Electric vehicle stocks closed the week ending March 25 on a mixed note, reacting to the return of risk appetite and some company-specific developments. Shares of EV leader Tesla, Inc. (NASDAQ:TSLA) reclaimed the $1,000 level, after trading under the mark for about two months, a week ahead of the release of quarterly deliveries.

Here are the key events that happened in the EV space during the week:

Tesla's Giga Berlin Opens, Additional Details Emerge On Master Plan Part 3 And More: After being in the works for about two years amid delays to secure local government approval, Giga Berlin, aka as Giga 4, officially opened this week. CEO Elon Musk travelled to Germany to grace the occasion and delighted the audience with his dance moves. The first Model Y vehicles manufactured at the plant were handed to customers.

With the plant coming online, it removes some of the logistical challenges the company was facing while exporting cars from China to sell in Europe.

In other developments, Musk suggested that Tesla could be submitting the full-self driving beta to European regulators as early as the summer of 2022. This, according to the Tesla chief, will mark the beginning of FSD beta's international rollout.

Hertz Global Holdings, Inc. (NASDAQ:HTZ) is expanding Tesla models in its fleet. The company confirmed it is adding Tesla's Model Y vehicles, in addition to the orders for 100,000 Model 3 vehicles it placed last year.

After tweeting that Tesla's Master Plan Part 3 is in the works, Musk shared more details on it this week. "Scaling to extreme size," Tesla, SpaceX and Boring Company will all be covered in the plan, he said in a reply to a tweet.

Nio's Q4 Fails To Impress Investors: The recovery seen in Nio, Inc. (NYSE:NIO) stock since mid-March stalled after the EV maker reported better-than-expected fourth-quarter revenues but issued lackluster guidance for the first quarter. Investors failed to appreciate Nio's plan for reaccelerating growth in 2022, thanks to the planned new product launches and the company's expansion into additional European countries.

Related Link: Rising Battery Costs Pressure EV Manufacturers: Is Tesla Better Positioned Than Most?

Rivian Confirms Amazon Delivery Van Plans: Rivian Automotive, Inc.'s (NASDAQ:RIVN) CFO Claire McDonough said in an interview with Bloomberg that the company is on track to hand over 10,000 delivery vans to Amazon, Inc. (NASDAQ:AMZN) in 2022.

Nikola Beats Out Tesla In Starting Semitruck Production: Beleaguered truckmaker Nikola Corporation (NASDAQ:NKLA) had a relief rally this week after the company said at its Analyst Day that production of its electric semitruck began on March 21. The company expects to deliver 300 to 500 Tre BEV semitrucks in 2022. The news is particularly positive for the company, as Tesla's version of a similar semitruck is expected to go into mass production at the Giga Austin plant only in 2023.

Li Auto Joins Peers In Raising Prices: Chinese EV startup Li Auto, Inc. (NASDAQ:LI) will reportedly increase the price of its Li One model from 338,000 yuan ($53,092) to 349,800 yuan ($54,946), effective in April.

However, customers who make a deposit through the Li Auto App, Li Auto website, and Li Auto retail centers, before the price hikes goes into effect, may need to pay only the original price.

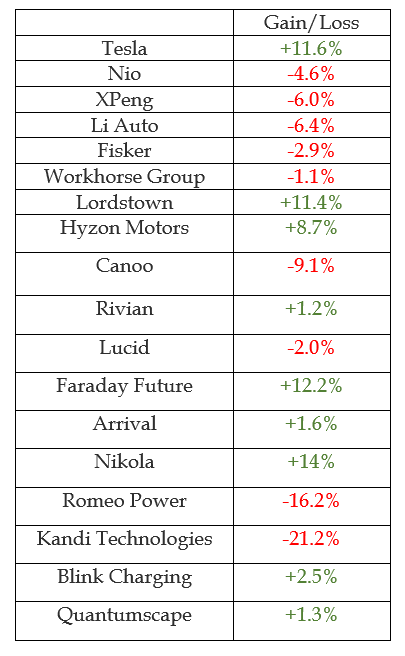

EV Stock Performances for The Week:

Related Link: Nio's First ET7 Sedans Roll Off The Production Line Ahead Of Q4 Earnings