Tencent is the world's largest games publisher. It's both an internet and entertainment giant in China—the equivalent of Facebook or Google—but gamers worldwide are probably more familiar with Tencent's investments into a growing number of game developers and publishers.

But with over 600 investments in its portfolio, staying on top of every company that Tencent has a stake in can be a little daunting.

That's why I've created this reference listing each of Tencent's public investments in foreign gaming companies (basically, companies outside of China), including, where possible, how much of that company Tencent owns. As part of our ongoing coverage of PC gaming in China, it's also important to understand the growing influence Chinese gaming companies like Tencent have on the global market. With Donald Trump, who issued an executive order banning transactions with Tencent's WeChat app just before he left office in 2020, returning to the Whitehouse in 2025, it's likely that influence is soon going to be under more scrutiny than ever.

Riot Games (League of Legends) – 100 percent

In 2011, Tencent went from being Riot Games' publishing partner in China to its majority stakeholder after paying $400 million for a 93 percent stake in the League of Legends developer. Four years later, Tencent scooped up the remaining 7 percent equity for an undisclosed amount, taking full control over Riot Games just as League of Legends was exploding as an esport around the world.

Tencent's purchase of Riot was nothing short of prescient—League of Legends is the most popular PC game in the world, pulling in an estimated $1.75 billion in revenue as recently as 2020. Riot Games remains largely free to steer the game how it pleases, but that relationship has some ugly downsides. Wanting to cash in on the mobile gaming boom, Tencent tried to get Riot to make a mobile version of LoL. When the developer refused, Tencent went ahead and made their own mobile clone of LoL called Arena of Valor that became one of the most profitable mobile games in Asia—and Riot wasn't very happy about it. That's mostly water under the bridge now that Tencent has abandoned Arena of Valor in the West and Riot has its own mobile version of LoL. Squabbles aside, Tencent's purchase of Riot has cemented it as the king of esports.

Epic Games – 40 percent

Tencent's $330 million investment in Epic Games back in June 2012 triggered one of the most dramatic shifts in PC gaming of the last decade, ushering in a new era of free-to-play games as a service. Seeing that "the old model" of selling games wasn't working, Epic founder Tim Sweeney decided to join forces with Tencent to better learn about operating live-service games. It paid off.

With Tencent's investment, Epic scrapped Unreal Engine 4's monthly subscription in favor of a free version where Epic earned royalties on sales, which has continued with UE5. Though developers might pay more for a successful game in the long run, it opened Unreal Engine up to an enormous community of indie developers and helped fuel intense competition between rival engine, Unity, which up until then was considered the best technology for small developers. At the same time, Epic began experimenting with live-service games like the Paragon and Fortnite: Save the World. While both games were failures, Save the World put Epic in the perfect spot to jump on the battle royale bandwagon and—almost by accident—create the biggest gaming pop culture phenomenon since Minecraft and Pokémon. Fortnite has made over $20 billion in lifetime revenue.

