Bitcoin traded flat, while Ethereum rose Thursday evening as the global cryptocurrency market cap inched up 0.3% to $983.9 billion.

| Coin | 24-hour | 7-day | Price |

|---|---|---|---|

| Bitcoin (CRYPTO: BTC) | -0.1% | -6.5% | $20,086.08 |

| Ethereum (CRYPTO: ETH) | 1.2% | -6.1% | $1,579.66 |

| Dogecoin (CRYPTO: DOGE) | 1.1% | -9.2% | $0.06 |

| Cryptocurrency | 24-Hour % Change (+/-) | Price |

|---|---|---|

| TerraClassicUSD (USTC) | +21.8% | $0.04 |

| EOS (EOS) | +9.9% | $1.52 |

| Balancer (BAL) | +9.7% | $7.81 |

See Also: Best Crypto Debit Cards

Why It Matters: The second-largest coin was buoyant amid the buzz surrounding its move to a proof-of-stake mechanism. The apex coin failed to make any significant moves.

Michaël van de Poppe said that Ethereum “carries the entire market.” The cryptocurrency trader tweeted, “If the regular markets are making a slight bounce, we'll probably accelerate quite fast with crypto to the upside.”

#Ethereum carries the entire market.

— Michaël van de Poppe (@CryptoMichNL) September 1, 2022

If the regular markets are making a slight bounce, we'll probably accelerate quite fast with crypto to the upside.

Among other risk assets, stock futures were flat at press time as investors awaited U.S. jobs data for August, due for release on Friday.

“The true test for Bitcoin is if it can stay close to the $20,000 level after the NFP [Non-Farm Payroll] release. A hot labor market report and Fed rate hike bets might surge and that could trigger downward pressure that eyes the summer lows,” said Edward Moya, a senior market analyst at OANDA.

Justin Bennett shared two charts on Twitter, and said either the dollar index or the S&P500 is “wrong,” adding that the "reaction to Friday's NFP should give us an answer.”

One of these markets is wrong.

— Justin Bennett (@JustinBennettFX) September 1, 2022

The reaction to Friday's NFP should give us an answer.$DXY $SPX pic.twitter.com/RoldlteXfk

