EV shares had a mixed ride in the week ending February 25, as the Ukrainian conflict kept risk aversion going in the markets. Market leader Tesla, Inc. (NASDAQ:TSLA) continued to bleed during the week, having dropped to a psychological support of around $700, its lowest level since August 2021. The stock did stage a recovery late in the week to cut some of the losses.

Here are the key events that happened in the EV space during the week:

Tesla: Tesla is doubling Down on its China strategy. A Reuters report suggested that the company will soon start work on a second manufacturing plant in Shanghai, close to its existing Giga Shanghai. Once operational, the new proposed plant will help increase Tesla's total production capacity in China to around 2 million vehicles.

Separately, the EV giant filed with the local Shanghai government to expand parts manufacturing capacity at Giga Shanghai in order for it to be able to meet robust export demand.

Tesla is completely transitioning away from radar to Tesla Vision. The company has updated information on the FAQ page, indicating that as of mid-February, all Tesla vehicles delivered in North America use Tesla Vision, an end-to-end computer vision system built using Nvidia Corporation's (NASDAQ:NVDA) CUDA. It uses camera vision and neural net processing to deliver Auto Pilot, full self-driving and certain active safety features.

In May 2021, the company did away with radars in its Model 3 and Model Y vehicles. The recent move would mean even the Model S and Model X vehicles will no longer be equipped with radar, but will have camera vision.

Meanwhile, Cathie Wood's Ark Invest continued to load up on Tesla shares during the week, taking advantage of the correction.

Lucid Initiates Recall of Air Sedan: Lucid Group, Inc. (NASDAQ:LCID) faced a setback even before it could get its deliveries going. The company filed with the National Highway Traffic Safety Administrator - regarding the recall of potentially 188 vehicles, citing safety concerns.

The safety issue stems from the incorrect installation of the snap ring below the front damper lower spring seat by the company's supplier.

Incidentally, Morgan Stanley analyst Adam Jonas said in a recent note he expects Lucid's fourth-quarter deliveries to come in below the consensus expectations of around 200 units. The number of vehicles recalled suggests Lucid may have called in all of the vehicles delivered.

Related Link: Ford Reportedly Plans To Separate Its EV Business: Here's Why

Li Auto Announces Q4 Report, Management Change: Chinese EV startup Li Auto, Inc. (NASDAQ:LI) reported fourth-quarter results, showing revenue growth of around 156% to $1.67 billion and non-GAAP earnings per share of 11 cents. The results exceeded the consensus estimates.

The company guided first-quarter deliveries in the range of 30,000 to 32,000 units and revenues of $1.39 billion to $1.48 billion.

The EV maker also said its chief technology officer Kai Wang is resigning, and his role will be taken over by its chief engineer Donghui Ma.

In the earnings report filed with the Hong Kong stock exchange, Li Auto said it plans to unveil its second EV model in the second quarter. The model will be a full-size luxury SUV with next-generation extended-range technology, it added.

Ford Not Looking To Spin-off Of EV Business: Ford Motor Company's (NYSE:F) CEO Jim Farley clarified on reports suggesting the automaker may choose to spin-off its EV business in order to unlock its potential. While speaking at the Wolfe Research conference, the CEO said the company does not have plans to splinter either its EV or ICE business. He named Tesla and Nio, Inc. (NYSE:NIO) as Ford's competition and said the company should aim not to match them but to beat them.

Rivian Says Production Ramping At Normal Facility: Rivian Automotive, Inc.'s (NASDAQ:RIVN) R.J. Scaringe said at the Wolfe Research conference that it is making progress in increasing EV production at its Normal, Illinois, assembly plant. The company has set its sights on taking a 10% share in the EV market by 2030, he added.

Nikola Promises Revenues In 2022: Nikola Corporation (NASDAQ:NKLA) reported a narrower-than-expected loss for the fourth quarter. The company also said it expects revenues of $90 million and $150 million for 2022, on the back of deliveries of 300-500 units of Nikola Tre EV semitrucks.

Volkswagen Persists With Porsche IPO Plans: Despite the market turbulence, Volkswagen AG (OTC:VWAGY) is sticking by its plan to do an initial public offering of its Porsche sports car subsidiary. The German automaker sees the proposed move as a strategic one, providing it with funding to pursue its EV ambitions.

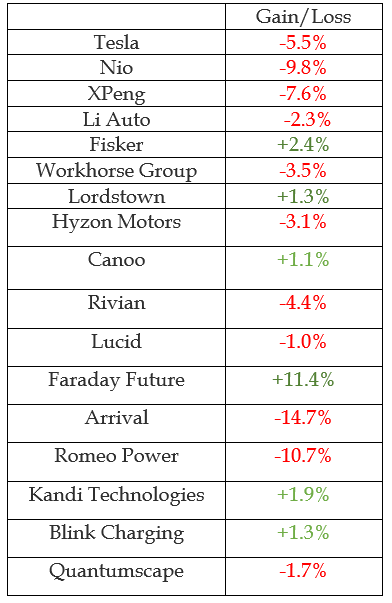

EV Stock Performances for The Week:

Related Link: Why Lucid Analyst Says Deliveries Miss Isn't A Big Deal Ahead Of Q4 Print