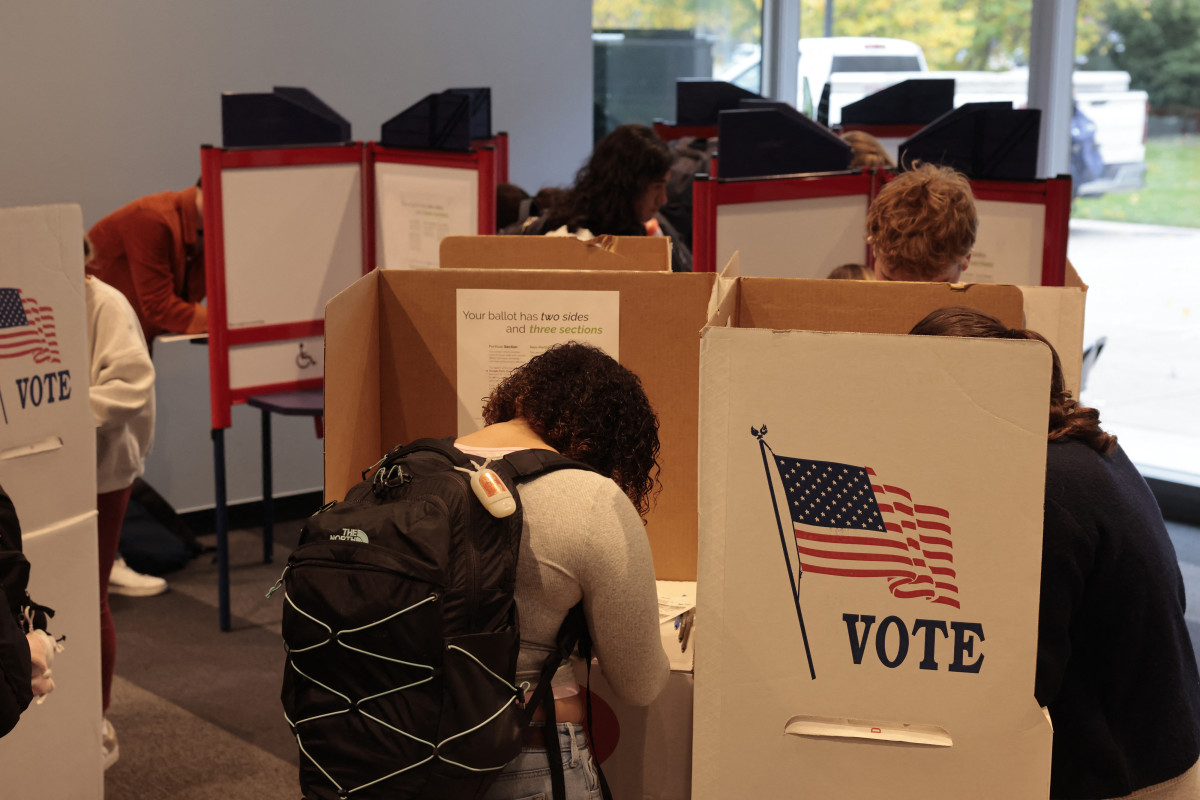

If you hadn't heard, there's an election on Tuesday, and it's probably the biggest event of the week for investors, markets and your money.

Even bigger than this week's Federal Reserve meeting, which comes after the election.

💰💸 Don’t miss the move: SIGN UP for TheStreet’s FREE Daily newsletter 💰💸

Because of the election, the Fed meeting starts Wednesday and will end with a decision on a possible interest-rate cut on Thursday.

Interspersed with the election and the Fed is another big week of earnings economic reports.

Related: Morgan Stanley makes a major move into unfamiliar territory

These come after a week when stocks fell back.

The Standard & Poor's 500 Index was off 1.4%. The Nasdaq was off 1.1%, and the Dow Jones Industrial Average slipped 0.15% slightly on the week.

The election is the week's key event because Kamala Harris and Donald Trump have differing views of the state of the nation and the economy.

There are worries about violence and riots. National Guard troops in Washington, Oregon and Nevada are on alert in case of violence, and there is the prospect of court battles and fights in Congress.

If all that happens, can the elections of 2000 and 2020 tell us what to expect?

In the 2000 election, where George W. Bush and Al Gore fought over hanging chads on Florida ballots, stocks fell back throughout November as the battle waged in voting offices and the courts. The Supreme Court ultimately gave the win to Bush.

Related: Nvidia stock will replace former tech titan in Dow Jones Industrial Average

To be sure, the market was struggling through the Dot-com era, the result of way too much money chasing after too many non-viable tech companies. Later came the Sept. 11, 2001 terror attacks. Stocks didn't bottom until the fall of 2022.

