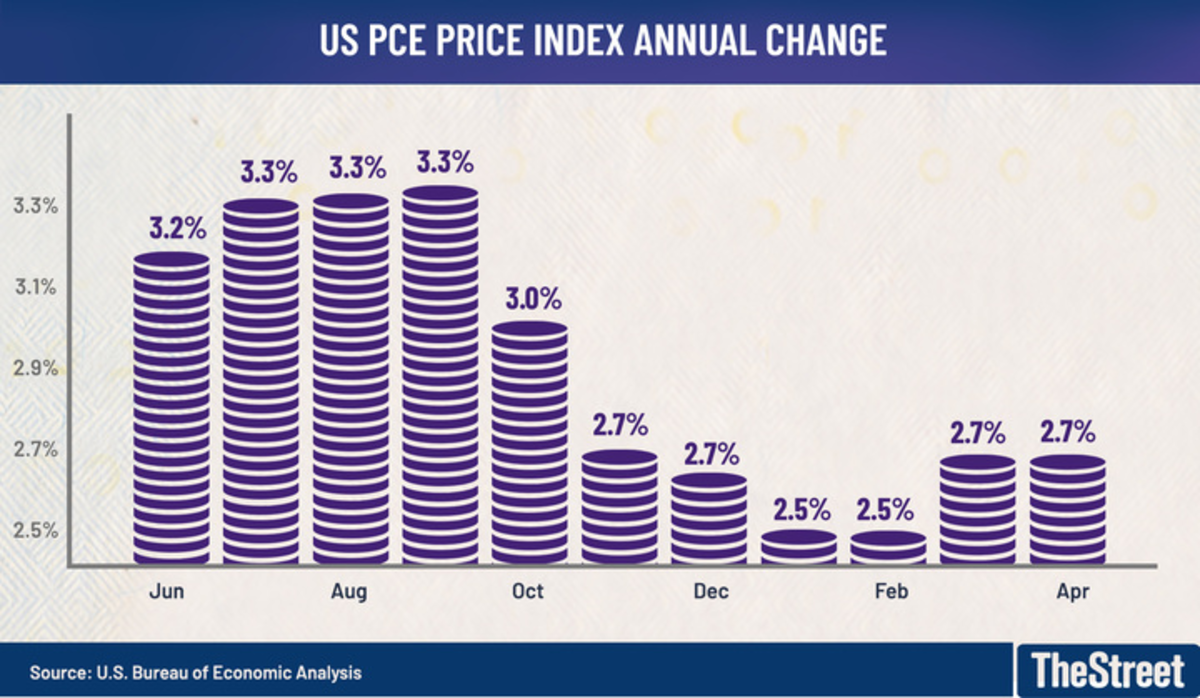

The Federal Reserve's preferred measure of inflation eased modestly in May, falling to the lowest levels in more than three years and possibly cementing the case for an autumn rate cut.

The Bureau of Economic Analysis' PCE Price Index report showed core prices (ex- energy and food) rose at an annual rate of 2.6% last month, matching Wall Street's forecast and coming in modestly lower than readings over the past two months and the slowest since March of 2021.

Related: S&P 500's top 5 stocks in June (Nvidia isn't one of them!)

Core pressures were up 0.1% monthly, a slower pace than April's revised 0.3% gain but matching Wall Street's consensus estimate.

Bond and stock market participants often focus on the bureau's core PCE inflation report. The Fed considers it a more accurate representation of consumer-price pressures because it incorporates changes in spending patterns.

The headline inflation index, meanwhile, held at an annual rate of 2.6%, matching Wall Street's forecast. Prices were unchanged on the month, the BEA said, following a 0.3% gain in March.

The BEA also noted that personal incomes for May rose 0.5%, up from the 0.3% pace in April, reflecting some firmness in the labor market. Spending slowed to a 0.2% rise compared with the 0.1% gain in April.

"The lack of surprise in today’s PCE number is a relief and will be welcomed by the Fed. Annual core PCE has now fallen to the lowest level in three years and should provide some comfort that inflation is once again decelerating," said Seema Shah, chief global strategist at Principal Asset Management.

"However, the policy path is not yet certain," she added. "A further deceleration in inflation, ideally coupled with additional evidence of labor market softening, will be necessary to pave the way for a first rate cut in September."

Stocks were little changed following the inflation data release, with the S&P 500 20 points higher and the Dow Jones Industrial Average looking at an early point advance.

Benchmark 10-year note yields eased 4 basis points to 4.275% following the release, while 2-year notes eased 3 basis points to 4.6871%.

The U.S. dollar index, which tracks the greenback against a basket of six global currencies, was marked 0.01% higher at 105.920.

Bureau of Economic Analysis

Earlier this month, the Commerce Department's headline Consumer Price Index for May was pegged at 3.3%, down from 3.4% in the prior month.

So-called core inflation, which strips out volatile components like food and energy, slowed to an annual rate of 3.4%, the lowest in more than two years.

More Economic Analysis:

- Bonds are freaking out about inflation

- Key bond market signal sounds inflation alarm

- Fed rate cuts face big reset on renewed inflation risks

The CME Group's FedWatch tool suggests the market expects no interest rate change from the Federal Reserve when its two-day May policy meeting ends on July 31 after holding rates steady at a two-decade high of 5.25% to 5.5% earlier this month.

Bets that the Fed starts cutting rates in September, however, are rising to around 66%, with markets still debating the odds of a second rate cut before the end of the year.

Related: Veteran fund manager picks favorite stocks for 2024