The story so far: Following a stern directive from the Supreme Court, the State Bank of India (SBI) released all details of the electoral bond scheme, except donors’ bank account numbers and their Know Your Customer (KYC) details to the Election Commission (EC), which has now published it on its website. Last month, the apex court deemed the ‘Electoral Bonds scheme, 2018’ unconstitutional, stating that it violated voters’ right to information about political funding and facilitated a quid pro quo culture.

In its February 15 order, the Court directed SBI to furnish details of the donors, recipients and the bonds encashed by the parties till date by March 6, adding that the electoral bonds scheme provided “blanket anonymity in financial contributions.” It also refused the bank’s request seeking till June 30 to furnish the details – after the General Assembly polls – stating the details were ‘readily available’ with the bank.

Prior to the ECI publishing the electoral bonds’ data, a Reuters investigation revealed that the BJP’s biggest donor of $204 million (₹1693 crores) was Prudent Electoral Trust. The trust, which was created in 2013 after the UPA government introduced the ‘Electoral Trust Scheme 2013’, facilitated tax-exempt contributions to parties by corporations and individuals, reducing cash contributions in campaign financing.

These two instruments – electoral trust and electoral bonds – have contributed to the BJP’s electoral war chest of over Rs 10,000 crore till date, giving the ruling party a massive edge over all Opposition parties combined ahead of the Lok Sabha elections scheduled to be held from April 19 to June 1.

Here’s a look at both the schemes and how they differ.

Electoral Trusts

Definition & contributions

An Electoral Trust (ET) is a body registered under the Companies Act, 1956, solely tasked with distributing contributions received from individuals or companies to political parties. Electoral trusts were set up under the Electoral Trusts Scheme, 2013 with the Centre framing rules for the eligibility and procedure for registering such trusts on January 31, 2013.

As per the rules, an electoral trust is allowed to receive voluntary contributions from individual Indian citizens, a company registered in India, a firm, or Hindu undivided family (HUF) in the form of a cheque, bank draft or electronic transfer to its bank account. No foreign entity, other registered electoral trusts, or individuals who are neither citizens nor residents of India can contribute to electoral trusts. An ET must distribute up to 95% of the voluntary contributions collected, with the surplus brought forward from the earlier year, to eligible political parties only. The remaining 5%, with a cap of ₹3 lakh, may be used for managing its own affairs.

These trusts are not allowed to use any contribution for the direct or indirect benefit of its members or contributors. They must also maintain accounts of the donors and their contributions, funds distributed to political parties, and expenses incurred by the trust. The accounts of any ET must be audited and the report must be furnished to the Commissioner of Income Tax, including the list of contributors, list of parties that funds were distributed to, and the amounts disbursed.

Disbursal to political parties

As of date, eighteen electoral trusts are active, with the biggest being Prudent Electoral Trust, which has multiple corporate donors. In 2022-23, only five ETs — Prudent Electoral Trust, Samaj Electoral Trust, Paribartan Electoral Trust, Triumph Electoral Trust and Einzigartig Electoral Trust — received contributions from corporate houses, according to the Association for Democratic Reforms (ADR). Of the ₹366.49 crore received by these trusts, Prudent alone received over ₹360 crore from 34 corporations, followed by Samaj which received ₹2 crore from one company. Paribartan received ₹75.50 lakh from two companies while Triumph received ₹50 lakh from two companies. Eleven individuals contributed to these ETs – eight to Prudent (₹2.70 crore) and three to Einzigartig (₹8 lakh).

The ruling BJP received 70% of the corporate donations via electoral trusts, i.e. ₹259.08 crore, of which ₹256.25 crore was from Prudent. After the BJP, the Bharat Rashtra Samithi (BRS) received the next largest share at 24.56% of the donations, i.e. ₹90 crore — all from Prudent. Meanwhile, YSR Congress Party (YSRCP) received ₹15 crore, the Congress received ₹1.5 crore and the Aam Aadmi Party (AAP) netted ₹90 lakh.

Overall, from 2013 to 2023, Prudent Electoral Trust has raised $272 million (₹2257 crore), of which 75% (₹1693 crore) has been donated to the BJP, Reuters reported. In comparison, the Congress party has received only $20.6 million (₹166 crore).

Prudent, which has received funds from top conglomerates like Bharti Airtel, ArcelorMittal Nippon Steel, Essar Steel, and GMR (Infra) does not reveal which party is funded by which of its donors; it publishes the list of donors and beneficiary parties separately. The trust was originally set up by Bharti Airtel, but control was later transferred to independent auditors Mukul Goyal and Venkatachalam Ganesh in 2014. The internal functioning of Prudent is not known and how they decide on which parties to disburse funds to is also unclear.

The Progressive Electoral Trust, set up by the Tata Group in 2014, is the second-biggest electoral trust, donating ₹360 crore to the BJP and ₹65.5 crore to Congress respectively. As per Reuters, Progressive’s by-laws mandate it to donate funds proportionate to the number of seats held by each party in the Lok Sabha. Only parties which win at least 16 seats in the Lower House qualify to receive funds from Progressive. For the past two years, Progressive has not received corporate donations either from the Tatas or any other company.

