4 analysts have expressed a variety of opinions on CareTrust REIT (NYSE:CTRE) over the past quarter, offering a diverse set of opinions from bullish to bearish.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 3 | 1 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 3 | 0 | 0 | 0 |

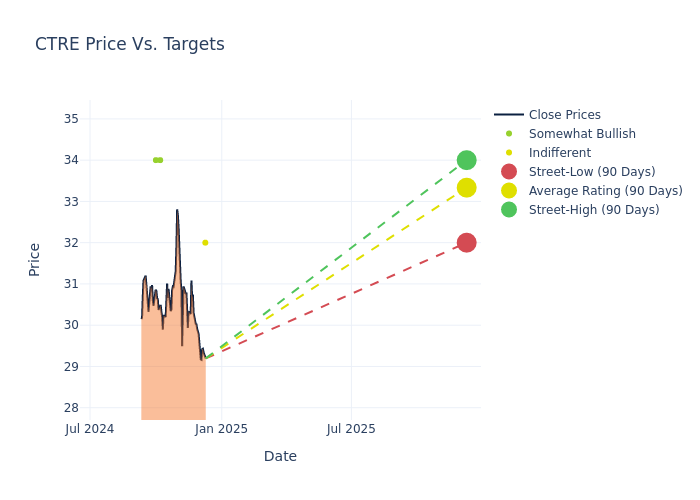

Insights from analysts' 12-month price targets are revealed, presenting an average target of $33.5, a high estimate of $34.00, and a low estimate of $32.00. This current average reflects an increase of 9.84% from the previous average price target of $30.50.

Diving into Analyst Ratings: An In-Depth Exploration

The perception of CareTrust REIT by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Juan Sanabria | BMO Capital | Lowers | Market Perform | $32.00 | $34.00 |

| Austin Wurschmidt | Keybanc | Raises | Overweight | $34.00 | $27.00 |

| Juan Sanabria | BMO Capital | Raises | Outperform | $34.00 | $33.00 |

| James Feldman | Wells Fargo | Raises | Overweight | $34.00 | $28.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to CareTrust REIT. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of CareTrust REIT compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of CareTrust REIT's stock. This examination reveals shifts in analysts' expectations over time.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of CareTrust REIT's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on CareTrust REIT analyst ratings.

Delving into CareTrust REIT's Background

CareTrust REIT Inc is a self-administered, publicly-traded REIT engaged in the ownership, acquisition, financing, development and leasing of skilled nursing, seniors housing and other healthcare-related properties. The Company has one reportable segment consisting of investments in healthcare-related real estate assets. It generates revenues by leasing healthcare-related properties to healthcare operators in triple-net lease arrangements. The Company generate revenues by leasing healthcare-related properties to healthcare operators in triple-net lease arrangements, under which the tenant is solely responsible for the costs related to the property (including property taxes, insurance, maintenance and repair costs and capital expenditures).

Financial Milestones: CareTrust REIT's Journey

Market Capitalization Analysis: Positioned below industry benchmarks, the company's market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Revenue Growth: CareTrust REIT displayed positive results in 3 months. As of 30 September, 2024, the company achieved a solid revenue growth rate of approximately 11.59%. This indicates a notable increase in the company's top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Real Estate sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 58.35%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): CareTrust REIT's ROE stands out, surpassing industry averages. With an impressive ROE of 1.53%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 1.19%, the company showcases effective utilization of assets.

Debt Management: With a below-average debt-to-equity ratio of 0.16, CareTrust REIT adopts a prudent financial strategy, indicating a balanced approach to debt management.

Analyst Ratings: What Are They?

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.