By Dmitriy Gurkovskiy, Chief Analyst at RoboForex

On Monday, 21 March, the major currency pair is trading at 1.1055. Investors couldn’t “save” the previous rising wave and the short-term prospects are looking rather uncertain.

Later today, market players should pay attention to the speech to be delivered by the US Fed Chairman Jerome Powell. He is rather unlikely to announce something investors don’t know. However, if he confirms the regulator’s plans to raise the rate several times this year and to cut its own portfolio, it will calm down financial markets.

This week, Powell is scheduled to speak several times. Apart from him, other FOMC members are also expected to address the audience.

Fundamentally, the “greenback” is now supported by a restrained risk attitude – these days, investors require “safe haven” assets.

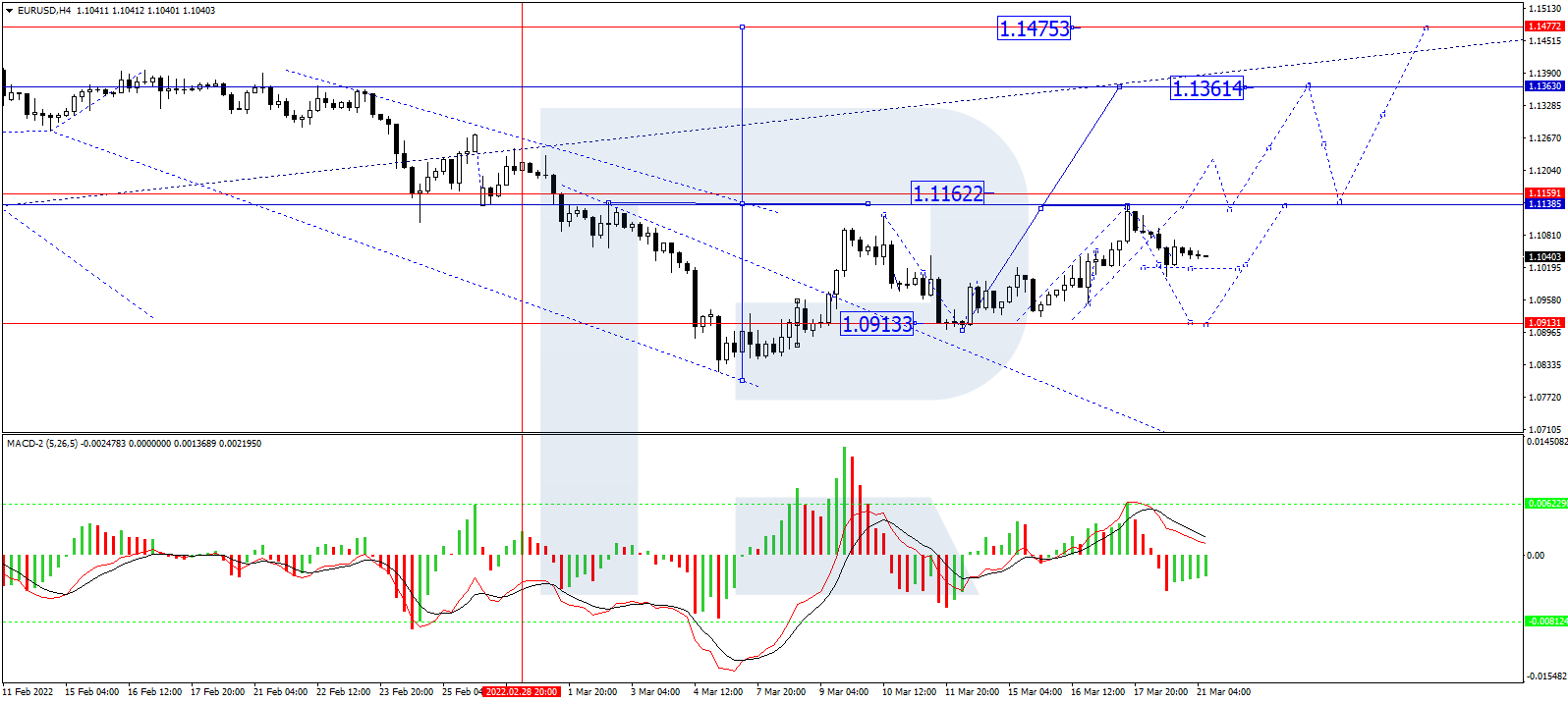

In the H4 chart, EUR/USD has finished the ascending wave at 1.1138; right now, it is correcting towards 1.0948 and may later form one more ascending wave the target at 1.1361. From the technical point of view, this scenario is confirmed by MACD Oscillator: its signal line is falling and may later break 0. After that, it is expected to continue moving towards new lows.

