The S&P 500 Index is at an all-time high. The U.S. economy, which added 2.7 million jobs in 2023, tacked on another 275,000 jobs just in February. And at 3.15%, the U.S. inflation index stands at roughly half of what it was a year ago.

Meanwhile, the largest video streaming company, Netflix, recently reported 12.5% revenue expansion in the fourth quarter to $8.833 billion, and it told equity analysts to expect 13.2% growth for the first quarter.

Still, according to TiVo's fourth-quarter Video Trends Report, these are, in fact, the hard times. The Xperi-owned video company says consumers are "waving the caution flag," using fewer video streaming services than they once were and spending less money on entertainment, with even high-income households becoming "increasingly cost-conscious."

Just for effect, TiVo even festoons its 20-page report with 15 graphics of little yellow auto-racing caution flags.

Slow down, overheated North American video business!

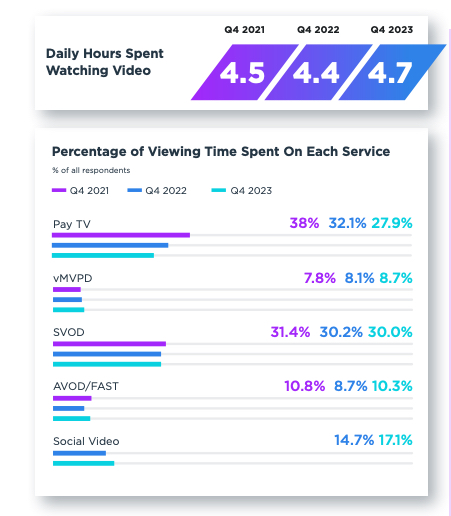

For starters, TiVo says the average number of video sources U.S. consuming housholds are tapping into is down from a Q4 2022 peak of 11.5 to just 11.1 in the fourth quarter of 2023, with paid sources dropping from 7.6 - 7.1, while non-paid services were up slightly over the two-year span (4.0 vs. 3.9).

TiVo said 20% of the 4,436 U.S. and Canadian consumers in its survey said they have too many video services.

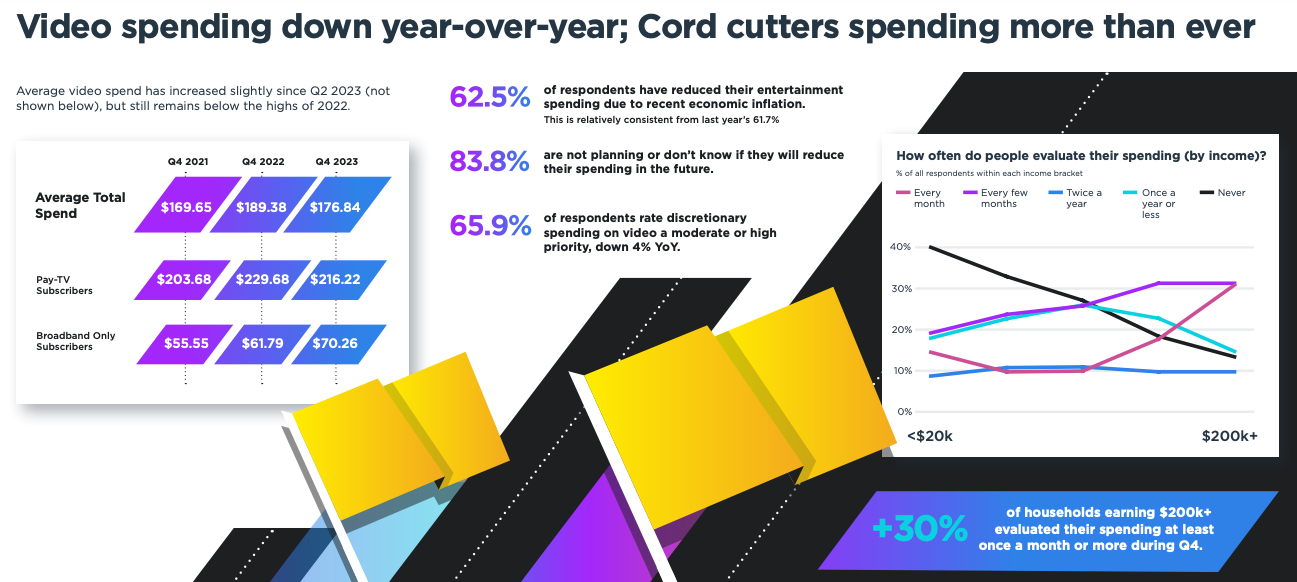

Overall monthly spending on video was down 6.6% over the same two-year span, TiVo said, dropping to $176.84 in the last three months of 2023.

Keeping with what is, by now, a fairly conventional narrative among research reports, TiVo -- which operates FAST platform TiVo Plus -- says that overall video consumption is actually up, and that consumers are increasingly turning to free ad-support streaming.

However, this is worth noting: Compared to TiVo's Q2 2023 Video Trends Report, per-household spending was actually up by 3.4%. Average deployed video sources per household were up, too (11.1 vs. 10.9) and so were paid sources (7.1 vs. 6.9).