With the Supreme Court striking down the electoral bonds scheme, corporations may switch back to electoral trusts, a Financial Express report claims. However, as the donor and beneficiary lists of electoral trusts have to be publicised along with the contributions made, political donations may go down, The Financial Express estimates.

Electoral Bonds

Definition & contributions

An electoral bond is a promissory note issued by authorised branches of the State Bank of India to companies or individuals wishing to donate to registered political parties. Electoral bonds were notified under the Electoral Bond Scheme, 2018, following which the Centre framed rules for the issue and purchase of such bonds and on their validity.

As per the rules, any person who is a citizen of India, or a company or firm established or incorporated in India can purchase such electoral bonds. Political parties that poll more than 1% of the total votes n the Lok Sabha or State Assembly elections and that are registered under section 29A of the Representation of the People Act, 1951, are eligible to receive these bonds.

These bonds do not bear details of either the donor or the payee, making it a completely anonymous contribution. Sold in denominations of ₹1000, ₹10,000, ₹1 lakh, ₹ 10 lakh and ₹ 1 crore, these bonds can be purchased by interested buyers via a bank account which has fulfilled the Know Your Customer (KYC) norms set by Reserve Bank of India (RBI). Payment against these bonds can be made in the form of cheque, demand draft, electronic payment or direct debit to the buyer’s account. The SBI branches cannot apply any interest, commission, brokerage or other charges on these bonds. Further, electoral bonds cannot be traded.

As per the rules, the bonds are made available for purchase from SBI for ten days in January, April, July and October. An additional period of thirty days when it will be available during the year of Lok Sabha elections was to be specified by the Centre. Once purchased, these bonds must be deposited within 15 days of issue and must be encashed by the parties within the same period. Any bond not encashed within its validity period will be deposited in the Prime Minister’s Relief Fund by SBI. Funds collected via such bonds are counted as income via voluntary contributions.

Passed via Money Bill

Prior to the scheme’s notification, the BJP-led NDA government had amended the Foreign Contribution Regulation Act, 2010 (FCRA) to allow foreign companies with a majority share in Indian companies to donate to political parties, inserting the amendment in the Finance Act, 2016, and thereby passing the amendment to FCRA as a Money Bill. Note that a Finance Bill which details the Union Budget is a Money Bill and does not need to be passed by the Rajya Sabha, only the Lok Sabha.

Similarly, via the Finance Act, 2017, the NDA government amended the Representation of the People Act, 1951 (RoPA), exempting political parties from publishing funds received via electoral bonds. The Finance Act, 2017, also amended the Reserve Bank of India Act, 1934, allowing the Centre to authorise any scheduled bank to issue electoral bonds; the Income Tax Act, 1961, to exempt parties from keeping a record of the contributions received via electoral bonds, and the Companies Act, 2013 to remove the cap on the amount companies can donate to a political party.

All of the above amendments and the scheme itself has now been struck down by the Supreme Court, which has deemed it unconstitutional. However, the constitutionality of the Money Bill route used to pass these amendments is yet to be decided upon by the Supreme Court.

Political contributions

By order of the Supreme Court, SBI supplied to the Election Commission of India the data on electoral bonds purchase between April 1, 2019 and February 15, 2024 in two sets — one list comprising of the donors’ names and the value and date of the bond purchased and the other list comprising the encashing political party’s name, and the value and date of the bond redeemed. This data was then published by the EC on its website on March 14.

As per the released data, 22,217 electoral bonds were purchased and 22,030 bonds were encashed between April 2019 and February 2024. While the number of bonds purchased and encashed prior to the above-mentioned period is unclear, the EC later also released the amount encashed by political parties between March 2018 and May 2019, as declared by the parties. Of the total bonds encashed since 2018, BJP ranked the highest with ₹6986 crore, followed by Trinamool Congress with ₹1397 crore, the Congress with ₹1334 crore, Bharat Rashtra Samithi (BRS) with ₹1322 crore, and Biju Janata Dal (BJD) with ₹944 crore.

