/Super%20Micro%20Computer%20Inc%20logo%20on%20phone%20and%20stock%20data-by%20Poetra_RH%20via%20Shutterstock.jpg)

Super Micro Computer (SMCI) shares closed nearly 14% higher today after the artificial intelligence (AI) server firm said its revenue more than doubled on a year-over-year basis to $12.7 billion in its fiscal Q2.

The Nasdaq-listed firm’s earnings per share (EPS) also came in miles ahead of Street estimates, suggesting its days of regulatory and governance issues may finally be behind it.

Following the post-earnings rally, SMCI stock is up roughly 17% versus its year-to-date low. Still, Wall Street analysts continue to forecast significant further upside in it this year.

Why Wall Street Is Bullish on SMCI Stock

Analysts are bullish on SMCI shares because the company confirmed in its earnings release that billions in delayed sales hit its books in its fiscal second quarter. This suggests strong underlying demand for artificial intelligence servers reinforcing Super Micro Computer as a key beneficiary of the ongoing data center buildout.

Super Micro Computer remains worth owning as its proprietary platform — Data Center Building Block Solutions — continues to gain traction with hyperscalers seeking rapid deployment capabilities combined with integrated cooling, networking and storage functionality.

This specialized expertise positions it advantageously in an otherwise commoditizing market for server hardware.

Technicals and Valuations Warrant Buying SMCI shares

SMCI also raised its full-year guidance this morning to $40 billion, confirming it expects Q2 strength to sustain through the remainder of 2025.

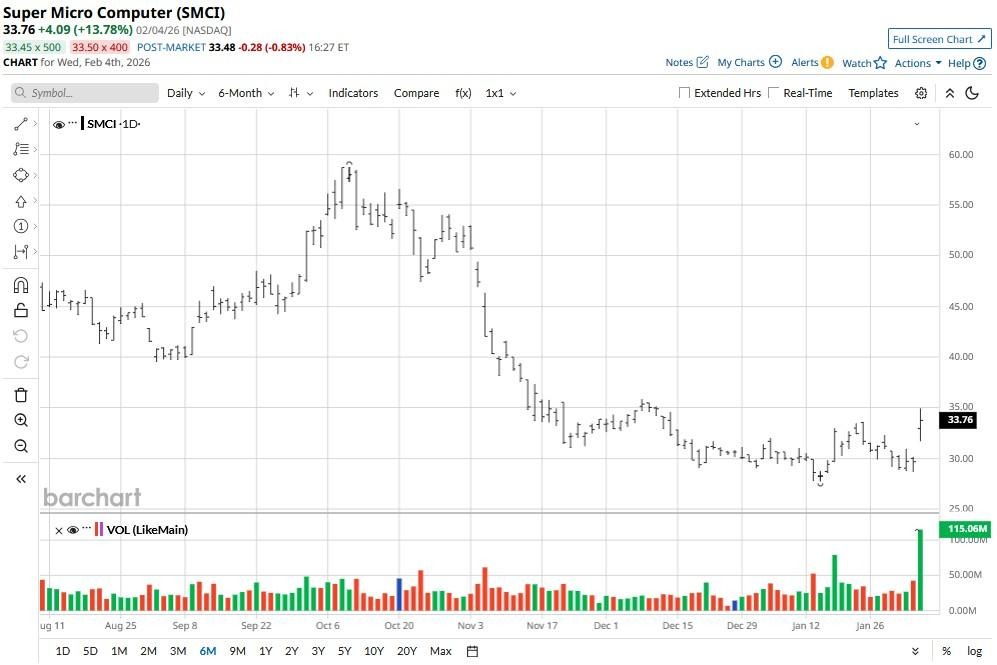

What’s also worth mentioning is that the post-earnings rally pushed Super Micro Computer shares decisively above their 50-day moving average (MA), indicating the momentum could continue over the next few weeks.

According to Barchart, options traders are pricing in another 30% rally in Super Micro Computer over the next three months, meaning it could be trading at nearly $43 by mid-May.

Even after the post-earnings surge, SMCI is going for about 17x forward earnings, which makes it exceptionally cheap for an AI name.

How Wall Street Recommends Playing Super Micro Computer

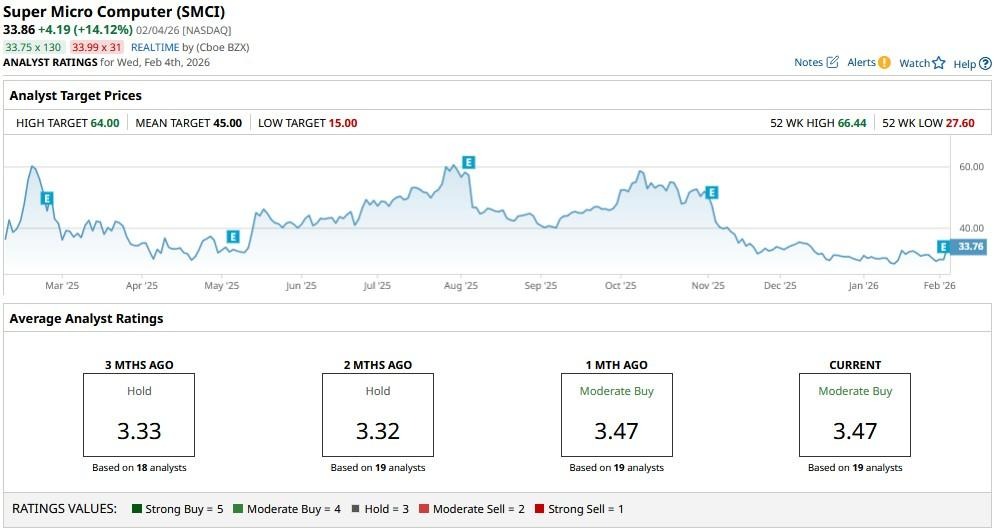

Wall Street analysts are sticking with a consensus “Moderate Buy” rating on SMCI stock for 2026.

Price targets on the AI server specialist are as high as $64 currently, indicating Super Micro Computer could nearly double from here over the next 12 months.

This article was created with the support of automated content tools from our partners at Sigma.AI. Together, our financial data and AI solutions help us to deliver more informed market headline analysis to readers faster than ever.