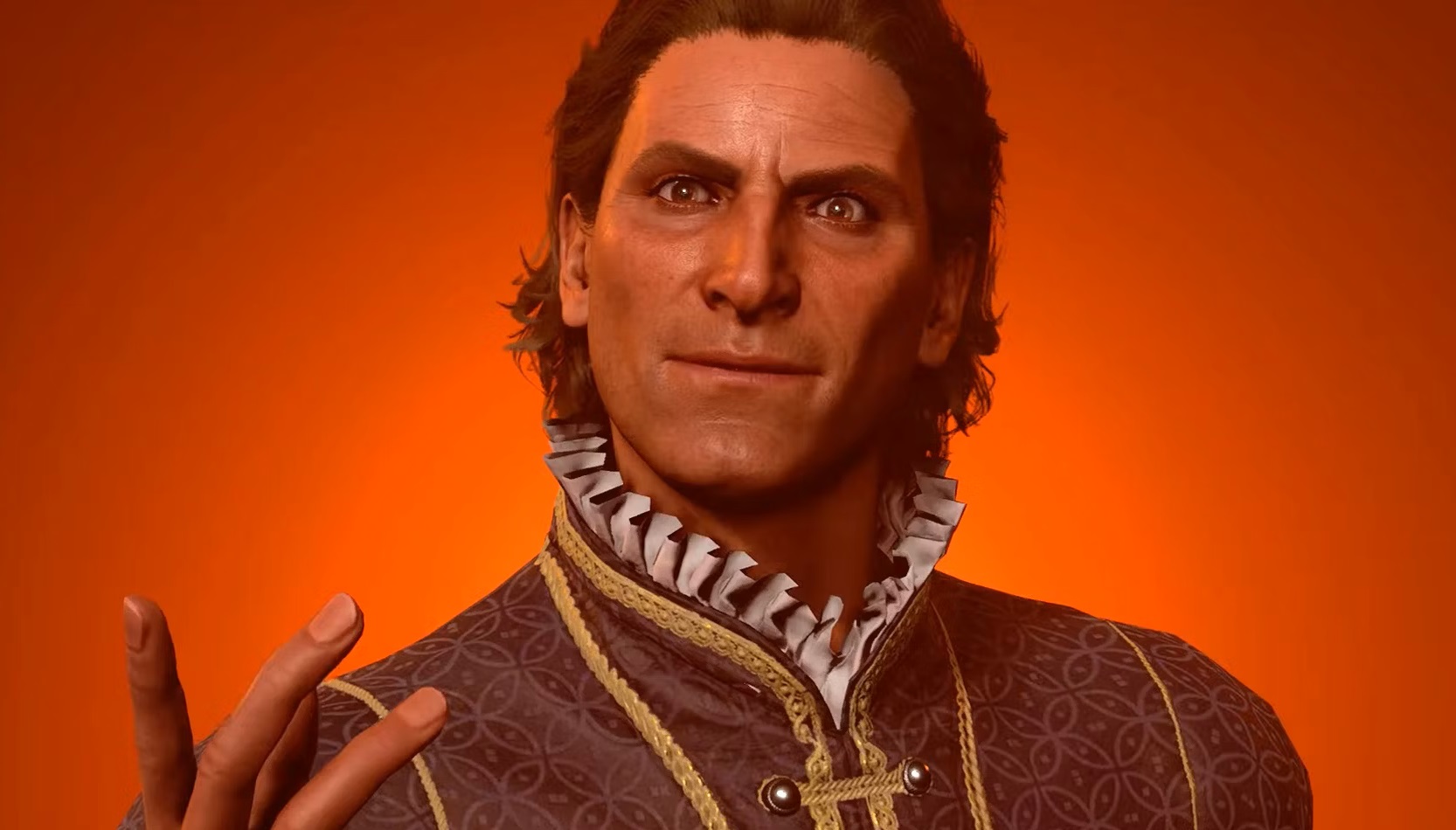

Larian Studios – 30 percent

Tencent is owns a full 30% of Baldur's Gate 3 maker Larian Studios, and is the company's only shareholder apart from CEO Swen Vincke and his wife. That sure sounds like a lot, but there's a caveat: Tencent appears to own what's called a "preference" share, meaning that Tencent doesn't have voting rights when it comes to Larian's decision making. So although Tencent might reap financial rewards from Larian's success, it doesn't get a say in what the company does. Only Swen and his partner have that right.

FromSoftware – 16 percent

As of 2022, Tencent subsidiary Sixjoy owns just over 16% of Dark Souls and Elden Ring maker FromSoftware. Another 14% belong to Sony, and the rest all belong to FromSoft's parent company: Kadokawa Corporation. The 2022 deal was in pursuit of "the expansion of the scope of [FromSoft's] own publishing in the significantly growing global market," although we haven't really seen the fruits of that just yet. Plus, there have been rumblings that Sony is looking to buy FromSoft outright, so the studio's future is more uncertain than it's ever been right now.

Krafton – 13.9 percent

Yes, Tencent owns a piece of both Fortnite and PUBG, the two founding father battle royales. What's even more amusing is that Tencent also has rights to publish both games in China, meaning it's actually in competition with itself—not a bad place to be in. Tencent's investment into Bluehole (PUBG's developer) first began in 2017, with the megacorp first acquiring 1.5 percent of Bluehole before increasing that investment to an undisclosed amount, rumored to be around 10 percent. Tencent was rumored to be seeking a complete acquisition of Bluehole, but that's likely long-since been abandoned now it has stakes in Krafton (which owns Bluehole) as a whole.

Ubisoft – 11 percent

Tencent was one of several investors that helped Ubisoft survive a hostile takeover in 2018 from Vivendi, who at the time was Ubisoft's largest stakeholder. For years, Vivendi had been steadily acquiring more stake in Ubisoft in hopes of ousting founder Yves Guillemot and seizing control for itself—putting thousands of jobs in jeopardy in the process. The situation looked grim until Ubisoft struck a deal with Vivendi that saw the French conglomerate divest its stake to a variety of investors that included Tencent, which took a 5% stake in Ubi.

In 2022, Tencent raised that stake to 11%, with the potential to increase to it as much as 17%. That deal also saw Tencent enter into a pact with Guillemot Brothers Limited, the holding company that owns most of the Guillemot family's 15% stake in Ubisoft. Tencent took a 49.9% stake in GBL, but only 5% voting rights.

As part of the agreement, though, Tencent is just a silent partner who cannot increase voting rights or ownership stake in Ubisoft—making a hostile takeover by Tencent impossible. The initial acquisition of Ubisoft shares also heralded in a strategic partnership where Tencent would publish Ubisoft games in China, which caused its own flurry of backlash over censorship.

Activision Blizzard – 5 percent

Years before Ubisoft, Tencent helped another company escape Vivendi: Activision Blizzard. Activision fell under Vivendi's control way back in 2007 when it merged with subsidiary Vivendi Games in order to join forces with Blizzard and benefit from the enormous success of World of Warcraft. Five years later, the merged companies of Activision Blizzard announced a deal to buy back Vivendi's stake in the company and become independent, and Tencent jumped at the opportunity to buy 5 percent of the company for an undisclosed amount.

