Tough Scene At Facebook On Thursday

Thursday was apparently a hard day for Mark Zuckerberg, the CEO of the company we all still think of as Facebook, but which is now officially called Meta Platforms, Inc. (NASDAQ:FB). According to Bloomberg, at the company's all-hands virtual meeting Zuckerberg,

appeared red eyed and wore glasses, and the Facebook staff were told in advance that he might tear up because he scratched his eye

Whether or not Zuck scratched his eye, his stock certainly had a black eye on the day, after posting earnings and guidance below Wall Street's expectations after the close on Wednesday, and posting its first ever quarterly decline in users. Let's look at a few lessons we can draw from this.

Lesson 1: A Stock Is Never Too Big To Fall

Facebook was the "F" in the FAANG stocks, one of the blue chip internet stocks alongside Amazon, Inc. (NASDAQ:AMZN), Apple, Inc. (NASDAQ:AAPL), Netflix, Inc. (NASDAQ:NFLX) and Google parent Alphabet, Inc. (NASDAQ:GOOG), (NASDAQ:GOOGL). Last summer, it became one of a handful of companies to have a market cap of over $1 trillion, and it was still nearly a $900 billion market cap company as of Wednesday's close. Nevertheless, it lost more than a quarter of its value in one day.

Lesson 2: Stop Orders Won't Protect You

The five-day chart of FB offers an instructive illustration of a stock gapping down in price after missing earnings.

Let's say, to pick a random number, you had wanted to limit your downside risk to a drop of no more than 17% in your Facebook shares at the close on Wednesday. If you placed a stop order to sell at $268, 17% below FB's closing price on Wednesday, that wouldn't have limited your loss to 17%, because the stock never traded at $268. Stop orders won't save you when a stock gaps down below your stop price.

Lesson 3: Hedging Works In These Situations

If, instead of using a stop order, you hedged your FB shares against a greater-than-17% drop on Wednesday, here's what one of those hedges looked like. These were the optimal puts, as of Wednesday's close, to hedge 100 shares of FB against a >17% drop over the next several months (you could have scanned for a cheaper hedge using a closer expiration, but for simplicity's sake, we used our default time to expiration on Wednesday).

Screen capture via the Portfolio Armor iPhone app.

Here's a look at that put as Thursday's close.

If you hedged with this put, as of Wednesday's close, you had $32,300 in FB shares then and $2,130 worth of the FB put, for a total position value of $34,430.

As of Thursday's close, your FB shares were worth $23,776, and your put was worth $6,370, for a total position value of $30,146. So you were down 12.4%, while an unhedged position in the stock was down 26.39% on the day.

What Next For Meta/FB Shareholders?

That depends on whether Zuckerberg can reignite growth with his Metaverse offerings, as growth has apparently stalled with the core Facebook app and Instagram. As Nicole Sherrod noted on Twitter after FB's earnings hit on Wednesday,

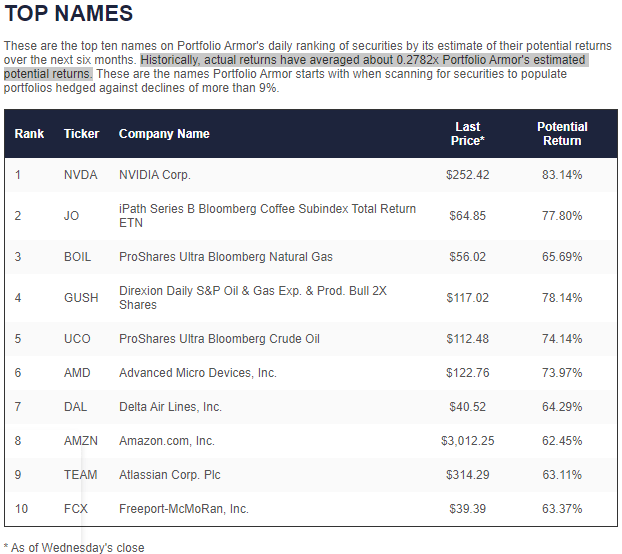

If you're looking for other places to put your money, here's a look at our top ten names as of Wednesday's close (Thursday's top ten wasn't available as of this writing):

As you can see, one of the other FAANGs, Amazon, made an appearance at #8. After dropping on Thursday, it was up 14% after hours on news of Amazon's earnings beat and price hike for Prime customers.