The 2020 election featured Donald Trump running for reelection against Joe Biden in the wake of the Covid-19 pandemic, a global shutdown and unrest and intense partisanship.

Stocks rallied even as Trump claimed the election had been stolen, perhaps because markets could see the ultimate result.

The S&P 500 rose nearly 15% in the last two months of 2020, ending the year up 16.3%. It would rise another 27% in 2021. It even rose 0.6% during the Jan. 6, 2021, attack on the U.S. Capitol.

The Fed has some explaining to do on interest rates

Something was already happening when the Fed announced it was cutting its key interest rate by a half percentage point on Sept. 18. Rates were starting to rise. They're still rising.

When Fed Chairman Jerome Powell holds a news conference Thursday afternoon, you can be sure he'll be asked to explain why rates moved higher.

Related: Jobs report shocker puts Fed interest-rate cut in play

The 10-year Treasury yield, which hit 3.62% on Sept. 16, is now at 4.397%. That's a 21% increase.

Freddie Mac, which buys mortgages from lenders, said the 30-year mortgage rate was up to 6.72% after dropping to as low as 6.08% on Sept. 19.

But Wall Street is still betting the Fed will drop its federal fund rate Thursday to 4.5% to 4.75% from 4.75% to 5%.

The Fed's goal has been to support employment. Employment may need a little support, even after all the cleanup of the damage from Hurricanes Helene and Milton is completed.

The October jobs report surprised most, showing jobs growing by 12,000, much less than expected. The unemployment rate, however, held at 4.1%.

Job growth estimates for August and September were also trimmed, with bars and restaurants showing serious job losses.

Partly, that's because many restaurants have shut down in the Covid aftermath.

Just Friday, TJI Fridays, the restaurant chain, filed for bankruptcy protection on Saturday, joining such chains as Red Lobster and Buca di Beppo, Mod Pizza and Outback Pizza.

Related: Iconic restaurant chain closes more locations before bankruptcy

Stephen Guilfoyle, "the Sarge," is a veteran analyst whose career began on the New York Stock Exchange in the 1980s. Sarge recently wrote on TheStreet Pro, "The month that job growth died." Phillippa Dunne and Doug Henning of the Liscio Report began their analysis with three words: "A miserable report."

More Wall Street Analysts:

- Analysts update Meta stock price target with Q3 earnings in focus

- Analysts update outlook for Nvidia's Blackwell chips amid AI boom

- Analyst reboots Reddit stock price target ahead of earnings

Palantir leads the week's earnings reports

The third-quarter earnings season continues this week with more of a hodgepodge of report due. Last week's reports were dominated by big technology companies Apple (AAPL) , Amazon.com (AMZN) , Google-parent Alphabet (GOOGL) , Microsoft (MSFT) and Tesla (TSLA) .

Related: Veteran trader makes surprising call between Palantir, Nvidia stock

Amazon was the winner of those stocks, up 5.4% for the week. Tesla was the loser, down 7.5% to $248.98.

The one likely to attract the most interest this week is Palantir (PLTR) , which builds software for big data analytics. Its biggest customer is the federal government, and its co-chairman is Peter Thiel, who is very close to Elon Musk.

The company's shares are up 144% in 2024.

The gain includes 12.7% just in the fourth quarter. The shares are 319% from when the company went public at $10 in 2020.

- Palantir earnings estimate: 9 cents a share, up from 7 cents a year ago.

- Revenue est.: $701.1 million, up 26% from a year ago.

Two important tech companies are due to report after Wednesday's close: Chipmaker Qualcomm (QCOM) and chip designer ARM Holdings (ARM) . Both are profoundly important to wireless technologies.

- Qualcomm earnings est. $2.56 a share, up from $2.02 a year ago.

- Revenue est.: $9.9 billion, up 14.3%, year over year.

ARM designs the chips used in computers but mostly mobile devices. Chip makers adapt the designs to their needs. It is majority owned by Japan's Softbank Group.

- ARM earnings est.: 25 cents a share, down 30% from a year ago.

- Revenue est.: $808.3 million, up 8.6% from a year ago.

Also reporting this week:

- Vertex Pharmaceuticals (VRTX) , Marriott International MAR, and NXP Semiconductors NXP all Monday.

- Marathon Petroleum (MPC) and Yum! Brands (YUM) , Tuesday.

- Toyota (TM) , Gilead Sciences (GILD) and American Electric Power (AEP) , Wednesday.

- Arista Networks (ANET) , AirBNB (ABNB) , advertising cloud company The Trade Desk (TTD) ; and Block (SQ) , Thursday

Related: Veteran fund manager sees world of pain coming for stocks