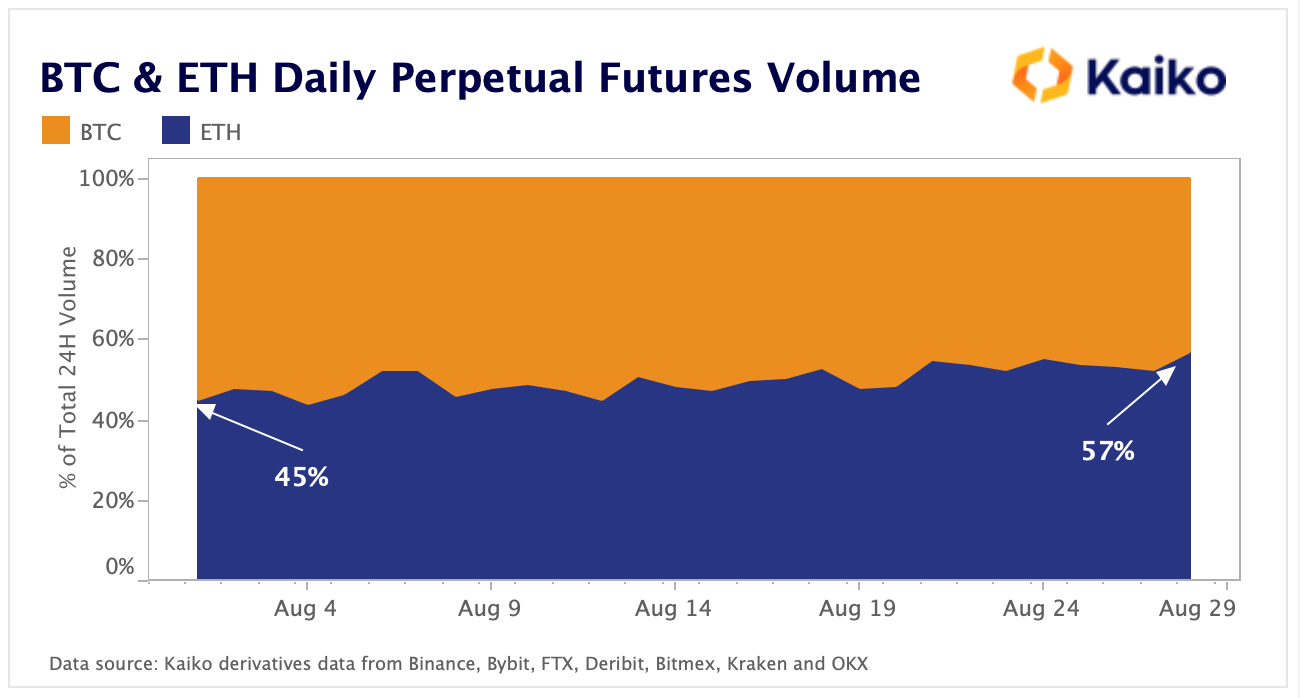

On the Ethereum side, derivatives are dominant ahead of the “Merge.” Kaiko Research pointed to the share of perpetual futures volume between BTC and ETH, and said the latter commanded 45% of the volume at the beginning of August to 57% at the end of the month.