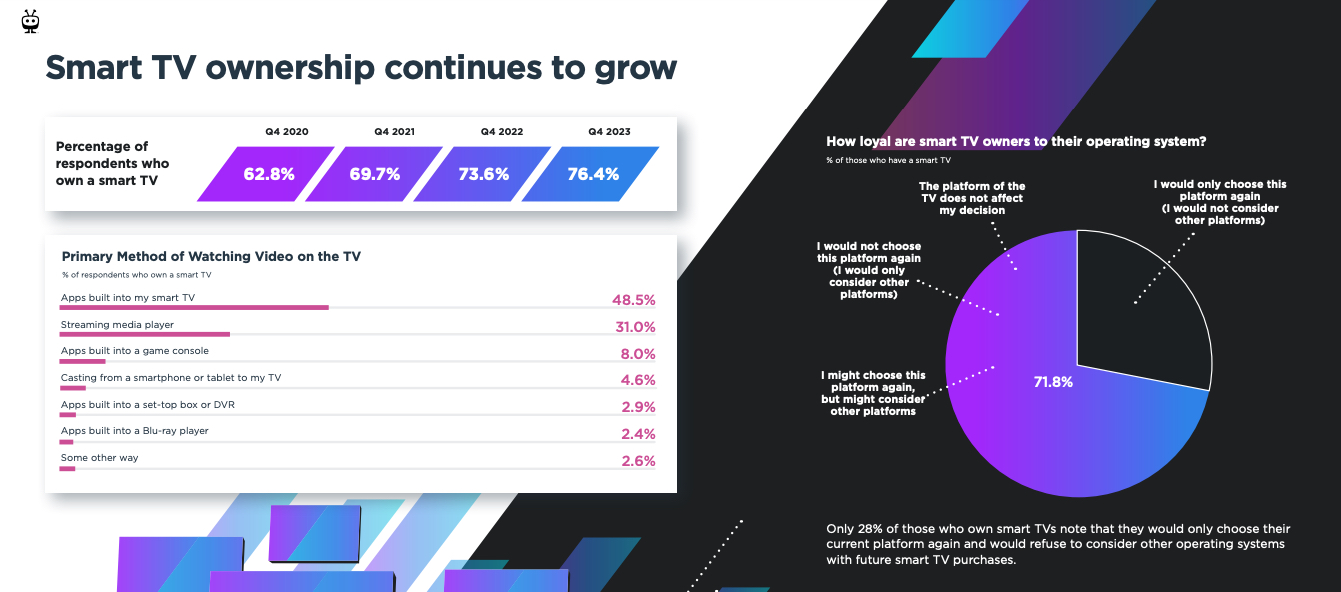

Meanwhile, putting down the caution flags to examine other parts of the North American video business, TiVo assures us that the smart TV market isn't saturated, and that consumers are open to trying new TVOS platforms beyond the major incumbents. This is undoubtedly good news for the boys upstairs at Xperi, who are trying to infiltrate the smart TV OS market with a Linux-based TiVo-branded software platform.

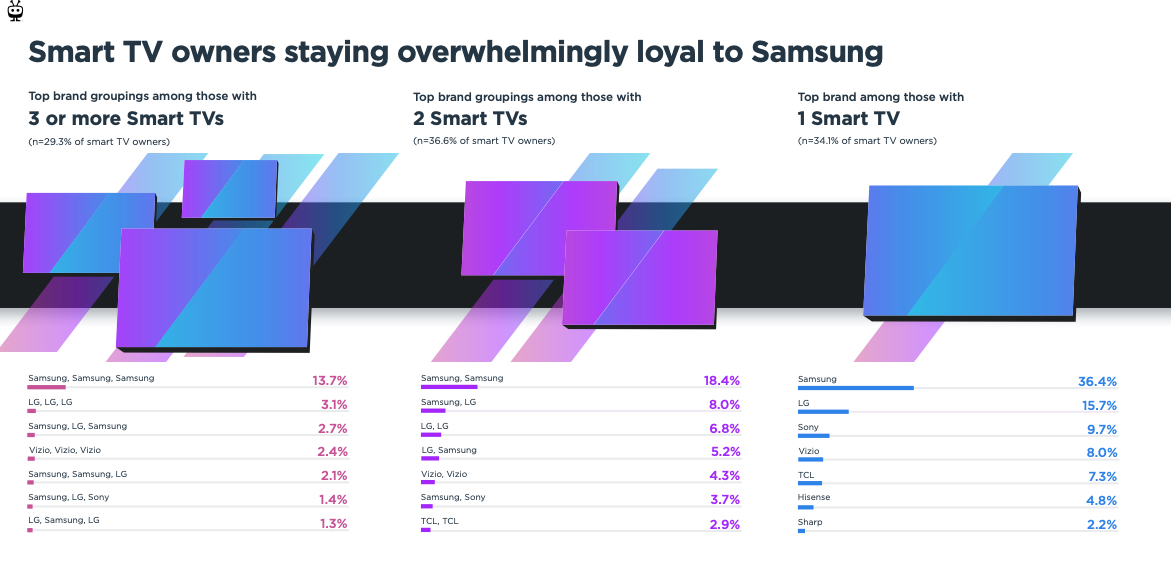

Notably, TiVo did find that Samsung maintains the most brand loyalty in the smart TV business.