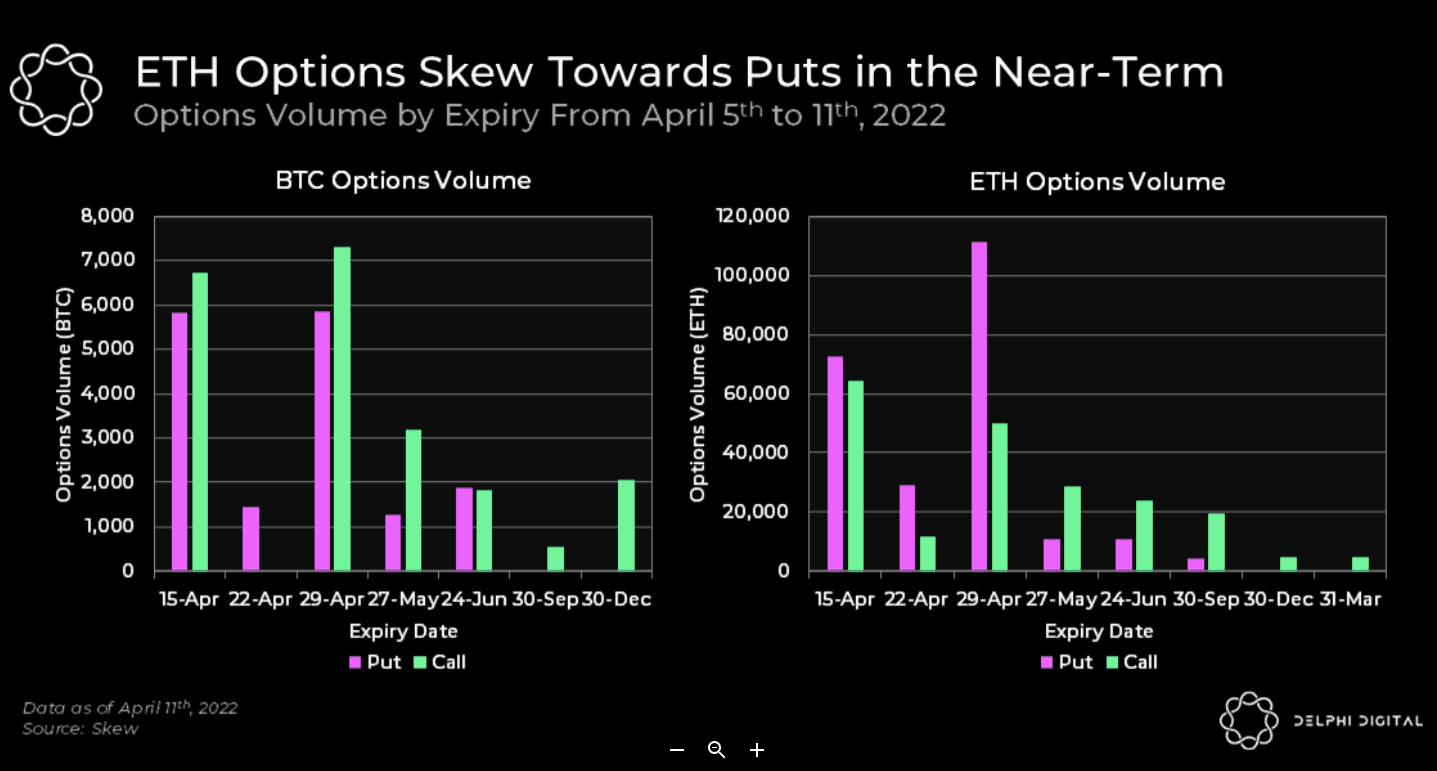

Ethereum (CRYPTO: ETH) options traders appear to be bearish in the near term, while Bitcoin (CRYPTO: BTC) options traders are likely undecided, said Delphi Digital.

What Happened: Delphi Digital said ETH options volume is skewed toward puts compared with BTC options, in a note seen by Benzinga.

Implied volatility (IV) continues to trend lower, according to Delphi Digital, and hit new yearly lows over the weekend, noted the on-chain analytics firm.

IV is a measure of market sentiments on how likely an underlying asset is expected to move. Lower means less likely, while higher means more likely.

See Also: How To Get Free Crypto

Why It Matters: There exists a contrarian view on why high ETH put volumes could turn out to be bullish, according to Delphi Digital.

“Investors may be buying cheap protection ahead of CPI release as IV falls.”

Delphi Digital said that the net outflow of ETH from exchanges is an indicator that investors are continuing to accumulate the second-largest coin by market cap ahead of its merge.

The merge is an event where Ethereum will attempt to switch from a proof-of-work model to a proof-of-stake mechanism.

Price Action: At press time, over 24 hours, ETH traded 1.15% higher at $3,014.26, while BTC traded 1.4% higher at $40,077.18, according to Benzinga Pro Data.