Ratings for Sprouts Farmers Market (NASDAQ:SFM) were provided by 11 analysts in the past three months, showcasing a mix of bullish and bearish perspectives.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 4 | 3 | 4 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 3 | 1 | 2 | 0 | 0 |

| 3M Ago | 1 | 1 | 2 | 0 | 0 |

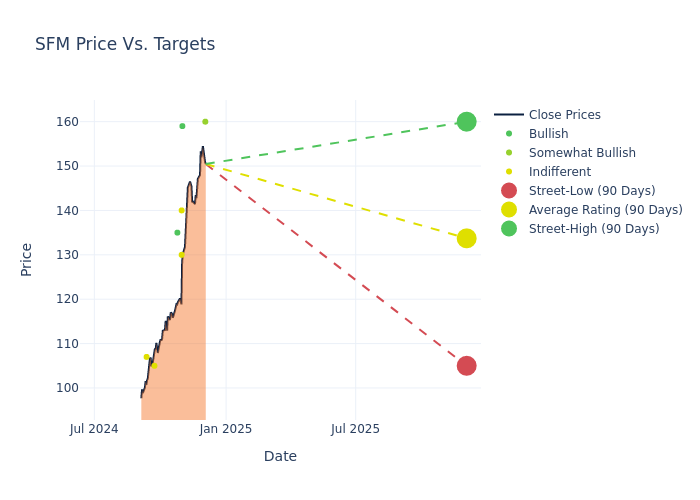

In the assessment of 12-month price targets, analysts unveil insights for Sprouts Farmers Market, presenting an average target of $129.82, a high estimate of $160.00, and a low estimate of $105.00. Witnessing a positive shift, the current average has risen by 14.44% from the previous average price target of $113.44.

Interpreting Analyst Ratings: A Closer Look

A comprehensive examination of how financial experts perceive Sprouts Farmers Market is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Michael Morris | Evercore ISI Group | Raises | Outperform | $160.00 | $155.00 |

| Kate McShane | Goldman Sachs | Raises | Buy | $159.00 | $127.00 |

| Edward Kelly | Wells Fargo | Raises | Equal-Weight | $130.00 | $90.00 |

| Kelly Bania | BMO Capital | Raises | Market Perform | $140.00 | $102.00 |

| Robert Ohmes | B of A Securities | Raises | Buy | $135.00 | $115.00 |

| Michael Morris | Evercore ISI Group | Raises | Outperform | $130.00 | $125.00 |

| Kate McShane | Goldman Sachs | Raises | Buy | $127.00 | $111.00 |

| Karen Short | Melius Research | Announces | Hold | $105.00 | - |

| Michael Morris | Evercore ISI Group | Raises | Outperform | $120.00 | $96.00 |

| Steven Shemesh | RBC Capital | Announces | Sector Perform | $107.00 | - |

| Robert Ohmes | B of A Securities | Raises | Buy | $115.00 | $100.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Sprouts Farmers Market. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of Sprouts Farmers Market compared to the broader market.

- Price Targets: Analysts provide insights into price targets, offering estimates for the future value of Sprouts Farmers Market's stock. This comparison reveals trends in analysts' expectations over time.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into Sprouts Farmers Market's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on Sprouts Farmers Market analyst ratings.

About Sprouts Farmers Market

Sprouts Farmers Market Inc offers a unique specialty grocery experience featuring an open layout with fresh produce at the heart of the store. Sprouts inspire wellness naturally with a carefully curated assortment of better-for-you products paired with purpose-driven people. The company continues to bring the latest in wholesome, innovative products made with lifestyle-friendly ingredients such as organic, plant-based, and gluten-free. It approximately has 407 stores in 23 states. It is one of the largest and fastest-growing specialty retailers of fresh, natural and organic food in the United States.

A Deep Dive into Sprouts Farmers Market's Financials

Market Capitalization Analysis: With an elevated market capitalization, the company stands out above industry averages, showcasing substantial size and market acknowledgment.

Revenue Growth: Over the 3 months period, Sprouts Farmers Market showcased positive performance, achieving a revenue growth rate of 13.57% as of 30 September, 2024. This reflects a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Consumer Staples sector.

Net Margin: Sprouts Farmers Market's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 4.71% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 7.01%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Sprouts Farmers Market's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 2.62%, the company showcases efficient use of assets and strong financial health.

Debt Management: Sprouts Farmers Market's debt-to-equity ratio is below the industry average at 1.23, reflecting a lower dependency on debt financing and a more conservative financial approach.

How Are Analyst Ratings Determined?

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.