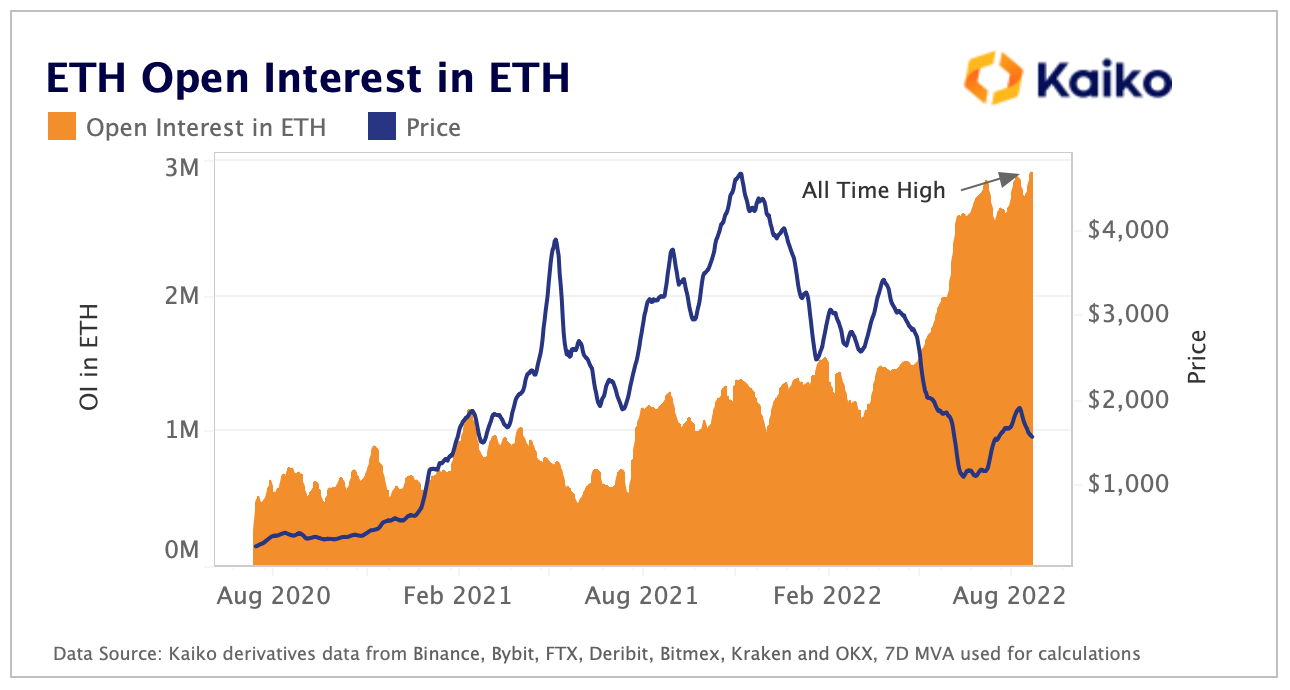

The cryptocurrency market data provider, in a note seen by Benzinga, also pointed to open interest — a measure of how many positions in futures are open at a moment in time and the amount of capital invested in futures.

Kaiko said open interest denominated in ETH shows that the “number of futures positions open at this time represents a staggering all-time high, acting as a massive leveraging force on the price action of ETH over the next few weeks.”

The data provider said approaching end-August funding rates have dropped sharply. “This dip negative, coinciding with a buildup in open interest, leads us to conclude that the majority of the new money piling into futures markets for ETH are short-biased,” said Kaiko.

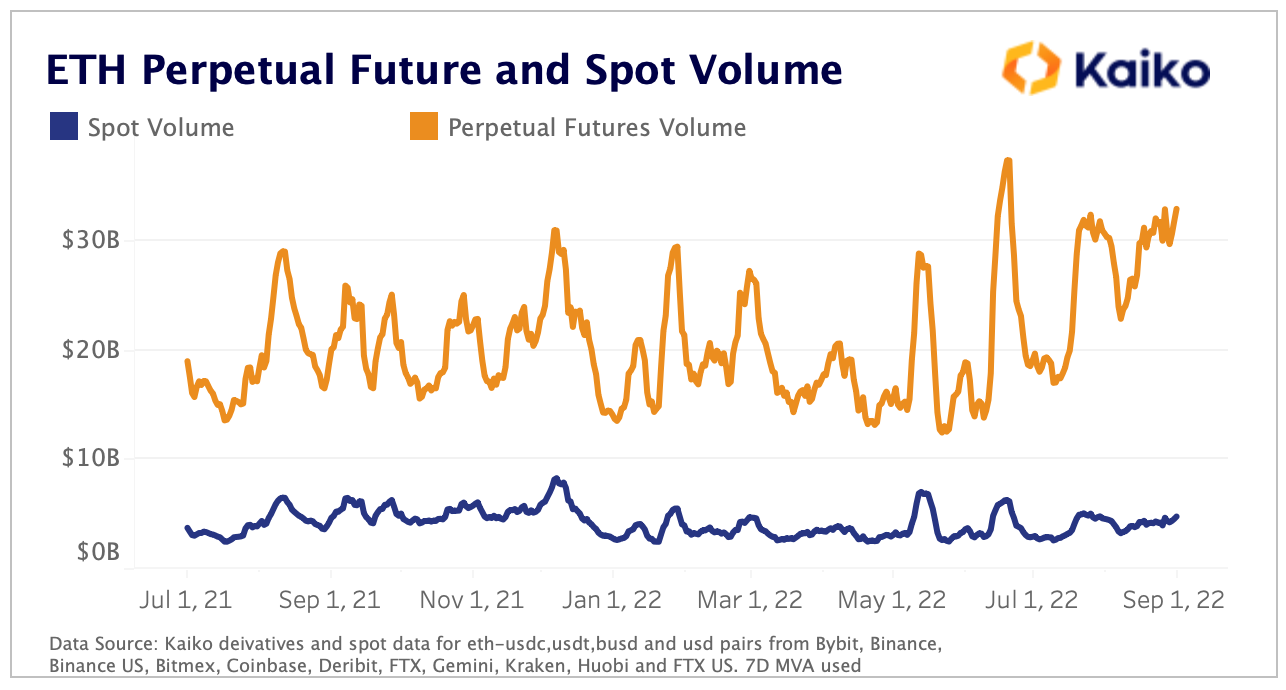

Perpetual daily volume in ETH has risen from $19 billion to over $33 billion over the last year. In a similar period, daily spot volume rose from $3.7 billion to $4.8 billion.

