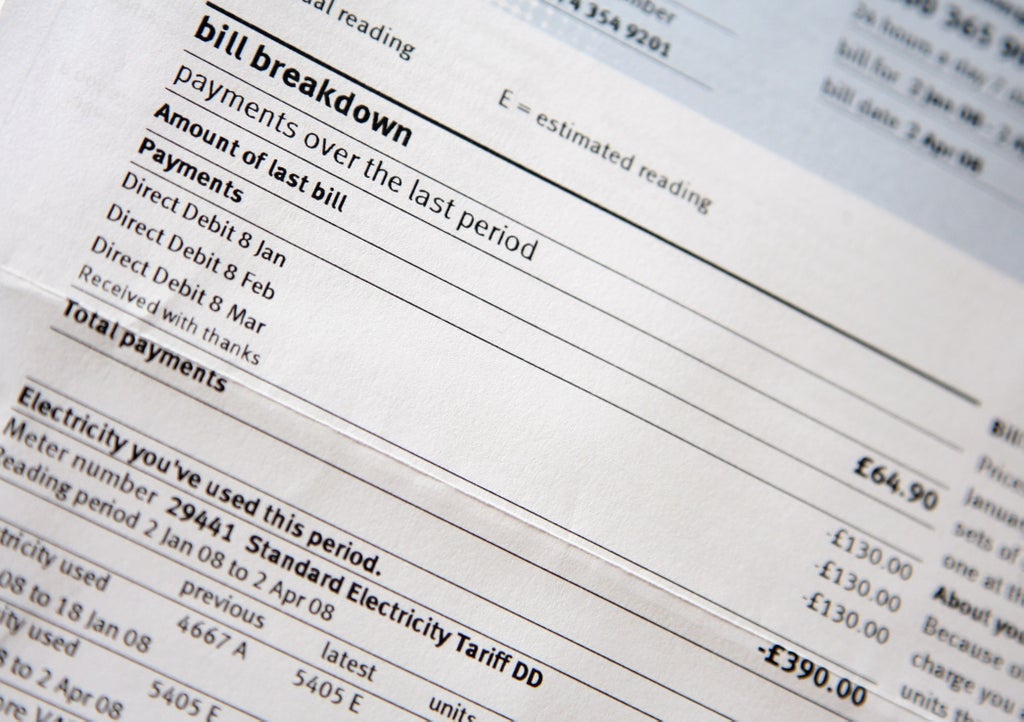

The energy price cap is the maximum amount a utility company can charge an average customer in the UK per year for the amount of electricity and gas they use, preventing businesses from simply passing on cost increases to the consumer.

But the cap, set by the regulator Ofgem and first introduced in January 2019, only applies to customers who are on a standard variable tariff, typically a provider’s default and most expensive option.

It does not safeguard consumers against global market fluctuations and does not limit an individual’s overall bill – if you use more than the “average user”, you still pay more.

The rate is reviewed every six months and the latest cap, announced on 3 February 2022, ushered in a rise of 54 per cent, meaning a steep increase in household bills this spring.

As of 1 April 2022, the cap rose from £1,277 to £1,971 for a household on average usage. That means a £693 per year increase for the average customer.

Prepayment meter customers likewise saw an increase of £708 from £1,309 to £2,017.

Jonathan Brearley, chief executive of the energy regulator Ofgem, said: “We know this rise will be extremely worrying for many people, especially those who are struggling to make ends meet, and Ofgem will ensure energy companies support their customers in any way they can.”

The last review on 6 August 2021 was itself a rise of 12 per cent or £139 on six months earlier but this latest development means more bad news for the consumer when the cost of living is already spiralling, with inflation expected to rise from its current level of 5.4 per cent to more than 7 per cent.

The Independent’s James Moore has likened the prospect of higher bills to “an Arctic wind blowing through people’s personal finances”.

Russia’s disastrous war in Ukraine has only added to the straitened state of affairs in the UK and elsewhere, given that the aggressor is a key supplier of energy to continental Europe.

Responding to rising domestic bills, chancellor Rishi Sunak has since announced that £150 council tax rebates would be given to homes in bands A to D and is set to unveil plans to offer a £200 discount on bills.

A government-backed loan scheme of that order will cost around £5bn to £6bn, well below the £20bn demanded by the energy industry, which has already been criticial of the announcements trailed.

Dale Vince, the boss of Ecotricity, has already called the measures “far too little, far too late”.

Responding in the House of Commons, Labour’s shadow chancellor Rachel Reeves likewise called Mr Sunak’s plans a “buy now pay later scheme that loads up costs for tomorrow”.

Before Christmas, suppliers had called on business secretary Kwasi Kwarteng to agree to a range of measures, from tax cuts to direct financial intervention by the government, so as to save customers from being hit by unaffordable rises contributing to the already-spiralling cost of living.

Energy UK, the trade body for British suppliers, called for VAT to be cut on household bills from 5 per cent to zero and for an industry-wide financing scheme to allow its firms to spread the cost of gas price spikes over several years.

But in October’s budget, Mr Sunak resisted calls to cut tax on energy, with Whitehall sources saying at the time that such a step would be poorly targeted, helping out people who could afford to pay more as well as those who will genuinely struggle.

Providers including E.On also asked for green levies that bankroll renewables and energy-efficiency upgrades to be removed from bills, arguing that this would be the more progressive approach because those on higher incomes would contribute proportionally more, although that would represent an unwelcome setback for the environment.

The same company’s CEO, Michael Lewis, went even further, imploring the government to be “radical” in using public funds to bailout customers in the short-term.

“Bills are going up so much that there is a wholesale price risk which impacts the whole economy and that’s got to be a government lead, as much as we can provide ideas,” Energy UK’s chief executive Emma Pinchbeck told BBC Radio 4’s Today programme as utility company bosses met with ministers in Westminster in early January, desperate to avoid the same fate as the 28 firms that went bust because of the burgeoning crisis in 2021.

Addressing the coming squeeze on household finances on his ITV show in January, the ever-resourceful money saving expert Martin Lewis was, for once, forced to admit he was stumped by the prospect of tackling such a dramatic increase in power costs, saying he was left “shaking” and “near tears” in frustration at being unable to help a single mother unable to meet her bills.

“There are lots of people out there that can afford the increase and won’t like it, but there are also millions of people who will be thrown into fuel poverty, who will get close to having that choice between heating and eating,” he warned his audience.

As Ofgem itself has done, Mr Lewis advised his viewers to speak to their supplier about possible payment plans and suggested households check whether they are eligible for the government’s Warm Home Discount or Winter Fuel Payment.

Given that the cheapest energy tariffs offered are usually approximately £200 below the energy cap, the customary guidance is to switch providers regularly to ensure you get the best deal and lock in the present low price for at least 12 months.

But such is the current state of uncertainty that even that piece of conventional wisdom is in doubt.

“In normal circumstances, switching is a good way to beat the price cap and save money. However, due to unprecedented conditions in the energy market right now, we’re changing the habit of a lifetime and advising our customers that switching might not be the right thing to do at the moment,” the price comparison site Moneysupermarket has advised its users.

Mr Lewis was broadly in agreement when he told subscribers to his weekly email: “It looks like most people should do nothing (no certainty, I don’t have a crystal ball), it looks like only a few edge cases should be looking at fixing right now. So if in doubt, just stick on today’s cheapest price – which is the cap.”