Within the last quarter, Medtronic (NYSE:MDT) has observed the following analyst ratings:

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 7 | 6 | 7 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 2 | 0 | 2 | 0 | 0 |

| 2M Ago | 1 | 1 | 2 | 0 | 0 |

| 3M Ago | 4 | 5 | 2 | 0 | 0 |

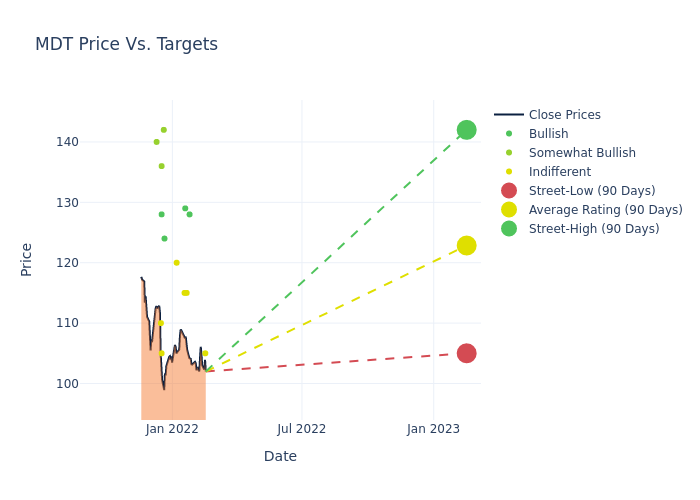

According to 20 analyst offering 12-month price targets in the last 3 months, Medtronic has an average price target of $127.8 with a high of $146.00 and a low of $105.00.

Below is a summary of how these 20 analysts rated Medtronic over the past 3 months. The greater the number of bullish ratings, the more positive analysts are on the stock and the greater the number of bearish ratings, the more negative analysts are on the stock

This current average represents a 9.22% increase from the previous average price target of $140.78.

How Are Analyst Ratings Determined?

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

This article was generated by Benzinga's automated content engine and reviewed by an editor.