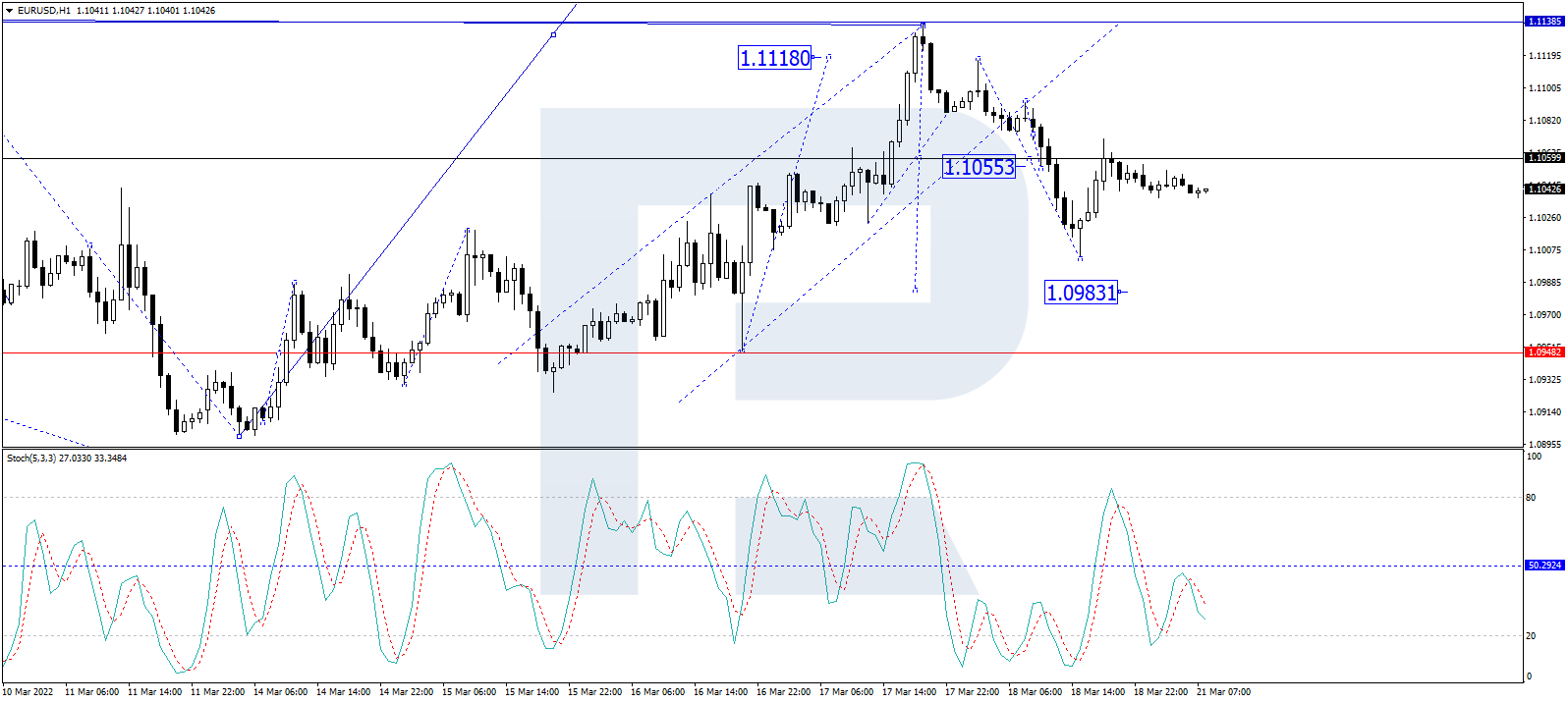

As we can see in the H1 chart, after reaching the short-term correctional target at 1.1000 and then forming a new ascending structure towards 1.1060, EUR/USD has rebounded from the latter level; right now, it is trading downwards again with the target at 1.0983 (at least). From the technical point of view, this idea is confirmed by the Stochastic Oscillator: its signal line is moving below 50 and may continue falling to reach 20. Later, the line may rebound from 20 and start a new growth towards 80.

Disclaimer

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.