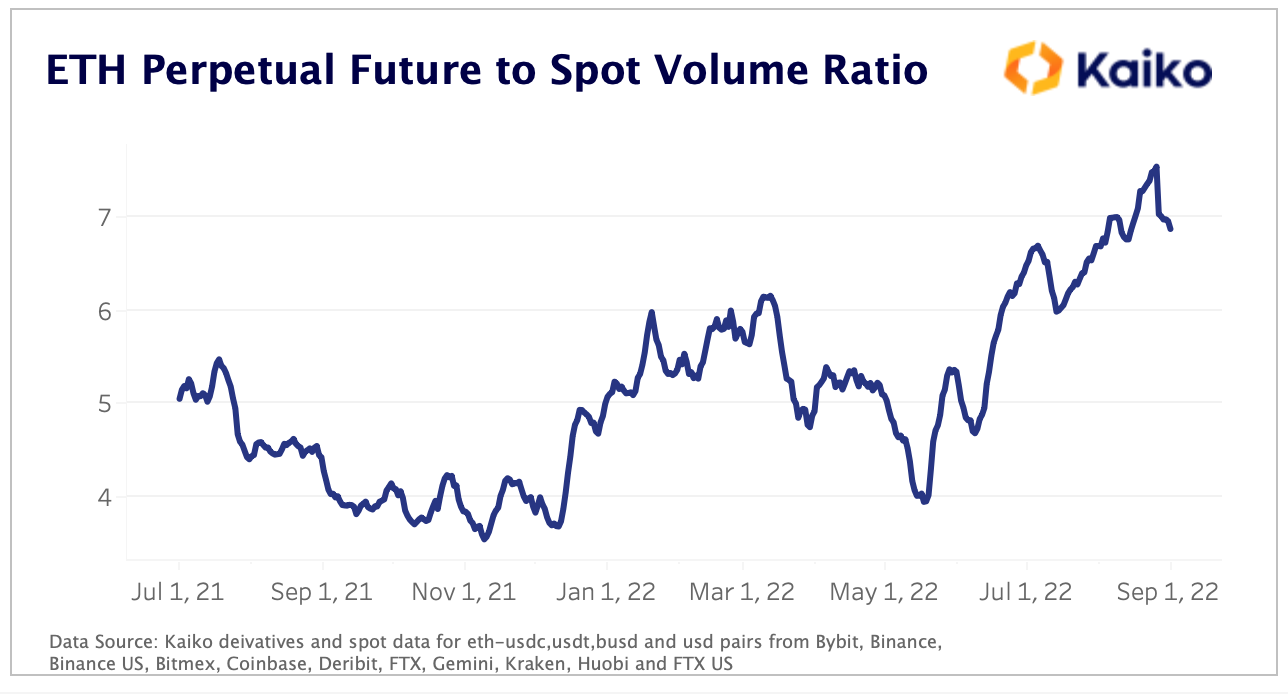

Converting those volumes to a ratio, Kaiko said we can see the “rising dominance of perpetual futures volume for ETH as the ratio of perps to spot volume has increased from 5 times the volumes to roughly 7.”

“With a rising dominance of perpetual futures volume versus spot markets, derivatives markets are having outsized effects on price action at present,” said Kaiko Research in conclusion.

“The Merge is one of the only events in crypto as of late that hasn’t been macro-driven and it will be interesting to see if it sparks a breakout towards a lower correlation with the stock market, for better or for worse.”

Read Next: Largest Ethereum Mining Pool Launches New ETH Staking Ahead Of Merge