During the last three months, 14 analysts shared their evaluations of General Motors (NYSE:GM), revealing diverse outlooks from bullish to bearish.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 8 | 2 | 2 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 1 | 5 | 1 | 1 | 0 |

| 3M Ago | 1 | 2 | 1 | 1 | 0 |

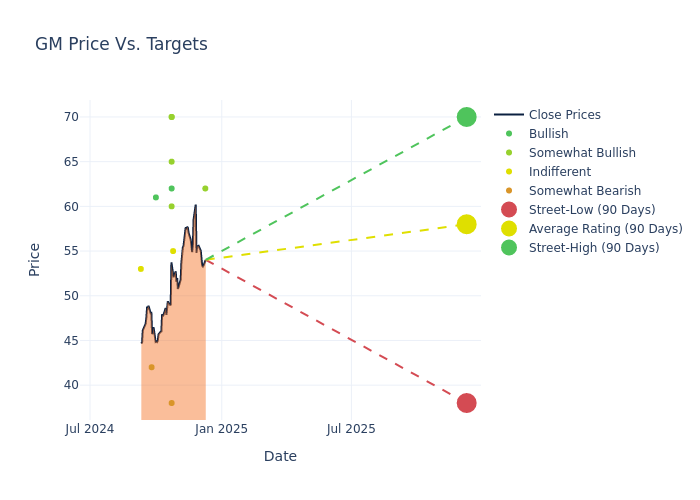

Analysts have set 12-month price targets for General Motors, revealing an average target of $57.93, a high estimate of $70.00, and a low estimate of $38.00. This current average has increased by 5.62% from the previous average price target of $54.85.

Breaking Down Analyst Ratings: A Detailed Examination

The perception of General Motors by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Vijay Rakesh | Mizuho | Raises | Outperform | $62.00 | $59.00 |

| Adrian Yanoshik | Bernstein | Raises | Market Perform | $55.00 | $53.00 |

| Tom Narayan | RBC Capital | Raises | Outperform | $65.00 | $58.00 |

| Ryan Brinkman | JP Morgan | Raises | Overweight | $70.00 | $64.00 |

| Patrick Hummel | UBS | Raises | Buy | $62.00 | $58.00 |

| Daniel Ives | Wedbush | Raises | Outperform | $60.00 | $55.00 |

| Colin Langan | Wells Fargo | Raises | Underweight | $38.00 | $33.00 |

| Dan Levy | Barclays | Raises | Overweight | $70.00 | $64.00 |

| Dan Levy | Barclays | Raises | Overweight | $64.00 | $60.00 |

| Tom Narayan | RBC Capital | Maintains | Outperform | $54.00 | $54.00 |

| Daniel Ives | Wedbush | Maintains | Outperform | $55.00 | $55.00 |

| Mark Delaney | Goldman Sachs | Raises | Buy | $61.00 | $53.00 |

| Adam Jonas | Morgan Stanley | Lowers | Underweight | $42.00 | $47.00 |

| Daniel Roeska | Bernstein | Announces | Market Perform | $53.00 | - |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to General Motors. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of General Motors compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of General Motors's stock. This comparison reveals trends in analysts' expectations over time.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of General Motors's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on General Motors analyst ratings.

All You Need to Know About General Motors

General Motors Co. emerged from the bankruptcy of General Motors Corp. (old GM) in July 2009. GM has eight brands and operates under four segments: GM North America, GM International, Cruise, and GM Financial. The United States now has four brands instead of eight under old GM. The company regained its us market share leader crown in 2022, after losing it to Toyota due to the chip shortage in 2021. 2023's share was 16.5%. GM's Cruise autonomous vehicle arm has previously done driverless geofenced AV robotaxi services in San Francisco and other cities but stopped in late 2023 after an accident. It restarted service in 2024 but not in California. GM owns over 80% of Cruise. GM Financial became the company's captive finance arm in October 2010 via the purchase of AmeriCredit.

General Motors's Economic Impact: An Analysis

Market Capitalization Analysis: Below industry benchmarks, the company's market capitalization reflects a smaller scale relative to peers. This could be attributed to factors such as growth expectations or operational capacity.

Revenue Growth: General Motors displayed positive results in 3 months. As of 30 September, 2024, the company achieved a solid revenue growth rate of approximately 10.48%. This indicates a notable increase in the company's top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Consumer Discretionary sector.

Net Margin: General Motors's net margin is impressive, surpassing industry averages. With a net margin of 6.21%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 4.34%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 1.06%, the company showcases effective utilization of assets.

Debt Management: General Motors's debt-to-equity ratio stands notably higher than the industry average, reaching 1.8. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

Understanding the Relevance of Analyst Ratings

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

If you want to keep track of which analysts are outperforming others, you can view updated analyst ratings along withanalyst success scores in Benzinga Pro.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.