Ethereum spiked and Bitcoin turned green Tuesday evening as the global cryptocurrency market cap rose 4.6% to $972.5 billion at 9:23 p.m. EDT.

| Coin | 24-hour | 7-day | Price |

|---|---|---|---|

| Bitcoin (CRYPTO: BTC) | 4.5% | 4.55% | $20,153.09 |

| Ethereum (CRYPTO: ETH) | 9.8% | 12.8% | $1,469.73 |

| Dogecoin (CRYPTO: DOGE) | 7% | 6.7% | $0.06 |

| Cryptocurrency | 24-Hour % Change (+/-) | Price |

|---|---|---|

| Toncoin (TON) | +29.1% | $1.90 |

| Lido DAO (LDO) | 12.2% | $1.7 |

| Cardano (ADA) | +10.2% | $0.40 |

See Also: Best Cryptocurrencies Under 1 Cent

Why It Matters: Ethereum has shot up 12.5% so far this week. The second-largest coin’s weekly gains overshadowed Bitcoin’s 4.35% appreciation in the time frame.

The two-largest coins rallied on Tuesday despite Google parent Alphabet missing earnings estimates and Microsoft revealing weak guidance going ahead. The tech-heavy Nasdaq closed 2.25% higher intraday.

Nasdaq futures were down 2.2%, while the S&P 500 futures were seen trading 1.1% lower at the time of writing.

Michaël van de Poppe said that Ethereum “cracked a ton of levels” with its massive move. “Great flip of $1,320 inducing continuation towards $1,500. [Ethereum] will flip [Bitcoin] this cycle, but now it's not the time to chase. Looking for some healthy corrections to play the next move to $1,600,” said the cryptocurrency trader on Twitter.

#Ethereum cracked a ton of levels with this massive move.

— Michaël van de Poppe (@CryptoMichNL) October 25, 2022

Great flip of $1,320 inducing continuation towards $1,500.#Ethereum will flip #Bitcoin this cycle, but now it's not the time to chase.

Looking for some healthy corrections to play the next move to $1,600. pic.twitter.com/z3d6O5nYY8

Meanwhile, an Ethereum whale wallet that had not been active for more than 6 years moved $22.2 million worth of ETH to an empty wallet, noted Santiment.

“[Ethereum’s] price is +8.1% since this transaction, briefly jumping over $1,500 for the 1st time since the #merge 6 weeks ago,” tweeted the market intelligence platform.

An #Ethereum whale wallet that had not been active for 6+ years woke up today & moved $22.2M worth of $ETH to an empty wallet. $ETH's price is +8.1% since this transaction, briefly jumping over $1,500 for the 1st time since the #merge 6 weeks ago. https://t.co/bLwZZwhJSa pic.twitter.com/L78mAfJHq2

— Santiment (@santimentfeed) October 25, 2022

“Both Bitcoin and Ethereum are gaining momentum as Wall Street musters up a few strong sessions. The economy is showing further signs of weakening and that is helping investors grow confident that the Fed will be in a better position to downshift their tightening pace after next week’s FOMC meeting,” said Edward Moya, a senior market analyst with OANDA.

Still, Moya pointed to a “handful of major risk events” going ahead in the week like tech earnings, major central bank decisions, and GDP numbers for the third quarter.

“To the upside, Bitcoin should find resistance at around $20,500, while $18,500 provides strong support,” said the analyst in a note, seen by Benzinga.

Glassnode pointed out both bearish and bullish cases for Bitcoin in a blog post. The on-chain analysis company said that the bear case is a “historically low on-chain utilization profile, and a looming miner deleveraging event.”

“With a $1.5 billion miner overhang, being just one source of distressed BTC, and multi-year lows in both trading and transfer volumes, significant distribution may meet thin order books,” said Glassnode.

