4 analysts have expressed a variety of opinions on Life360 (NASDAQ:LIF) over the past quarter, offering a diverse set of opinions from bullish to bearish.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 1 | 1 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 1 | 1 | 0 | 0 |

| 2M Ago | 1 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

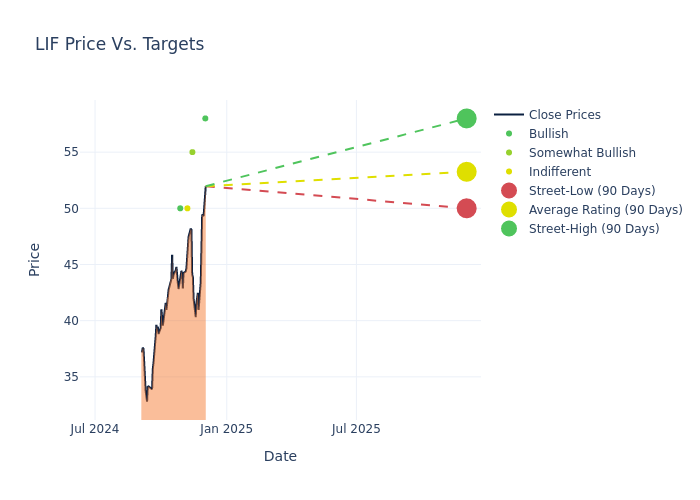

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $53.25, with a high estimate of $58.00 and a low estimate of $50.00. This current average has increased by 26.04% from the previous average price target of $42.25.

Investigating Analyst Ratings: An Elaborate Study

The standing of Life360 among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Maria Ripps | Canaccord Genuity | Raises | Buy | $58.00 | $54.00 |

| Andrew Boone | JMP Securities | Raises | Market Outperform | $55.00 | $40.00 |

| Chris Kuntarich | UBS | Raises | Neutral | $50.00 | $35.00 |

| Mark Kelley | Stifel | Raises | Buy | $50.00 | $40.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Life360. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Life360 compared to the broader market.

- Price Targets: Understanding forecasts, analysts offer estimates for Life360's future value. Examining the current and prior targets provides insight into analysts' changing expectations.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into Life360's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on Life360 analyst ratings.

Get to Know Life360 Better

Life360 is the world's largest family-focused social network, with over 50 million monthly active users. Security-conscious families use the Life360 app to track each other's whereabouts and to track the location of their pets and personal belongings. Life360 also offers a suite of additional security features, such as driver safety monitoring, roadside assistance, and emergency dispatching. In the US, the Life360 app regularly ranks in the top 10 most popular social-networking apps and in the top 25 across all apps in terms of daily active users.

A Deep Dive into Life360's Financials

Market Capitalization Analysis: The company's market capitalization surpasses industry averages, showcasing a dominant size relative to peers and suggesting a strong market position.

Positive Revenue Trend: Examining Life360's financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 18.11% as of 30 September, 2024, showcasing a substantial increase in top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Information Technology sector.

Net Margin: Life360's net margin excels beyond industry benchmarks, reaching 8.28%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Life360's ROE excels beyond industry benchmarks, reaching 2.31%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 1.85%, the company showcases effective utilization of assets.

Debt Management: Life360's debt-to-equity ratio is below the industry average. With a ratio of 0.0, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Understanding the Relevance of Analyst Ratings

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.