/Eaton%20Corporation%20plc%20logo%20on%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)

With a market cap of $130.8 billion, Eaton Corporation plc (ETN) is a power management company that serves multiple industries through segments including Electrical Americas, Electrical Global, Aerospace, Vehicle, and eMobility. The company provides a wide range of electrical products, hydraulic systems, aerospace components, and industrial solutions.

Companies valued at more than $10 billion are generally considered “large-cap” stocks, and Eaton fits this criterion perfectly. Eaton offers advanced vehicle technologies and power management systems for both traditional and electric mobility applications.

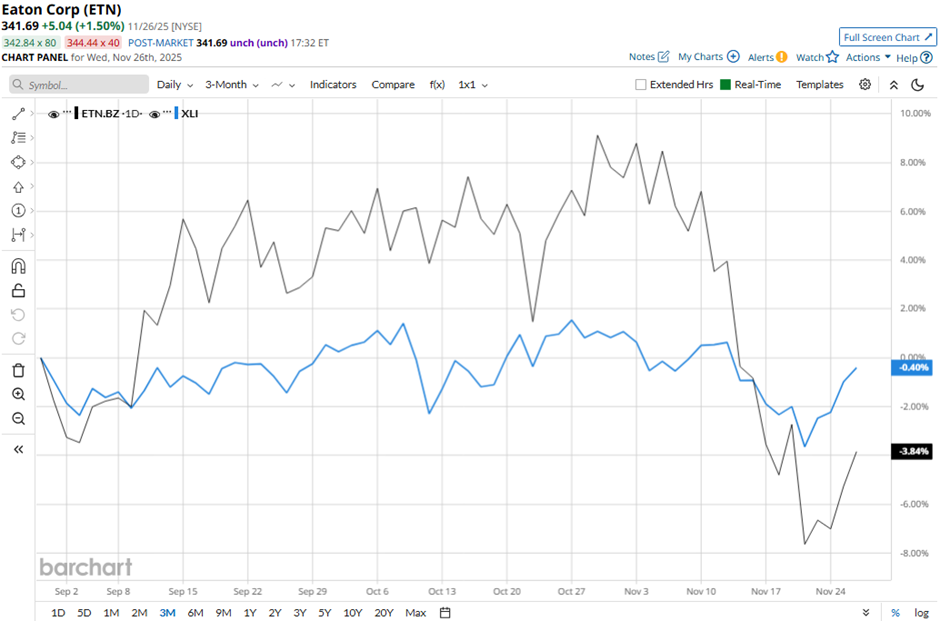

Shares of the Dublin, Ireland-based company have fallen 14.5% from its 52-week high of $399.56. Eaton’s shares have declined 2.9% over the past three months, underperforming the Industrial Select Sector SPDR Fund’s (XLI) marginal dip over the same time frame.

In the longer term, ETN stock is up nearly 3% on a YTD basis, lagging behind XLI’s nearly 16% return. In addition, shares of the power management company have dropped 9.4% over the past 52 weeks, compared to XLI’s 6.3% return over the same time frame.

Despite recent fluctuations, the stock has been trading above its 50-day moving average since late April.

Despite beating adjusted EPS expectations with $3.07, ETN shares fell 2.3% on Nov. 4 as the company reported weaker-than-expected Q3 2025 revenue of $6.99 billion. Investors were also concerned about significant weakness in Eaton’s Vehicle and e-Mobility segments, which saw sales declines of 8% to $639 million and 19% to $136 million, respectively.

However, ETN stock has performed better than its rival, Honeywell International Inc. (HON). Shares of Honeywell have dipped 10.9% on a YTD basis and 12.6% over the past 52 weeks.

Despite the stock’s underperformance relative to the sector, analysts remain moderately optimistic about its prospects. ETN stock has a consensus rating of “Moderate Buy” from 23 analysts' coverage, and the mean price target of $418.43 is a premium of 22.5% to current levels.