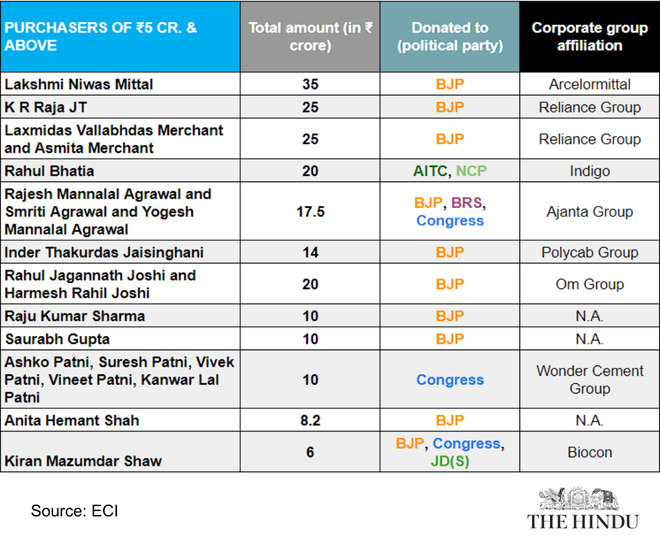

The data also revealed the top corporate donors to be Future Gaming and Hotel Services (₹1368 crore), Megha Engineering (₹1186 crore), MK Jalan Group (₹616 crore), Sanjiv Goenka Group (₹609 crore), and Aditya Birla Group (₹545.8 crore). Among individual donors, ArcelorMittal Chairman Lakshmi Mittal topped the list, donating ₹35 crore, followed by Reliance Group’s ex-board member KR Raja JT (₹25 crore), Reliance’s ‘Group controller’ Laxmidas Vallabhdas Merchant (₹25 crore), Indigo’s Managing Director Rahul Bhatia (₹20 crore), and Ajanta Group’s Managing Director Rajesh Mannalal Agrawal (₹17.5 crore)

On further directions from the Supreme Court, the unique alphanumeric number assigned to each bond was released by SBI, which allows the matching of the details about which donor paid which political party and when. As per the data released by EC, all top 19 donors have contributed portions of their donations to the BJP.

Of the bonds worth ₹ 1368 crore, Future Gaming and Hotel Services, the highest electoral bond donor, contributed ₹542 crore to Trinamool Congress (TMC), ₹503 crore to Dravida Munnetra Kazhagam (DMK), ₹154 crore to YSRCP and ₹100 crore to BJP. The second-largest donor, Megha Engineering (MEIL) and its group company Western UP Power Transmission Company Ltd, are BJP’s biggest donors via electoral bonds, contributing ₹584 crore and ₹80 crore respectively.

The third-highest donor MK Jalan Group — comprising of Keventer Food Park Infra, Ltd., MKJ Enterprises, Ltd., Sasmal Infrastructure Private Ltd and Madanlal, Ltd — contributed ₹351 crore to the BJP and ₹160 crore to the Congress. MEIL’s ₹584 crore contribution to BJP is the single-highest donation by any donor to any party via bonds.

Among Opposition parties, the largest donor for the TMC and YSRCP is Future Gaming and Hotel services, at ₹542 crore and ₹154 crore respectively. Congress’ top donor is Vedanta Ltd (₹ 125 crore). BJP’s largest donor, MEIL, is also BRS’ top donor (₹195 crore) while Essel Mining is BJD’s top contributor (₹ 174.5 crore).

Electoral bonds vs Electoral trusts

Electoral trusts are required to furnish details of the companies donating to them and the parties to which they disburse funds. Companies, too, have to reveal any contribution above ₹ 20,000 made to such trusts in their annual audit. They also cannot contribute more than 7.5% of their profits to the parties via these trusts. The audit and contribution reports of ETs are not publicised, but are filed with the EC.

Due the amendments to many laws, electoral bonds circumvented the rule which mandates that political parties declare any contribution over ₹20,000. Companies were also not required to limit their political contributions to 7.5% of three years of net profits. This allowed companies to donate unlimited funds to any party anonymously without revealing details of such transactions. While the Centre has claimed that this ensures privacy of the donors, Opposition and several associations challenging the scheme have highlighted the opacity of the entire process.

In contrast, ETs offer greater transparency.

Contributions via electoral trusts and electoral bonds also vary by crores. According to The Hindu Businessline, ETs have contributed approximately ₹2,557.74 crore to various political parties from 2013 to 2023. Steadily increasing from ₹85.37 crore to ₹366.48 crore, most contributions were disbursed via one trust, Prudent, which has disbursed 76% of its donations to the ruling BJP. In comparison, political parties have received approximately ₹13,500 crore via electoral bonds between 2018 and 2024, with BJP cornering over 50% of the donations via bonds.

Moreover, after the revelation of the biggest electoral bond donors, it was noted that the same donors had also been the top contributors to the largest electoral trust, Prudent. According to The Hindu Businessline, the top electoral bond donor, Future Gaming and Hotel Services, which contributed ₹1368 crore via bonds, has also contributed ₹100 crore to Prudent Electoral Trust. The Trust’s other top donors – its founder Bharti Group (₹205 crore), DLF group (₹192 crore), Megha Engineering (₹87 crore), Torrent Group (₹60 crore) and Haldia Energy (₹25 crore) also place on the list of the top donors in electoral bonds.

A key difference between the two schemes is the limited window within which companies can purchase bonds. Donors can contribute to parties via electoral trusts all year long, but can purchase electoral bonds only in the four windows when SBI sells bonds in tranches.

Further, as mentioned earlier, any contributions over ₹20,000 received via electoral trusts have to be declared by political parties in their annual income filings. However, any amount of funds received via electoral bonds are exempt from declaration as income for political parties.

Currently, the electoral bonds scheme stands invalidated, while the electoral trusts scheme is in force. The process via which laws were amended to pass the electoral bonds scheme – the Money Bill route – is also up for scrutiny by the apex court, while the electoral trust scheme faces no such challenge.