Eastman Chemical Company (NYSE:EMN) is set to release second-quarter 2022 results after the closing bell on Jul 28. Benefits of cost and productivity actions and innovation are likely to get reflected in the company's performance. However, it is likely to have faced challenges associated with raw material, energy and logistics costs in the second quarter.

Eastman Chemical missed the Zacks Consensus Estimate for earnings in three of the last four quarters while beat once. The company has a trailing-four quarter earnings surprise of roughly 0.2%, on average. The company posted a negative earnings surprise of 0.5% in the last reported quarter.

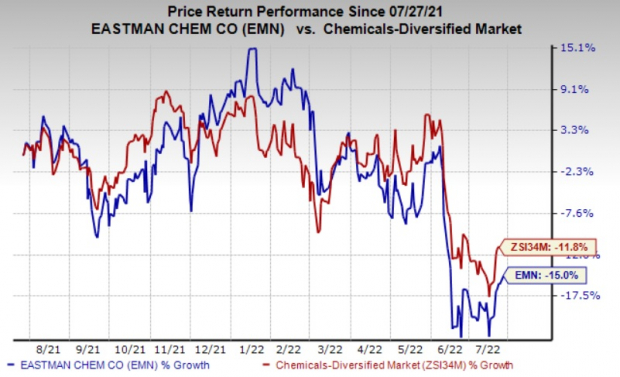

Shares of Eastman Chemical are down 15% in the past year with the industry's 11.8% decline.

Let's see how things are shaping up for this announcement.

Zacks Model

Our proven model predicts an earnings beat for Eastman Chemical this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earning beat.

Earnings ESP: Earnings ESP for Eastman Chemical is +0.85%. The Zacks Consensus Estimate for the second quarter is currently pegged at $2.69. You can uncover the best stocks to buy or sell before they're reported with our Earnings ESP Filter.

Zacks Rank: Eastman Chemical currently carries a Zacks Rank #3.

What do the Estimates Say?

The Zacks Consensus Estimate for Eastman Chemical's second-quarter revenues is currently pinned at $2,751.4 million, which indicates a 3.7% year-over-year increase.

The Zacks Consensus Estimate for the Eastman Chemical's Additives and Functional Products division revenues is pegged at $720 million, suggesting a 22.2% decline year over year. The consensus estimate for Advanced Materials unit's revenues is $899 million, indicating an increase of 16.9% year over year.

The Zacks Consensus Estimate for the Chemical Intermediates segment's revenues is pegged at $773 million, which indicates a 5% rise from the year-ago quarter's levels. The same for the Fibers segment stands at $231 million, indicating a 3.6% year-over-year rise.

Factors to Watch For

The company's second-quarter earnings are likely to have benefited from cost-management and price hike actions and revenues from innovation. It might have benefited from lower operating costs from its operational transformation program in the quarter.

The company is also expected to have gained from new business revenues from innovation in the June quarter. It remains focused on growing new business revenues leveraging its innovation-driven growth model. Eastman Chemical is also likely to have benefited from strategic acquisitions and end-market recovery.

Strong end-market demand is also expected to have supported Eastman Chemical's top line in the quarter to be reported. The company is seeing strong demand in major markets, including building and construction, personal care, and animal nutrition.

However, Eastman Chemical is expected to have faced headwinds from higher raw material, energy and distribution costs in some of its products in the second quarter. Headwinds associated with supply-chain disruptions and logistics issues are also likely to have impacted its performance. The semiconductor shortage is also expected to have affected demand in the automotive market.

Stocks That Warrant a Look

Here are some companies in the basic materials space you may want to consider as our model shows these too have the right combination of elements to post an earnings beat this quarter:

Albemarle Corporation (NYSE:ALB), scheduled to release earnings on Aug 3, has an Earnings ESP of +11.87% and carries a Zacks Rank #2.

The Zacks Consensus Estimate for Albemarle's second-quarter earnings has been revised 11.8% upward over the past 60 days. The consensus estimate for ALB's earnings for the quarter is currently pegged at $2.94.

Celanese Corporation (NYSE:CE), scheduled to release earnings on Jul 28, has an Earnings ESP of +0.89% and carries a Zacks Rank #3.

The Zacks Consensus Estimate for Celanese's second-quarter earnings has been revised 2.2% upward over the past 60 days. The Zacks Consensus Estimate for CE's earnings for the quarter is currently pegged at $4.58.

Tronox Holdings Inc. (NYSE:TROX), slated to release earnings on Jul 27, has an Earnings ESP of +3.57% and carries a Zacks Rank #3.

The consensus estimate for Tronox's second-quarter earnings has been revised 0.6% upward in the past 60 days. The Zacks Consensus Estimate for TROX's earnings for the quarter is pegged at 84 cents.

To read this article on Zacks.com click here.

Image sourced from Shutterstock