The "wine trader" wooed her online for months with his flirtatious smile and emoji-sprinkled texts. Then he went for the kill, defrauding the Philadelphia-based tech professional out of $450,000 in a cryptocurrency romance scam.

The con -- which drained Shreya Datta, 37, of her savings and retirement funds while saddling her with debt -- involved the use of digitally altered deepfake videos and a script so sophisticated that she felt her "brain was hacked."

The scam is commonly known as "pig butchering," with victims likened to hogs fattened up by fraudsters with feigned love and affection before the proverbial slaughter -- tricking them into a fake crypto investment.

The rapid growth of this fraud, thought to be run by crime syndicates in Southeast Asia, has resulted in losses worth billions of dollars in the United States, with victims saying there is little recourse to recover the money.

As it has for many victims, Datta's experience began on a dating app -- Hinge, in her case, where last January she met "Ancel," who introduced himself as a French wine trader based in Philadelphia.

Datta said she was "charisma bombed" as the conversation quickly moved to WhatsApp. The gym buff with a dreamy smile deleted his Hinge profile to give her "focused attention," a refreshing experience in the age of fleeting online relationships.

They exchanged selfies, flirty emoticons and did brief video calls in which the suave but "shy" man posed with a dog, later determined to be AI deepfakes.

They texted daily, with "Ancel" enquiring about little things like whether she had eaten, preying on Datta's desire for a caring companion after her divorce.

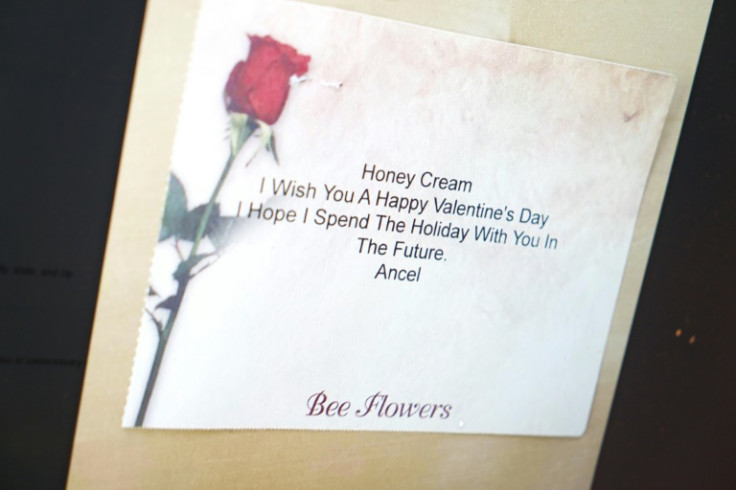

Plans to physically meet kept getting pushed back, but Datta was not immediately suspicious. On Valentine's Day last year, she received a bouquet from "Ancel" sent from a Philadelphia flower shop, with the card addressing her as "Honey Cream."

When she sent him a selfie, posing with the flowers, he sprayed her with red kiss mark emojis, according to WhatsApp exchanges seen by AFP.

Between the mushy exchanges, "Ancel" sold her a dream.

"The dream was, 'I'm retiring early, I'm well off. What is your plan?'" Datta, an immigrant from India, told AFP.

"He's like, 'I've made all this money investing. Do you really want to work till you're 65?'"

He sent her a link to download a crypto trading app -- which came with two-factor authentication to make it appear legitimate -- and showed her what he called money-making trades through annotated screenshots seen by AFP.

Datta converted some of her savings into cryptocurrency on the US-based exchange Coinbase and the fake app initially allowed her to withdraw her early gains, boosting her confidence to invest more.

"As you make astronomical amounts of money trading, it messes with your normal risk perception," Datta said in hindsight.

"You feel like, 'Wow, I can do even more.'"

"Ancel" egged her on to invest more savings, take out loans and, despite her reluctance, liquidate her retirement fund.

By March, Datta's nearly $450,000 investment had more than doubled on paper, but alarm bells went off when she tried to withdraw the amount and the app demanded a personal "tax."

She turned to her London-based brother, who did a reverse image search of the pictures "Ancel" had sent her and found they were of a German fitness influencer.

"When I realized it was all a scam and all the money was gone, I had proper PTSD symptoms -- I couldn't sleep, couldn't eat, couldn't function," Datta said.

"It was very traumatizing."

Dating sites are rife with disinformation, with Facebook groups such as "Tinder swindler dating scams" and "Are we dating the same guy?" cropping up, and researchers calling out the growing use of AI-generated profile pictures.

But the use of romance as a hook to commit financial fraud is provoking new alarm.

The FBI told AFP that last year more than 40,000 people reported losses totaling well over $3.5 billion from cryptocurrency fraud, including pig butchering, to the agency's Internet Crime Complaint Center.

But that estimate is likely low, as many victims tend not to report the crime out of shame.

"What's horrific about this crime is it is meant to take every last penny from its victim," Erin West, a California-based prosecutor, told AFP, adding that she is "deluged with victims every day."

Self-harm among victims is a common concern, campaigners say, with most unable to recover their losses and some falling prey to another breed of scammers -- fake recovery agents.

Datta, who is in therapy and has moved to a smaller apartment to manage her debt, said she had little hope of recovery after reporting the crime to the FBI and Secret Service.

Neither body responded to AFP's queries about her particular case. Nor did Coinbase, which informed Datta in an email -- after she was conned -- that she "may have sent cryptocurrency to a fraudulent investment platform."

More agonizing, Datta said, was dealing with public judgments such as, "How could you be so stupid?"

"There should be no shame in becoming a victim of this absolutely masterful psychological scam," West said.

"Victims are truly brainwashed."