Grinding Gear Games (Path of Exile) – 80 percent

In 2018 Tencent snatched up a majority stake in the New Zealand developer of Path of Exile, Grinding Gear Games. The purchase alarmed Path of Exile players who feared the Chinese publisher would start implementing more aggressive microtransactions or changes to Path of Exile's delicate in-game economy. But, like many of Tencent's acquisitions, Grinding Gear Games has supposedly kept its independence over Path of Exile's operation. In the year since, little has changed about Path of Exile's economy or microtransactions despite the game's continued growth.

Other investments worth noting

Remedy – 14 percent: Tencent bought a trifling 3.8% of Remedy's shares back in 2021, which it then increased to a meatier 14% in 2024. In September of 2024, Remedy and Tencent entered into a $17 million loan agreement which could later be converted into Remedy shares "under certain circumstances" on the third anniversary of the drawdown.

Leyou Technologies (owner of Digital Extremes) – 100 percent: Tencent picked up Leyou, the former chicken processing company that owns studios like Warframe dev Digital Extremes, Splash Damage, and Athlon Games, for $1.5 billion in 2020. “We’ve always been dedicated to creating team-based games that spark friendships and build passionate communities, and we strive to work with partners who believe in that mission," said Splash Damage co-founder and CEO Richard Jolly.

Inflexion Games – 100 percent: Tencent bought Nightingale maker Inflexion from Improbable in 2022. Improbable sold the studio in order to focus on "metaverse activities." Inflexion boss Aaryn Flynn said "It’s a privilege to work with the Tencent family. The depth of knowledge and expertise that Tencent’s global teams provide, and their empowerment of our team’s independence and creative spirit, offer an invaluable opportunity for collaboration."

Supercell – 84.3 percent: Tencent's $8.6 billion investment in this Finnish mobile developer was, at the time, one of the biggest gaming industry buys in history. But considering the fact that Tencent makes billions from its mobile games, and Supercell's enduring hits like Clash of Clans, the acquisition makes a lot of sense. Like Riot, Supercell reportedly retains most of its independence and is still located in Finland.

Platinum Games – Undisclosed investment: At the beginning of 2020, Tencent invested an undisclosed amount into Platinum Games, but the terms of the deal weren't specified. Kenichi Sato, Platinum's president and CEO, said Tencent "has no effect on the independence of our company, and we will continue operations under our current corporate structure."

Yager – Undisclosed majority stake: In February of 2020, Tencent also invested an undisclosed amount into Yager, the developer of Spec Ops: The Line among some more recent but less notable free-to-play games. Tencent upped that to an equally undisclosed 'majority stake' in Yager in 2021, which the latter said gave it "the resources to expand the studio and the games in development. With Tencent, we now have a powerful, globally operating partner to support our strategic plans for Yager."

Frontier Developments – 9 percent: Tencent invested £17.7 million into the developer of Elite Dangerous and Planet Zoo in 2017 as part of a strategic partnership to capitalize on increased interest in space and "themepark" games in China.

Kakao – 13.5 percent: Kakao is a South Korean internet and entertainment company whose games subsidiary is responsible for the mega-hit Black Desert Online, another live-service titan with revenue regularly north of $1 billion, and also publishes PUBG in South Korea.

Paradox Interactive – 10 percent: When Swedish grand strategy publisher Paradox first went public in 2016, Tencent swooped in to buy 5 percent for $21 million. Part of the sale was motivated because Steven Ma, the head of publishing at Tencent Games, is a big fan of Hearts of Iron 2. Today, Paradox lists Tencent as holding a 10.07% stake, making it the studio's third-largest investor.

Fatshark – Undisclosed majority stake: Warhammer: Vermintide 2's success led Tencent to acquire a large minority stake in Swedish developer Fatshark in early 2019 for an estimated $56 million. Tencent upped that to a majority stake in 2021, though the precise percentage of its stake wasn't clear.

Funcom – 100 percent: Tencent's most recent purchase was 29 percent of Funcom, the makers of Conan Exiles and The Secret World. Tencent acquired 100% of Funcom in 2020, delisting it from the Oslo stock exchange and [securing] funding for strong growth, as well as the opportunity to draw from Tencent’s knowledge and experience in the gaming industry," per Funcom.

Sharkmob – 100 percent: The at-the-time new studio comprised of ex The Division and Hitman devs was fully bought by Tencent in early 2019, and now makes Exoborne. Tencent announced layoffs at the company's London office in November 2024.

Discord – Undisclosed: Discord has received $158 million in funding in 2019, including an undisclosed amount from Tencent (among many other investors).

That covers most of the companies that PC gamers will care about. It also owns around 20 percent stake in Sea, a South-East Asia esports and publishing company, an undisclosed majority stake in web game publisher Miniclip (now dead), and about a half a dozen minority stakes in a variety of mobile game companies to boot.