Once, these were the most desirable homes in the country. But now, the owners of a Ponsonby villa have suffered the worst loss in this year's house price slide

It was June 2021. Buying a restored Ponsonby villa must have seemed like investing in gold bullion – with prices to match. The purchasers of 75 Islington St paid $2.7 million at auction for three bedrooms, one bathroom and a driveway to park the car.

Families elsewhere in New Zealand look aghast at such prices – but many Aucklanders had grown confident that prices would always go up, and interest rates would stay low. Some paid too much.

Early this year, another house near Ponsonby came on the market – the one the Ponsonby homeowners really wanted, they one they hadn't realised would be available. So they went all in ... and in April, they put their Islington St villa on the market.

"The current owners bought here intending to remain for years," the listing said, "but an unexpected opportunity means this classic Ponsonby offering is now for sale."

Kellands real estate agent Martin Dobson sounds somewhat rueful: "It's the same old story, you know, buying and selling in the same market. You get the same."

He listed it according to the time-honoured wisdom: "Classic Ponsonby never goes out of style," the marketing said. "A classic villa frontage with bullnose veranda beckons behind the picket fence. Polished floors gleam alongside the character fireplace in the lounge, while sun streams into the open-plan rear kitchen-dining room."

The owners felt they'd paid a low price for their new dream home, nearby – but the purchaser of their villa may be feeling even more fortunate. The new owner paid $2.4m.

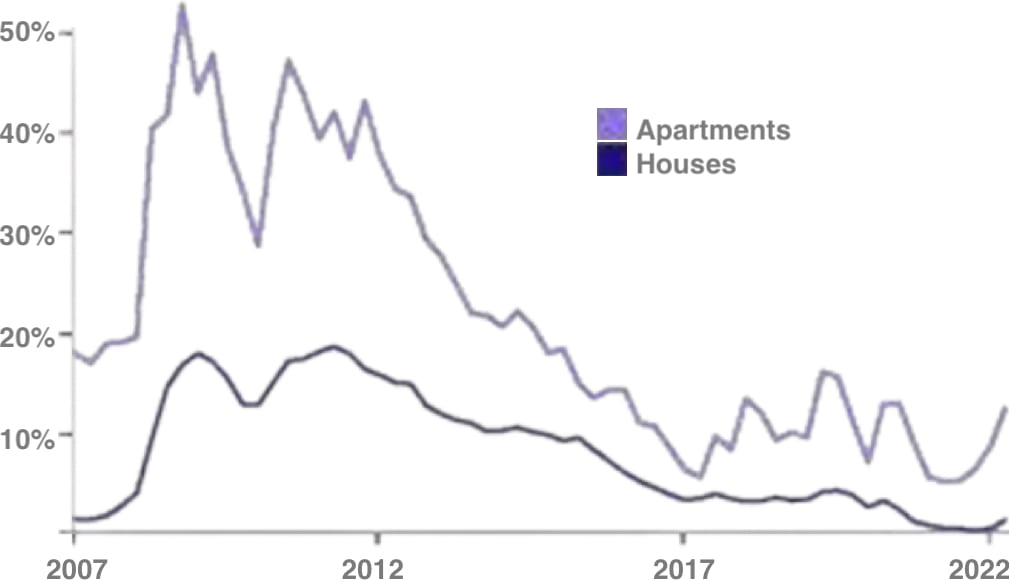

Homeowners more likely to sell at a loss – especially apartments

That's a gross loss of $300,000, plus Dobson's commission and marketing, in just 11 months – according to CoreLogic figures supplied to Newsroom, the biggest real loss in this property slump.

"The big thing was, they didn't have to sell that property," Dobson says. "But they wanted to sell that property because they had found something else."

There are still some big properties defying the downturn. A renovated 4 bedroom house at 9 Ranui Road, Remuera (swimming pool, double Grammar zone, etc) sold the same month for $11.4 million – more than double the $5.175m the vendors paid for it in 2007.

CoreLogic chief property economist Kelvin Davidson crunched the data for Newsroom, to identify the vendors that experienced the worst pain or greatest gain this year.

It comes off the back of a quarterly report, showing the market has passed a turning point for profitable resales, as gains start to fall.

The vast majority of vendors (98.1 percent) are still selling for more than they paid, as long as they've held the property for a couple of years or more. But they may not make as much as they'd hoped, or expected, or as much as they would have if they'd sold at the peak, last last year.

On average, those vendors that made gross profits had held their properties for 7.6 years. Those that made a loss had held their properties an average 1.3 years.

"So in other words, the loss-makers tend to have only been held for a short period – perhaps changed personal circumstances forced them to sell sooner than intended," Davidson says.

And he makes the same point as Dobson – that those selling and buying in the same market see little change. "Resellers still get large gross profits, reflecting long hold periods," he says. "Of course, most owner-occupiers just have to recycle that equity.

"It’s likely the figures will be softer again next quarter, but sellers haven’t lost all their power, with unemployment low, so it’ll probably be a gradual weakening rather than a slump."

Davidson says the results are not too much of a surprise, following interest rate increases and a surge in new listings, which has shifted the balance of power from sellers to buyers – and seen property values themselves decline.

According to the Pain & Gain report, the median resale profit dropped from a record high of of $440,000 in the last quarter of 2021, to $418,000 in the first quarter of this year, and then to $370,000 in the April-June quarter.

The report shows the worst-hit prices were in the biggest North Island cities: 3.6 percent of Auckland resales were at a loss; 2.6 percent in Hamilton, 2.2 percent in Wellington, and 1.1 percent in Tauranga.

“We must put these figures into context and that is they’re still historically strong, which reflects the fact that home owners tend to hold property for seven or eight years on average, which locks in gains even as property values weaken over the short-term,” Davidson says.

“Nevertheless, the turning point has arrived, and for owner occupiers this isn’t typically a cash windfall unless they’re downsizing or moving into a cheaper location. Often sellers need the entire amount, and then some, to upgrade into their next property.”