/United%20Rentals%2C%20Inc_%20logo%20magnified-by%20Casimiro%20PT%20via%20Shutterstock.jpg)

Valued at a market cap of $53.8 billion, United Rentals, Inc. (URI) is an equipment rental company based in Stamford, Connecticut. It provides a broad range of construction and industrial equipment, including aerial work platforms, earthmoving machinery, material handling equipment, and power solutions. The company is scheduled to announce its fiscal Q4 earnings for 2025 in the near future.

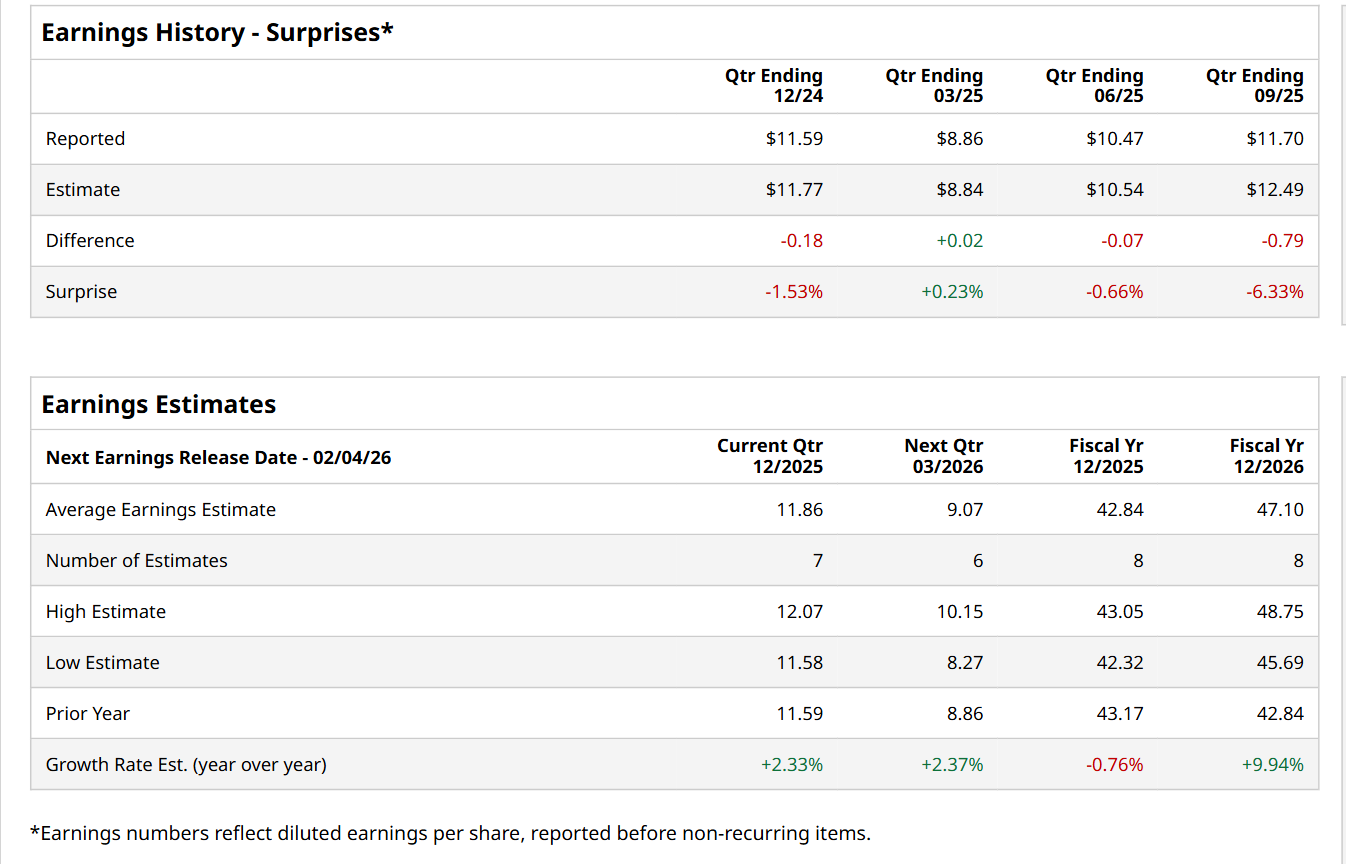

Before this event, analysts expect this equipment rental company to report a profit of $11.86 per share, up 2.3% from $11.59 per share in the year-ago quarter. The company has missed Wall Street’s bottom-line estimates in three of the last four quarters, while surpassing on another occasion. Its earnings of $11.70 per share in the previous quarter missed the consensus estimates by 6.3%.

For the current fiscal year, ending in December, analysts expect URI to report a profit of $42.84 per share, down marginally from $43.17 per share in fiscal 2024. Nonetheless, its EPS is expected to rebound and grow by 9.9% year-over-year to $47.10 in fiscal 2026.

Shares of URI have soared 30.8% over the past 52 weeks, outperforming both the S&P 500 Index's ($SPX) 16.2% return and the State Street Industrial Select Sector SPDR ETF’s (XLI) 22.3% uptick over the same time period.

On Jan. 5, shares of URI surged 5% after UBS Group AG (UBS) upgraded the stock to “Buy” from “Neutral” and raised its price target to $1,025. The upgrade was driven by expectations of a rebound in U.S. non-residential construction activity, which UBS believes will support stronger demand for URI.

Wall Street analysts are moderately optimistic about URI’s stock, with a "Moderate Buy" rating overall. Among 22 analysts covering the stock, 12 recommend "Strong Buy," two indicate “Moderate Buy,” seven suggest "Hold,” and one advises a “Strong Sell.” The mean price target for URI is $964.53, indicating an 8.1% potential upside from the current levels.