In the latest quarter, 10 analysts provided ratings for PACCAR (NASDAQ:PCAR), showcasing a mix of bullish and bearish perspectives.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 4 | 6 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 1 | 1 | 0 | 0 |

| 2M Ago | 0 | 3 | 4 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

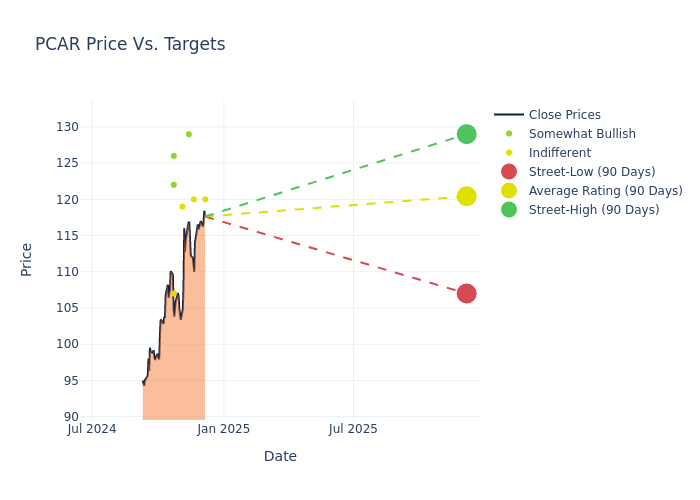

The 12-month price targets assessed by analysts reveal further insights, featuring an average target of $117.9, a high estimate of $129.00, and a low estimate of $103.00. Surpassing the previous average price target of $113.30, the current average has increased by 4.06%.

Analyzing Analyst Ratings: A Detailed Breakdown

A comprehensive examination of how financial experts perceive PACCAR is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Stephen Volkmann | Jefferies | Maintains | Hold | $120.00 | $120.00 |

| Kyle Menges | Citigroup | Raises | Neutral | $120.00 | $110.00 |

| David Raso | Evercore ISI Group | Raises | Outperform | $129.00 | $99.00 |

| Nick Housden | RBC Capital | Maintains | Sector Perform | $119.00 | $119.00 |

| Jamie Cook | Truist Securities | Raises | Hold | $107.00 | $103.00 |

| Angel Castillo | Morgan Stanley | Lowers | Overweight | $126.00 | $135.00 |

| Tami Zakaria | JP Morgan | Lowers | Overweight | $122.00 | $125.00 |

| Tami Zakaria | JP Morgan | Raises | Overweight | $125.00 | $115.00 |

| Kyle Menges | Citigroup | Raises | Neutral | $108.00 | $100.00 |

| Jamie Cook | Truist Securities | Lowers | Hold | $103.00 | $107.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to PACCAR. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of PACCAR compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of PACCAR's stock. This examination reveals shifts in analysts' expectations over time.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of PACCAR's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on PACCAR analyst ratings.

All You Need to Know About PACCAR

Paccar is a leading manufacturer of medium- and heavy-duty trucks under the premium brands Kenworth and Peterbilt (primarily sold in the NAFTA region and Australia), and DAF trucks (sold in Europe and South America). The company's trucks are sold through more than 2,300 independent dealers globally. Paccar Financial Services provides retail and wholesale financing for customers and dealers, respectively. The company commands roughly 30% of the Class 8 market share in North America and 17% of the heavy-duty market share in Europe.

Understanding the Numbers: PACCAR's Finances

Market Capitalization Analysis: The company's market capitalization surpasses industry averages, showcasing a dominant size relative to peers and suggesting a strong market position.

Negative Revenue Trend: Examining PACCAR's financials over 3 months reveals challenges. As of 30 September, 2024, the company experienced a decline of approximately -5.25% in revenue growth, reflecting a decrease in top-line earnings. When compared to others in the Industrials sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: PACCAR's net margin excels beyond industry benchmarks, reaching 11.8%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): PACCAR's ROE excels beyond industry benchmarks, reaching 5.35%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): PACCAR's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 2.3%, the company showcases efficient use of assets and strong financial health.

Debt Management: With a below-average debt-to-equity ratio of 0.83, PACCAR adopts a prudent financial strategy, indicating a balanced approach to debt management.

How Are Analyst Ratings Determined?

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.