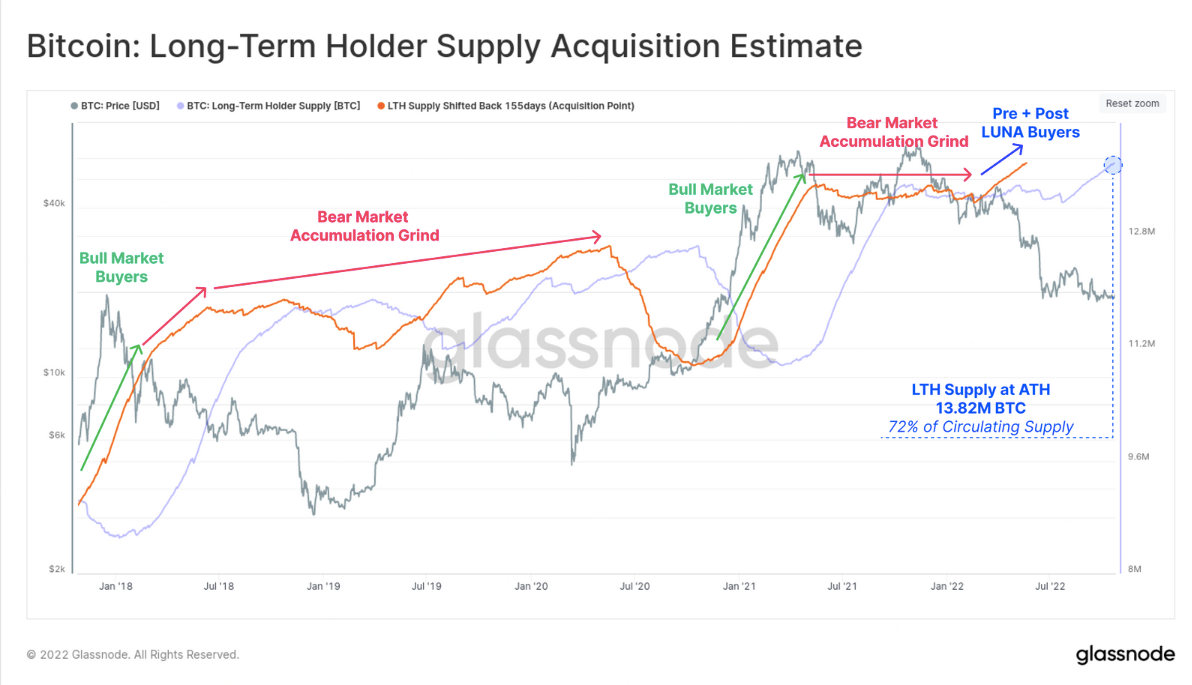

On the flip side, Hodling is at an all-time high. Glassnode said, “Despite being small in relative number, the conviction of Bitcoins die-hard believers is unshaken, and their balance continues to grow, through thick and thin.”

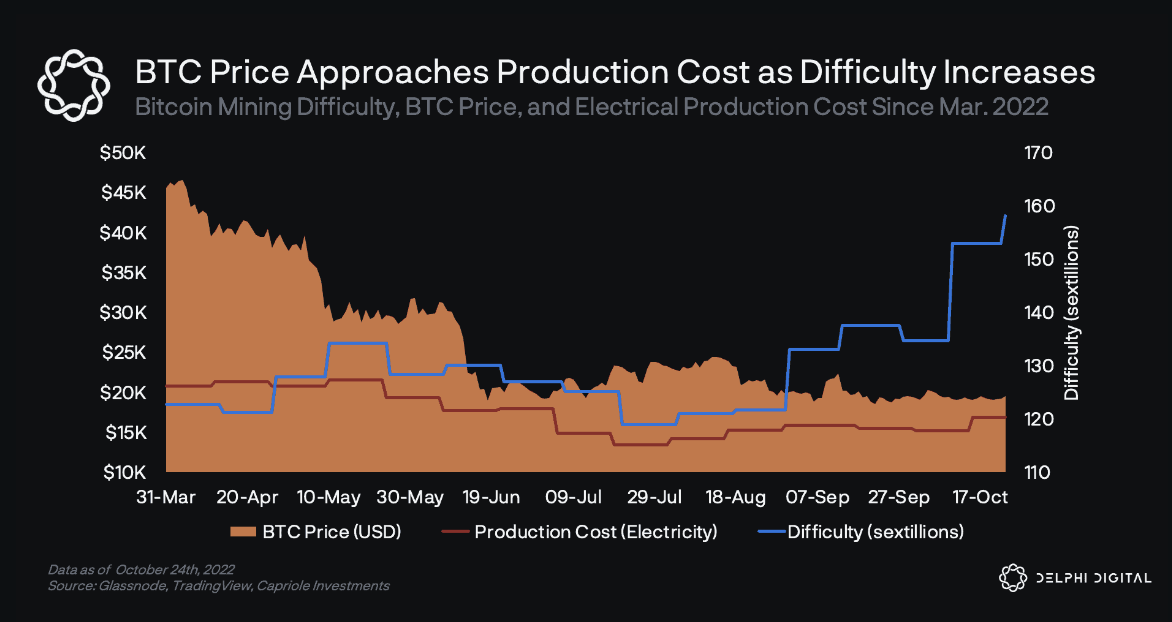

Since the end of March 2022, the Bitcoin mining difficulty has risen by a total of 29%, while Bitcoin price has fallen 57% in the same period,” said Delphi Digital.

“This suggests that miners may be experiencing a significant decrease in profitability from just six months prior. However, Bitcoin’s hash rate has been oblivious to these numbers, marking an all-time high of 262 EH/s,” wrote the independent analysis firm, in a note.

BTC’s price is approaching the estimated production cost of electricity once again. “Currently, the production cost sits at $16.9K while the BTC price sits at $19.8K, a 17% difference,” according to Delphi Digital.

Delphi Digital noted that the production cost of electricity has “consistently marked a price floor for BTC” in the last five years.

“The price has reached the production cost just three times in the network’s history: in Dec. 2018, Mar. 2020, and Jun. 2022. After each of these instances, the price has rallied.”

Read Next: Bitcoin Crosses $20K Mark, Ending 3-Week Slump — Will The Crypto Target $25K Next?