Norwegian Cruise Line (NCLH) shares pushed notably higher on Tuesday after Elliott Investment Management announced a more than 10% stake in the cruise line.

The activist investor identified years of strategic misjudgments, inconsistent execution, inadequate cost discipline, and repeated guidance failures as primary impediments to value creation.

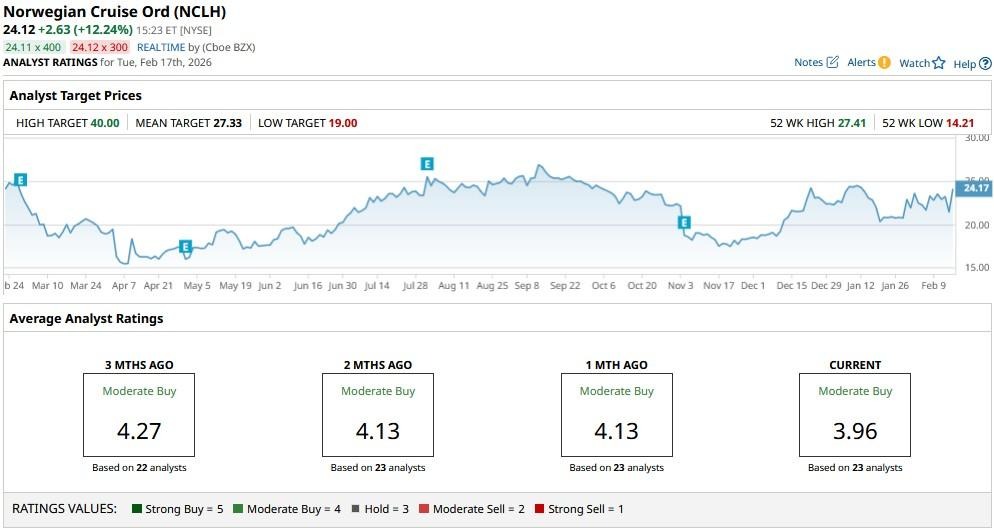

Despite today’s surge, Norwegian stock is down nearly 9% versus its 52-week high.

Should You Invest in Norwegian Stock Too?

As the company’s largest shareholder, Elliott is now calling for comprehensive board restructuring and replacement of executive leadership with industry-experienced professionals.

According to the activist investor, implementing a new business plan designed to close operational gaps with rivals Royal Caribbean (RCL) and Carnival (CCL) could push NCLH stock to its pre-pandemic high of $56.

Elliott’s forecast signals Norwegian Cruise Line could more than double from here, reflecting the magnitude of untapped potential within this NYSE-listed firm.

Note that NCLH is currently going for a price-to-sales (P/S) ratio of about 0.15x only, indicating it’s trading at a significant discount, not just to its peers, but to its historical multiple as well. This makes investing in Norwegian a rather exciting proposition for 2026.

Where Options Data Suggests NCLH Shares Could Be Headed

Norwegian shares are attractive because the company has valuable strategic assets, including globally recognized cruise brands, a loyal customer base, and modern fleet infrastructure.

Elliott is pushing to innovate guest experiences and better monetize the “Great Stirrup Cay” — an island NCLH owns — which may also help unlock the next leg of growth in its stock price.

Meanwhile, limited capacity growth and surging consumer demand presents an opportune window for strategic repositioning and financial improvement.

All in all, options traders are currently pricing in a rally to $29 in Norwegian Cruise Line by mid-May, and Elliott’s plan could pave the way for it to print that 52-week high within the next three months.

How Wall Street Recommends Playing Norwegian Cruise Line

Much like Elliott Investment Management, Wall Street remains bullish on NCLH shares as well.

The consensus rating on Norwegian Cruise Line sits at a “Moderate Buy” rating currently, with the mean target of roughly $27 indicating potential upside of 13% from here.

This article was created with the support of automated content tools from our partners at Sigma.AI. Together, our financial data and AI solutions help us to deliver more informed market headline analysis to readers faster than ever.