KEY POINTS

- Trading volume hit nearly $1.1 billion and inflows were at $106.8 million

- BlackRock's $ETHA accounted for most of the inflow haul, with $266.5 million

- Grayscale's $ETHE suffered outflows of nearly $485 million

Ether ($ETH), the native cryptocurrency of the Ethereum blockchain, didn't budge even as Ethereum exchange-traded funds (ETFs) exceeded $1 billion in trading volume on the first day of trading, raising questions about why Ether prices seem unaffected by the hype.

Trading volume figures trump inflows

Nine spot $ETH ETFs went live Tuesday after receiving final approval from the U.S. Securities and Exchange Commission (SEC). Trading volume "was just shy of $1.1 billion," said senior Bloomberg ETF analyst James Seyffart and backed by data from Yahoo Finance and The Block Pro Research.

BlackRock's $ETHA accounted for some 24% of the trading volume at $240 million, while Fidelity's $FETH made up for $136 million of the trades. Grayscale's $ETHE led the pack with nearly half of the total trading volume at $456 million.

UPDATE: First full day of flows for the ETHness stakes are in. The Ethereum ETFs took in $107 million. @BlackRock's $ETHA lead the way with $266.5 million followed by @BitwiseInvest's $ETHW with $204 million. Very solid first day pic.twitter.com/j28vIwVWvR

— James Seyffart (@JSeyff) July 24, 2024

As for inflows, it was a "solid first day," Seyffart noted. The Ethereum ETFs hauled in a total of $106.8 million, led by BlackRock's $ETHA at $266.5 million. Bitwise Invest's $ETHW came in second place with $204 million in flows.

Ether prices stagnant

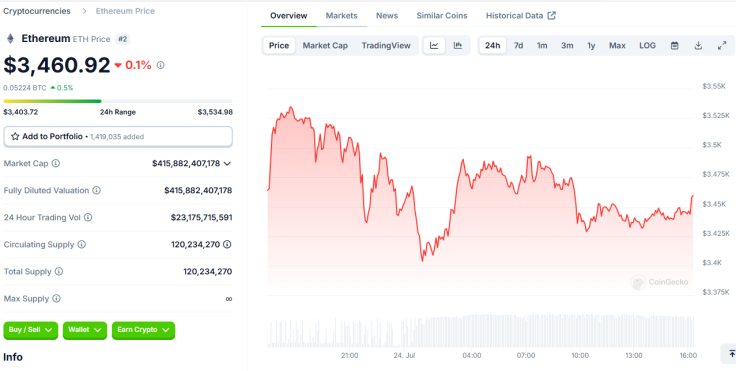

Despite the solid numbers, Ether prices didn't spike at all. In fact, $ETH has been down by over 1% in the last 24 hours, as per CoinGecko data.

Cryptocurrency users on X (formerly Twitter) are raising concerns about Ethereum being unmoved by the significant trading volume figures – as opposed to how Bitcoin prices reacted positively to trading and inflow figures on Day one of spot $BTC ETFs.

Why is price still down 1% ??

— Fleury (@FleuryNFT) July 23, 2024

And somehow it hasn't moved at all 😂

— Enguin 🐧 (@penguin_curator) July 23, 2024

When price go up?

— Smokey (@Smokey_titan) July 23, 2024

Grayscale to blame?

While Grayscale's $ETHE did lead the way in trading volume Tuesday, it also was the leader in outflows, seeing $484.9 million out. Senior Bloomberg ETF analyst Eric Balchunas said he doubted if the other ETFs can offset $ETHE outflows of this magnitude with inflows.

Damn. That’s a lot. Like 5% of the fund. Not sure The Eight newbies can offset w inflows at this magnitude. On flip side maybe its for best to just get it over with fast, like ripping a band aid off https://t.co/MCxGmRGAdr

— Eric Balchunas (@EricBalchunas) July 23, 2024

Day 1 done – what's next?

Despite some concerns about Ether prices being stagnant when Ethereum ETFs were performing good, most crypto users remain positive about the world's second-largest digital asset by market capitalization.

One user said Ethereum's fate "has always been written in the stars," and another said the trading volume only shows "huge market confidence" in spot $ETH ETFs, adding that prices will rally as more investors put their cash in.

#Crypto traders view #Ethereum as undervalued and anticipate that the recent launch of spot #ETH #ETFs in the U.S. could drive its price to new highs.

— TOBTC (@_TOBTC) July 24, 2024

Despite a muted initial response, the ETFs have quickly amassed significant trading volume, with predictions of increased… pic.twitter.com/SgmMfVxERr

Blockchain-based platform TOBTC said crypto traders view $ETH as undervalued and there is anticipation the approval of spot Ethereum ETFs will drive prices to new all-time highs. For analysts, Ether should maintain prices above $3,350 so it can be on an uptrend in the coming months.

As of writing, $ETH is trading above $3,400.