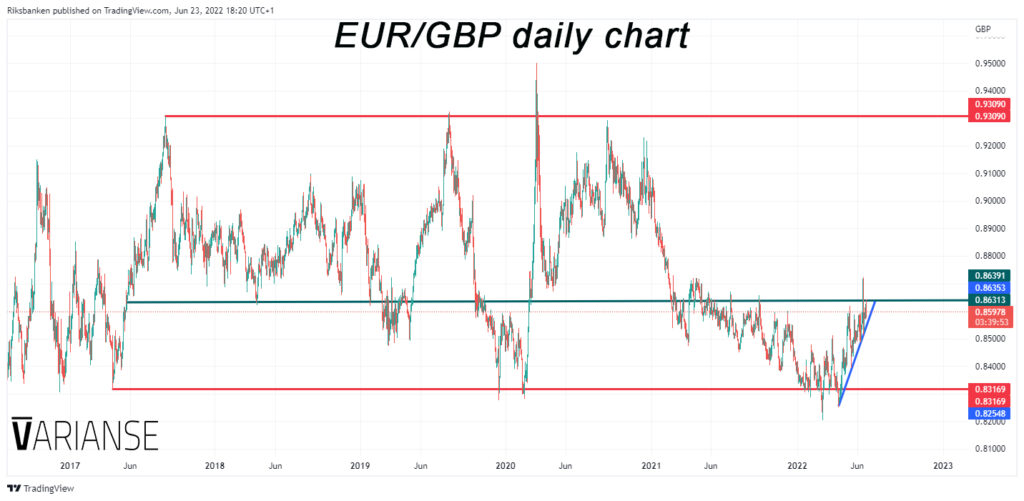

Two months ago, EUR/GBP looked destined for the junk heap. The outbreak of war in Ukraine and a then relatively dovish European Central Bank in comparison to the Bank of England had pushed the pair temporarily beyond the 0.8310 precipice more than once. A downtrend at that time seemed all but inevitable. Remarkably, those dark times proved very short lived. As confidence in the UK economy unravelled and the ECB gradually tilted more hawkish, the pair managed, but only briefly, to touch a high of 0.87213 on the 15 June.

Trades must now ponder whether some new catalyst will either push this cross back above the 0.8650 region, which has historically acted as a strong pivot area, or push price back down toward that 0.8310 precipice. Recent price action does suggest another push higher in EUR/GBP certainly can’t be ruled out. The pair has yet to break below the lower high of 0.83934 that ended the last corrective move on the 17 May that would mark an outright reversal. Also, price has yet to pierce below the diagonal support line that has demarcated the recent move higher in EUR/GBP.

That said, the 0.8650 region remains a big obstacle to overcome. Such a sustained move higher would leave open the possibility of price rising to 0.8800, the mid-point between EUR/GBP’s much wider 0.93064 – 0.8310 range. In turn, this would imply either a dramatically weaker GBP/USD or a dramatically stronger EUR/USD. If EUR/GBP is about to head south, based on market profile, the 0.8525 region could hold out as near-term support, before more aggressive buying sub 0.8400 takes hold.