/EBay%20Inc_%20logo%20by-%20JHVEPhoto%20via%20iStock.jpg)

eBay Inc. (EBAY) is a leading e-commerce company that operates one of the world’s most established online marketplaces, connecting millions of buyers and sellers. Headquartered in San Jose, California, the platform facilitates commerce through auction-style listings, fixed-price sales, and mobile apps, catering to individuals and small businesses with a wide range of products from collectibles and electronics to fashion and home goods. The company has a market cap of around $41.5 billion.

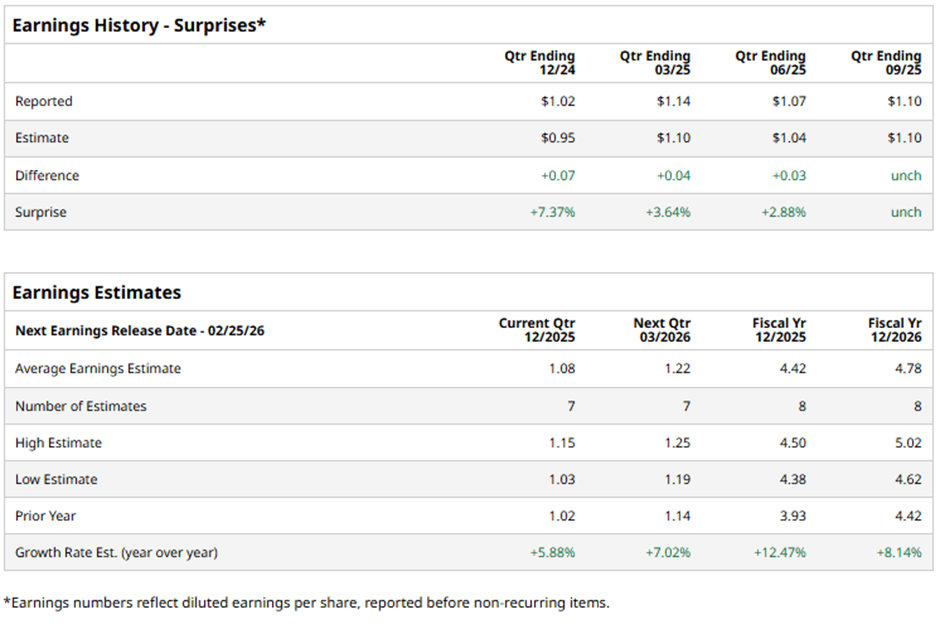

The e-commerce company is expected to release its Q4 2025 earnings in the near term. Ahead of this event, analysts expect eBay to post earnings of $1.08 per share, marking a 5.9% increase from $1.02 per share reported in the same quarter last year. Additionally, the company has surpassed or met Wall Street’s bottom-line estimates in each of the past four quarters.

For fiscal 2025, analysts forecast EBAY to report an EPS of $4.42, an increase of 12.5% from $3.93 reported in fiscal 2024. Moreover, in fiscal 2026, its earnings are expected to surge 8.1% year-over-year to $4.78 per share.

EBAY has surged 37% over the past 52 weeks, outpacing the S&P 500 Index’s ($SPX) 13.3% gain and the State Street Consumer Discretionary Select Sector SPDR ETF’s (XLY) 3.9% rise during the same period.

eBay’s stock rose largely because the company delivered better-than-expected earnings and revenue growth, with consistent GMV increases that boosted investor confidence. Strong performance, along with strategic initiatives such as enhanced AI-powered tools, improved seller experiences, and partnerships, helped drive the rally.

In the third quarter ended Sept. 30, eBay reported revenue of $2.8 billion, marking about a 9% year-over-year (YOY) increase, while GMV came in at $20.1 billion, up around 10% YOY. Non-GAAP EPS stood at $1.36, a 14% rise compared with the prior year.

Analysts’ consensus view on EBAY is moderately optimistic, with a “Moderate Buy” rating overall. Out of 34 analysts covering the stock, nine recommend a “Strong Buy,” two suggest “Moderate Buy,” 21 advise a “Hold,” one gives a “Moderate Sell,” and one “Strong Sell.” EBAY’s mean price target of $96 indicates an upside potential of 5.8%.