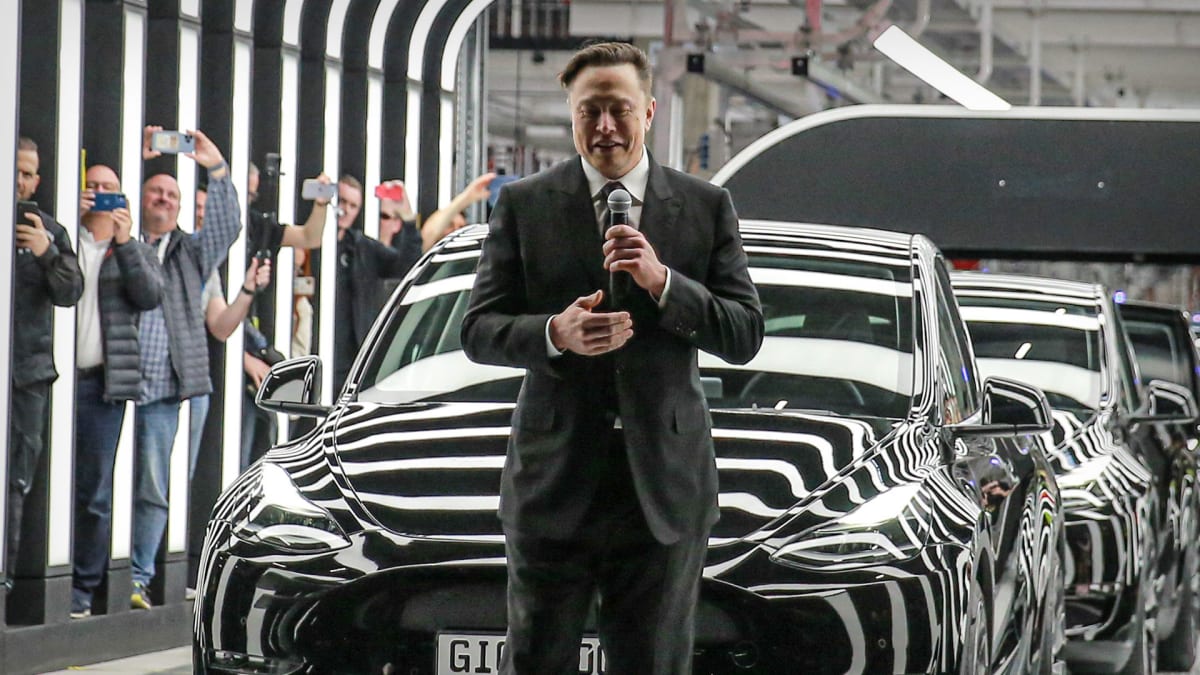

Elon Musk has a lot on his plate these days between running his space company, SpaceX, running his social media platform, Twitter (TWTR), and running the golden goose that funds all of his other adventures, Tesla (TSLA).

Now a group of shareholders are saying that Musk's large plate is hurting Tesla's growth, and they're not taking it anymore.

DON'T MISS: Tesla Stock Tumbles as Elon Musk Stresses Sales Growth Over Profits After Q1 Earnings

"Corporate boards can and should intervene if a chief executive appears to be distracted or overly focused on other ventures. Yet, the Board has permitted Elon Musk to run multiple companies, leading to an inability to address the multiple strategic and competitive issues facing Tesla," the letter states.

The group of long-term investors holds over $1.5 billion Tesla shares and says that the company's board has allowed Musk to be "overcommitted" to his other ventures while Tesla is at a critical juncture in its own development.

Last week, Tesla shares took a major hit after the company reported its weakest profit margin in more than two years while adjusted earnings fell more than 20% year over year.

The letter estimates that Tesla has lost $582.4 billion in market cap since Musk first disclosed his stake in Twitter on April 4, 2022.

More than just attacking Elon, the shareholders are going after Tesla's very governing structure.

"We believe that Tesla’s current governance structure - specifically its staggered elections, supermajority voting requirements, board composition, and director compensation practices - is one of the primary causes of its poor oversight," the letter said.

"In addition to his brother Kimbal Musk, CEO Elon Musk has long-standing friendships with directors Ira Ehrenpreis and James Murdoch... We are concerned that these close personal ties and extraordinary pay reduces the Boards’ objectivity, independence, and ability to prioritize the needs of Tesla and its shareholders."

Signers of the letter include institutional investors Amalgamated Bank, Nia Impact Capital, the NYC Comptroller's Office, and SOC Investment Group, among others.

Get exclusive access to portfolio managers and their proven investing strategies with Real Money Pro. Get started now.