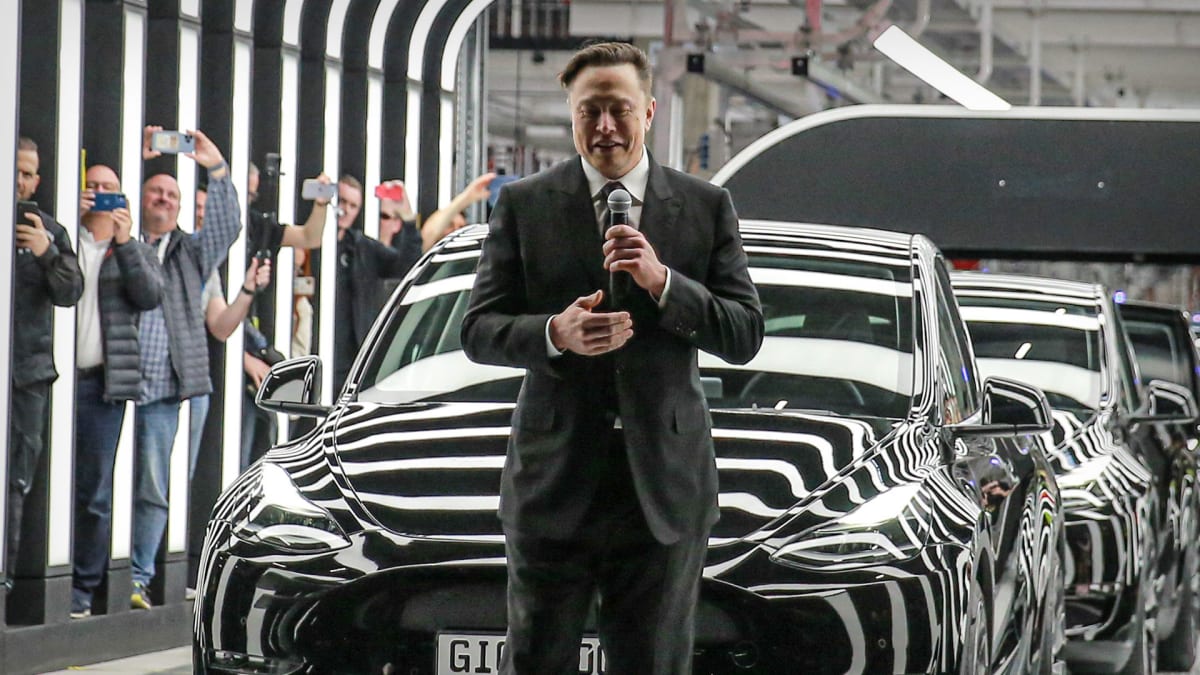

Elon Musk knows he can no longer ignore the discontent rumbling among individual Tesla investors.

The billionaire is seen as a guru by Tesla (TSLA) fans and investors, who most often embrace every project, even the craziest ideas, that he brings up.

But for a few weeks now, a cold wind has been blowing in the direction of the CEO of the leading manufacturer of electric vehicles.

For the first time, Musk is facing harsh criticism from among his most diehard fans. These fans no longer hesitate to challenge him.

"I have utmost respect for @elonmusk as a manager, leader, and visionary," Tesla investor Gary Black posted on Twitter. "Just wish he’d hire someone to fix Twitter and focus on $TSLA as CEO with all its opportunities and challenges and which could be a $3T market cap company in 5 years."

Tesla Stock Is Down 55%

The reason for this unusual displeasure is the continued decline of Tesla stock on Wall Street. Tesla's stock price is down more than 55% this year, translating into a market value loss of more than $600 billion. Tesla's market capitalization is below $500 billion for the first time in almost two years.

Musk explained that this fall was due to macroeconomic problems.

"Macro conditions are difficult," the billionaire posted on Twitter on Dec. 8, as an effort to explain Tesla's stock decline. "Energy in Europe, real estate in China & crazy Fed rates in USA."

Until recently, this explanation would have sufficed for Tesla fans and investors. They're aware that the Federal Reserve's aggressive interest rate hikes are making it expensive to finance car purchases.

But many now believe Tesla's current problem is Musk.

"Elon blaming recent $TSLA underperformance on macro factors incl "crazy Fed rates in USA' doesn’t seem right," Black challenged the billionaire.

For the investor, one of the most vocal in the Tesla community, the billionaire made a mistake in acquiring Twitter. That's because since Musk became the owner of the social network, he has abandoned Tesla and alienated the carmaker's traditional customer base by regularly attacking Democrats and more particularly progressives.

Musk in recent months has indeed declared himself the unofficial leader of the conservatives. And in the name of free speech, he's gotten rid of the safeguards Twitter had installed to limit hateful, racist and antisemitic speech.

"Only one other time did I think @elonmusk was putting $TSLA SH at risk. That was Feb 2021 when TSLA invested $1.5B in #btc," Black recently said, referring to Tesla's decision in February 2021 to invest in bitcoin. "We almost exited $TSLA again in Apr 2022 at $340 when Elon bid $54.20 for $TWTR. I was convinced that Elon buying TWTR was bad for TSLA SHs," he added.

Musk Makes a Promise. He Doesn't Elaborate.

Black said he hoped Musk would "come to his senses that attacking his woke left customer base is hurting the $TSLA brand and he will tone down his political views," and that the tech mogul would "soon appoint a TWTR CEO and resume his duties as $TSLA CEO full time, easing [shareholder] tensions."

This opinion seems to be shared by Goldman Sachs analyst Mark Delaney, who cut his Tesla stock-price target. The analyst says demand for Tesla cars will worsen as the economy continues to slow down.

"Tesla’s brand has become more polarizing,” Delaney wrote to a note to clients. "Tesla’s brand has significant value related to the company’s leadership position in clean energy and advanced technology.”

The analyst added that the company must shift consumers' attention back to what Tesla does and away from Musk's tweets.

His price target for the stock is now at $235, down from $305.

Seeing that doubt is setting in, Musk on Dec. 14 released a recipe that helped him become one of the world's most powerful bosses: make promises. He has just promised Tesla investors that he will ensure that his acquisition of Twitter will benefit them one day.

"I will make sure Tesla shareholders benefit from Twitter long-term," the Techno King said.

He gave no further details, leaving Twitter users to guess.

"How so?" asked one Twitter user.

Action Alerts PLUS: Give Yourself the Gift of Future Returns!

You're invited to join Action Alerts PLUS for just $79.99/yr. Don't miss this chance to unlock best-in-class investing guidance from trusted portfolio managers -- without the management fees.